Be your own investment manager with M1’s portfolio automation

M1’s innovative approach to portfolio automation

In today’s investing landscape, investors have a wealth of options for portfolio management. Gone are the days when traditional brokerages and wealth advisors were the only choices. Many investors now value the ability to self-manage their portfolios with minimal hassle. This is where M1’s portfolio automation excels.

Key benefits of M1’s portfolio automation

- Ideal for self-managing investors: Equip yourself with the tools to automate your wealth-building strategy efficiently.

- Elimination of advisor fees: Maximize your investment returns by cutting out extra costs.1

- Dynamic rebalancing: Maintain optimal portfolio balance seamlessly without selling assets.

- You’re in charge: Design and manage your portfolio with unparalleled control and efficiency.

Are you ready to embrace the future of portfolio automation?

The shift from traditional to automated investment platforms

The following are general industry shifts and not necessarily functionality offered by M1.

The investment landscape is rapidly transforming as automation revolutionizes how individuals manage their financial strategies. Cutting-edge automation features streamline investment management. Direct indexing offers personalized tax management and portfolio customization, while automatic rebalancing ensures portfolios remain aligned with target allocations.

Tax optimization strategies enhance efficiency by minimizing liabilities and allowing investors to keep more of their returns. Customizable portfolios align investments with personal values, such as ESG criteria, and benefit from automated management.

Integration with financial planning tools provides a comprehensive view of financial health and empowers individuals to confidently shape their financial futures. These innovations may reduce the need for traditional financial advisors (farewell to hefty 1% fees on your million-dollar portfolio?), ushering in a new era of personalized and efficient wealth-building.

Discover M1: The smarter investment solution

M1 stands out in the crowded marketplace of investment platforms by combining strategic autonomy with advanced automation. This unique blend allows investors to take charge of their financial destiny without sacrificing the benefits of automated portfolio management.

Why traditional brokerage clients keep switching to M1 for portfolio automation

Much of M1’s clientele transitions from traditional brokerages like Charles Schwab, Fidelity, and Vanguard.

Here’s what convinced them to move their portfolios:

- Personalized portfolio design: Craft your portfolio based on your unique investment strategy, selecting from a diverse array of stocks and ETFs.

- Seamless strategy automation: Automate your investment strategy execution to ensure it aligns with your financial objectives.

- Cost-effective management: Significantly lower the expenses associated with managing your investments by eliminating advisor fees.

These features make M1 an attractive option for high-net-worth individuals and finance enthusiasts seeking both control and efficiency in their investment process.

Benefits of M1 for high-net-worth individuals

M1 offers several benefits that cater specifically to high-net-worth individuals and finance enthusiasts, including cost efficiency, ease of maintaining portfolio balance, and the empowerment of self-managed investors.

Experience cost efficiency with M1

One of the standout advantages of M1 is its cost-efficiency. Traditional financial advisors often charge significant fees for their services, which can eat into your investment returns. While M1 doesn’t offer advisory services, we do offer an easy and low cost alternative for those who want to try self-managing, allowing you to invest more of your money and keep more of your gains.

Maintain portfolio balance with dynamic rebalancing

Maintaining a balanced portfolio is crucial for long-term investment success. M1’s dynamic rebalancing feature ensures that your portfolio remains aligned with your investment strategy, even as market conditions change. This automation reduces the need for constant monitoring and manual adjustments, providing peace of mind for busy investors.

Empowerment of self-managed investors with M1

M1 empowers self-managed investors by providing the tools and resources needed to make informed investment decisions. Whether you’re a seasoned investor or just starting, M1 offers a platform that caters to your needs, allowing you to take control of your financial future.

Harness the power of dynamic rebalancing with M1

M1 revolutionizes the investing world with its dynamic rebalancing feature, offering automation that could replace a financial advisor for those who want to own their investment decisions. Imagine effortlessly keeping your portfolio on track with your investment aspirations! M1 makes it possible by automatically maintaining your asset allocation via cash adjustments, empowering you to take control without constant oversight.

How M1’s dynamic rebalancing works

Dynamic rebalancing kicks in with every deposit and withdrawal. M1 intelligently distributes funds, maintaining your target allocation so you can focus on your goals. For those who regularly add or withdraw funds, this is a game-changer. Say goodbye to manual adjustments and hello to a seamless investment experience that keeps your portfolio aligned with your vision.

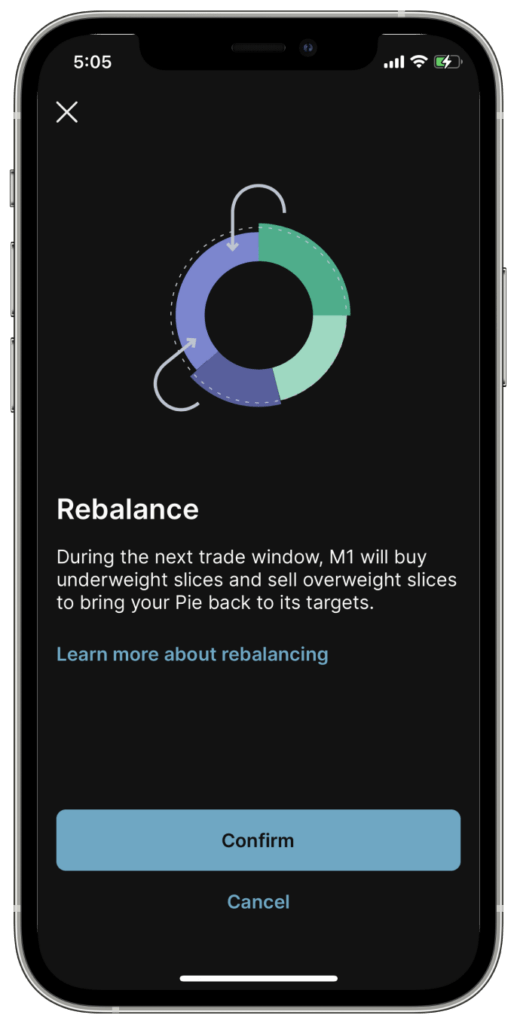

One-click rebalancing: simple and effective

M1 also offers a one-click rebalancing option. This is perfect for those who like to periodically rebalance. At a traditional brokerage, you might find yourself doing a lot of manual calculations quarterly or annually to rebalance. But with M1, you can initiate a full rebalance—no napkin math needed. With just a click, you can realign your investments when they stray from your target. This simple yet powerful tool gives you the flexibility to manage your portfolio with ease, combining personal oversight with M1’s automated precision.

By blending these innovative features, M1 makes sophisticated portfolio management accessible to everyone. Whether you’re an investing novice or a seasoned pro, M1 empowers you to independently set and manage your strategies.

Comparing M1’s portfolio automation with traditional financial advisors

When it comes to managing your investments, choosing between M1 and traditional financial advisors can make a significant impact. Let’s dive into the notable contrasts and see why M1 might just be the game-changer you’re looking for.

Reduce investment fees with M1

Tired of high fees eating into your investments? With M1, you can invest more by eliminating those pesky advisor fees. While traditional advisors often charge a percentage of your assets under management (AUM), which can snowball over time, M1 stands out by not charging management fees. This means more of your hard-earned money stays where it belongs – in your investment portfolio!1

Gain control of your financial future with M1

With M1, the power is in your hands! While financial advisors can be beneficial for those unsure of where to start, M1 offers experienced investors the flexibility to craft and manage their own strategies.

Streamlined investment management with automation

Already know your investment goals? M1’s automation features make it easy to execute your strategy without the hassle. Forget about spending hours making manual portfolio changes—M1 automates these tasks.

Why M1 is different than other investment platforms

Investing has never been more accessible, thanks to a variety of platforms offering similar features. But M1 sets itself apart with a unique blend of strategic freedom, advanced automation, and cost-effective solutions, making it the ideal choice for savvy investors. Here’s why M1 is a game-changer:

Automated yet personalized investing

Many platforms provide automated investment services, but with M1, you have the ability to customize your portfolio to align with your investment strategy. Choose from a diverse selection of stocks and ETFs, and build the portfolio that’s right for you.

Leverage intelligent automation

M1 takes automation beyond basic rebalancing. The platform dynamically reallocates your funds through deposits and withdrawals, keeping your portfolio aligned with your goals. This sophisticated level of automation is rarely matched by other platforms, giving you an edge in the investment game.

Invest without management fees

While some platforms charge percentage-based management fees, M1 stands out by offering self-managed services without these costs. This allows investors to focus on maximizing returns without worrying about fees tied to their total assets under management.1

Ready to be your own investment manager?

If you’re tired of outdated investment platforms that charge hefty fees and limit your control, it’s time to meet M1. This game-changer combines strategic autonomy with cutting-edge automation, putting you in the driver’s seat of your financial future. Say goodbye to the old-school approach and hello to smarter wealth management. With M1, you’re not just following the trend; you’re leading the charge. Plus, take advantage of our new client promotion: Borrow on margin at 6.25%!

Ready to ditch the past and embrace the future of investing? Try M1 and revolutionize the way you manage your portfolio.

- A $3 monthly platform fee will apply to clients with less than $10,000 in M1 assets or without an active Personal Loan. The fee will be waived if your opened M1 Invest or Earn accounts settled aggregate balance equals or exceeds $10,000 for at least one day during the 30 days prior to program launch. The monthly platform fee will be waived for all clients with an active M1 Personal Loan, regardless of their M1 Invest or Earn balances. Other M1 fees may apply. Please see M1’s fee schedule for more information. ↩︎

- Categories

- Invest