The 6 principles of value investing

Everyone likes a bargain, especially value investors. Value investing is a strategy that involves picking stocks that you believe are trading lower than their value.

Created in the 1930s by Benjamin Graham and popularized by Warren Buffett, it has since become a favorite for investors with long-term mindsets. As an investor focused on the long-term, Warren Buffett did not make his first million until age 30 and his first billion until age 56. He believes in investing in the business as a whole – not the stock on a particular day.

In a 1996 letter to shareholders, he wrote, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

When choosing stocks, value investors analyze the company’s finances to determine long-term value. At a bare minimum, a value investor notes the following six principles:

- Investors see stock as partial ownership of a business.

- The long-term horizon can be a competitive advantage.

- The market exists to serve us.

- Leave room to be wrong.

- Risk isn’t volatility, even though many investors see it that way.

- Eventually, stocks revert to their fair value.

1. Investors see stock as partial ownership of a business.

Trading and investing are like different religions. They have different beliefs and rules of engagement when it comes to the market. Traders think in the short term; investors have a long-term mindset. Traders value the stock; investors value the business. Both approach the market with differing strategies.

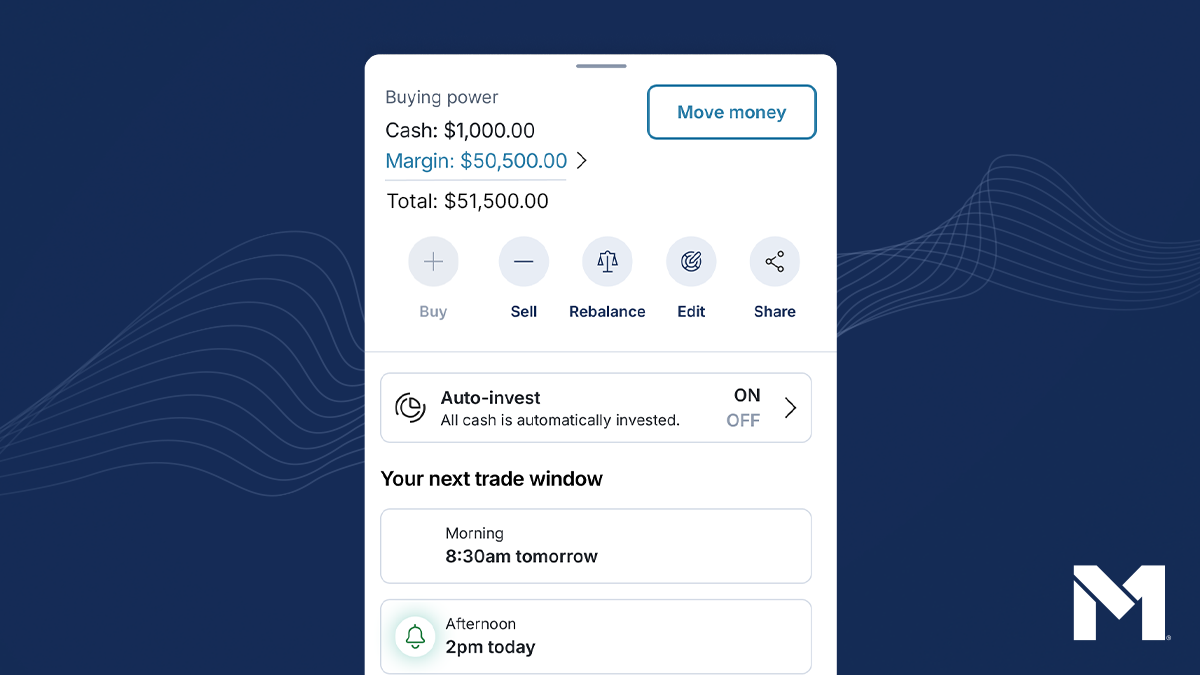

At M1, we believe in long-term ownership as the path to improving your financial well-being and building wealth. So, our community is made up of long-term investors. While they all follow different strategies, they share the value of ownership.

We believe in ownership as a pillar of investing so much that we built an entire credit card for investors around it.

But ownership isn’t just credit cards for investors and mindset. Value investors believe that every stock has an intrinsic value or true worth. Because of external factors, the stock price does not always reflect this. The goal of a value investor is to identify the stock’s intrinsic value through the business’s financials and buy when its stock price is low, assuming that it will eventually reach its intrinsic value somewhere along the way.

How to determine the intrinsic value

One of the indicators of a stock’s intrinsic value is its price-to-earnings ratio. The (P/E) ratio of a stock represents the dollar amount an investor should expect to invest in a company to receive one dollar back of that company’s earnings. A high P/E ratio can mean a stock is overvalued, while a low P/E ratio can mean undervalued. Value investors tend to look for stocks with a low P/E ratio in the bottom 10% of their sector.

They also tend to examine factors such as cash flow, valuation, competition, returns, balance sheets, and management. All of these factors can affect a business’s performance in the long run.

Even if you aren’t a financial analyst, you can still learn how to research stocks.

2. The long-term horizon can be a competitive advantage.

Wall Street can be obsessed with the short-term. External factors can drive the price of a stock down in the short term creating an opportunity to buy. And if a value investor truly believes in the stock’s intrinsic value, it gives them a competitive advantage in the long term.

External factors, aka “hype”

As a value investor, trust yourself and your plan. External factors such as current events, trends, or the latest “hype” can cause a stock price to go up, down, and sideways in the short term. It’s always best to be aware of what’s going on, but it’s ultimately up to you to remain focused. Don’t let your emotions get the best of you.

3. The market exists to serve us.

While the market prices stocks on a daily, it doesn’t value them that way. Value happens in the long run. And price fluctuations aren’t necessarily a reflection of a stock’s value. If you, the value investor, know the stock’s intrinsic value, these price fluctuations can be used to your advantage. In situations like these, research comes in handy to inform you when (if at all) to buy.

4. Leave room to be wrong.

This is known as the margin of safety. With any investment, you’re opening yourself up to risk, and unexpected things can happen. Brand, business model, and leadership all contribute to a business’s quality. Lower quality businesses are more at risk than higher quality ones, so your margin of safety will depend on these factors. Finding the right margin of safety is ultimately up to you and relies on what you believe will earn you the best returns while minimizing any potential losses. In the end, the right margin of safety is what helps you sleep at night during periods of market volatility.

5. Risk isn’t volatility, even though many investors see it that way.

For value investors, volatility is not always risk—it’s an opportunity. If you know a stock’s intrinsic value, you can buy at the lows with the expectation that the business will reach its worth somewhere along the way.

Risk to a value investor is saying you’re okay with potentially losing money in the short term. Unless volatility changes your perception of the stock’s long-term value, it’s natural and shouldn’t distract you from your long-term goals.

6. Eventually, stocks revert to their fair value.

The market goes through cycles of highs and lows. It’s predictably unpredictable. However, if a stock is undervalued somewhere along the way, it will find its value. A value investor’s goal is to see this intrinsic value (what it’s worth)—not necessarily what the stock’s price is at that moment.

Strategy is ultimately up to you

Everyone invests differently, so finding a strategy that fits your long-term goals and risk tolerance is ultimately up to you. Educating yourself on the strategies that are out there is an important step towards financial well-being.

- Categories

- Invest