Intrigued by IPOs? Read this before you invest

Buying the stock of newly listed companies can be rewarding – and exciting. Before getting lost in the hype, understand how IPOs work and how they might fit into your investing strategy.

Build wealth through smart investing. Learn about diverse investment options and strategies to maximize returns and achieve financial goals.

Buying the stock of newly listed companies can be rewarding – and exciting. Before getting lost in the hype, understand how IPOs work and how they might fit into your investing strategy.

A majority of investors make one or more of these critical mistakes when choosing stocks. Are you guilty?

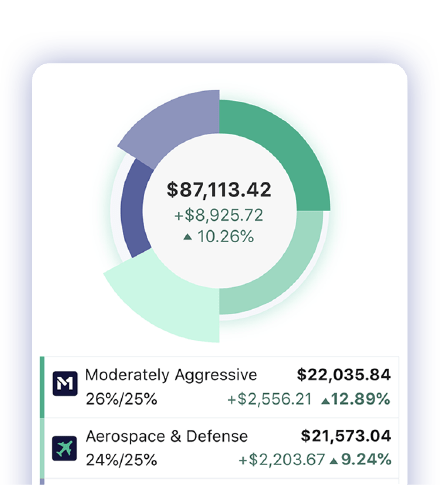

M1 gives you the power to create your investing portfolio as you see fit, but what are the drawbacks of a portfolio that is too complex?

A lot of new investors are drawn to penny stocks. It’s easy to see why these instruments might seem appealing at first glance: because penny…

Once upon a time, individuals who wanted to invest in the stock market had to pay expensive fees to do so. Even if you had…

During the last weeks of 2018, we polled our customers to get a sense of their investment plans for 2019. Here, we present those findings, along…

Prior to 1601, fortunes were made and lost on the uncertainty of new business ventures. With very few individuals in a position to put their…

Uh, oh… Your go-to investing platform was bought by another firm, and your brokerage account is being moved. It happens: just this year, E*Trade acquired 1…

Should you invest in the stock market, or keep your money in a savings account? Here’s what you need to consider when choosing where to put your money.

Invest, borrow, and spend on one intuitive platform. Customize your strategies, automate the big picture, and let The Finance Super App®️ take care of the day-to-day. M1 gives total control for your wealth today and tomorrow.

Check the background M1 Finance LLC with FINRA’s BrokerCheck

Disclosures

By using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. All agreements are available in our Agreement Library. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information.

M1 is a technology company offering a range of financial products and services. “M1” refers to M1 Holdings Inc., and its wholly-owned, separate affiliates M1 Finance LLC, M1 Spend LLC, and M1 Digital LLC.

All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future performance. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.

Brokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.

M1 Finance, LLC does not charge commission, trading, or management fees for self-directed brokerage accounts. You may still be charged other fees such as M1’s platform fee, regulatory fees, account closure fees, or ADR fees. For a complete list of fees M1 may charge visit M1’s Fee Schedule.

M1 is not a bank. M1 High-Yield Savings Accounts and Personal Loans are furnished by B2 Bank NA, Member FDIC and Equal Opportunity Lender, and serviced by M1 Spend LLC, a wholly-owned operating subsidiary of M1 Holdings, Inc.

M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

The Owner’s Rewards Card by M1 is no longer accepting new applications. Review Cardholder Agreement for important information about the Owner’s Rewards Card by M1. The Owner’s Rewards Card by M1 is serviced by M1 Spend LLC, on behalf of M1 Credit Receivables LLC.

© Copyright 2026 M1 Spend LLC. All rights reserved.

M1 Digital LLC is a wholly separate affiliate of M1 Finance LLC, and neither are involved with the execution or custody of cryptocurrencies. Cryptocurrencies are not FDIC or SIPC insured. For relevant crypto disclosures and risks, visit Crypto Disclosures.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

M1 Finance LLC

200 N LaSalle St., Ste. 810, Chicago, IL 60601

© Copyright 2026 M1 Holdings Inc.