Client stories: Tripling wealth using the FIRE movement on M1

The Financially Independent, Retire Early (FIRE) movement has drawn skeptics and devotees for its extreme savings and investing philosophy as a way to retire early. The FIRE movement targets conventional retirement and argues that by dedicating most of your income to investing, it might be possible to quit your job and live off small withdrawals from your investments decades before you turn 65 years old.

One of our clients at M1, Billy G., follows the FIRE framework—and he’s planning to retire at age 35. Billy contributes this to his passion for investing, a long-term mindset, and a financial platform that put him in control of his wealth.

We asked Billy to share his journey to early retirement, including how he and his wife use M1 to achieve their financial goals.

In 2018, Billy discovered the FIRE movement, but he had yet to discover an investing platform with the mindset and tools that worked for him and his family. Billy was working as an account manager while spending his free time doing the things he loves: gardening, camping, video games, and working out.

As a long-term investor, Billy needed to find a platform that was right for his financial goals.

“M1 is a great investing platform that has the best parts of other platforms, without the extra fluff that’s unimportant to long-term investors.”

The traditional platform Billy used before M1 had heavy fees. “You had to hope you were timing it perfectly.” As a long-term investor, Billy disagreed with this method of trading. He also wanted the ability to invest in fractional shares — a feature M1 has offered for years to give everyone a chance to own a slice of pricier stocks.

Save for your dream retirement with a customized investment portfolio >>

Over the last few years, Billy has invested towards his and his wife’s FIRE goal using M1.

“M1 really promotes automated investing. Just investing a hundred dollars a week or a few hundred dollars a month is simple. You don’t really have to worry about timing the market. I love that idea.”

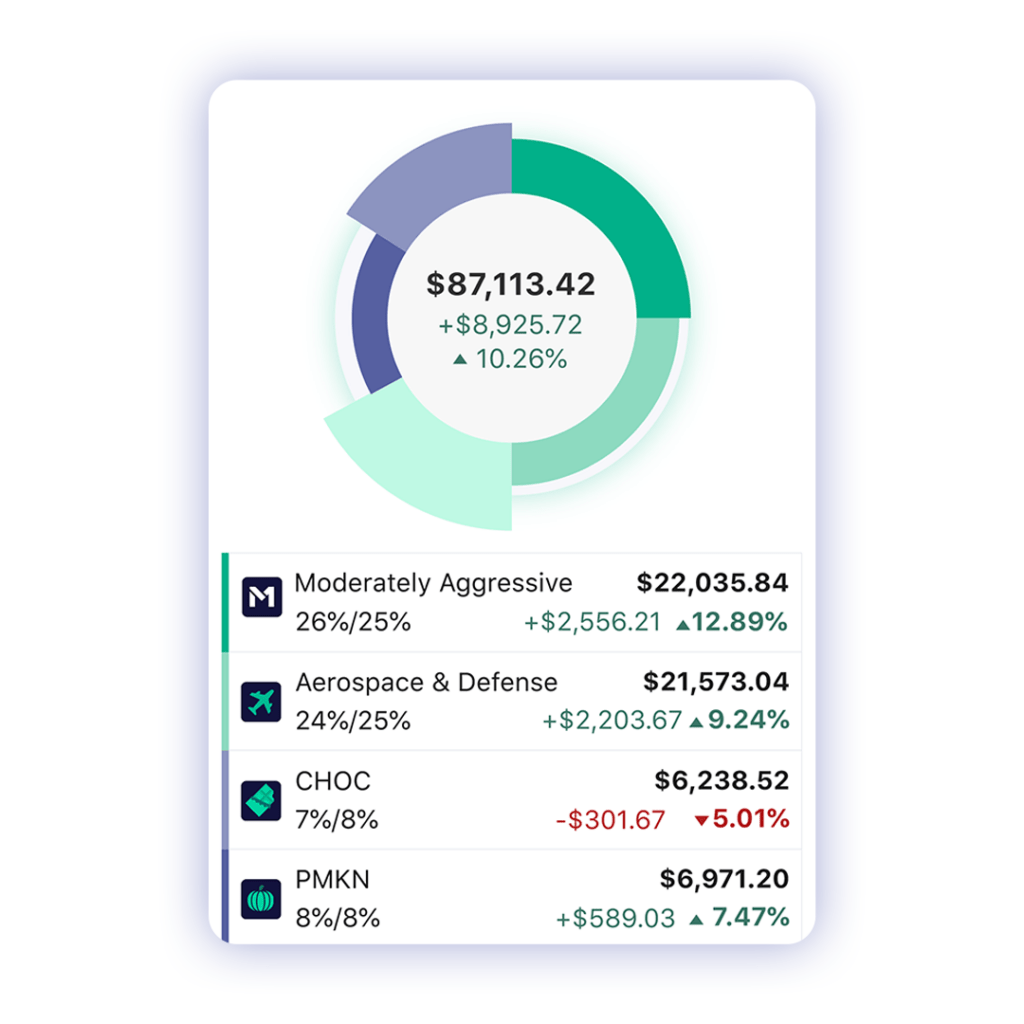

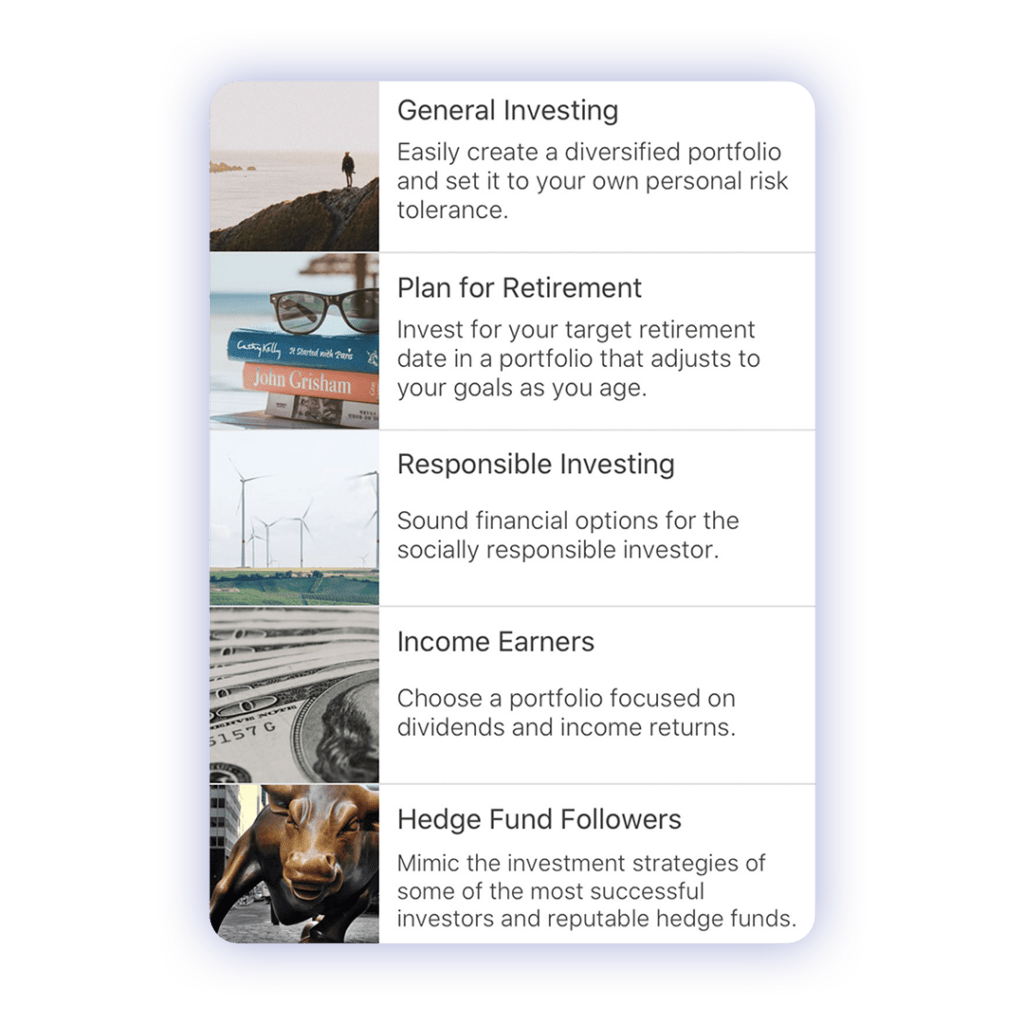

Automatic investing, scheduled contributions, and automatic rebalancing has taken much of the stress out of investing for Billy. He now has control over his investments and can decide between a custom portfolio of stocks and funds or an model portfolio designed by M1.

Utilizing all M1 has to offer has improved Billy’s well-being and helped him achieve his goals.

“M1 has helped me holistically. I now plan on retiring at 35. My wife and I are planning a year-long road trip to hit up all the national parks around the country. We can be free to do whatever we want to do.”

Long-term investing mindsets and a passion for personal finance unite M1 clients. Whether it’s achieving financial freedom or saving for retirement, committing to a wealth-building investment strategy is one way to improve your overall financial well-being.

At M1, money itself isn’t the end goal. Instead, it’s about providing the financial tools that help you achieve wellness, safety, happiness, and independence.

Want to share your M1 story? Tell us about it here.

Testimonials may not be representative of the experience of other customers. Not a guarantee of future performance or success.

- Categories

- M1