What are dividends?

Dividends are a portion of a company’s profits that are distributed to its shareholders as a part of owning the stock. They are usually worth a percentage of the stock’s price (a good yield can be anywhere from 2%-6%). They are paid on a regular basis, typically once a quarter. Not all stocks pay dividends.

Dividends are important to the average investor as they provide a consistent source of income and offer potential for long-term growth through compounding.

Dividend investing is one of the major types of investing strategies. Dividend investing is a strategy that involves investing in stocks that pay regular dividends to their shareholders. They are a popular choice among investors who prioritize stability and income generation. Find out more about investing strategies here.

In this post, we’ll explain how dividends work, the types of dividends, the tax implications of dividends, and dividend investing on M1.

How do dividends work?

Dividends can be thought of almost like a reward for owning stock in a company. When a company generates profits, its board of directors can decide whether to pay some or all of the profit out as a dividend or reinvest the profit back into the company.

How are dividends decided?

Decisions regarding company dividends are made by the board of directors. Companies that pay dividends are typically well-established and financially stable, so dividend-paying stocks have been historically less volatile than non-dividend stocks. Other types of assets, including funds like ETFs, may also pay dividends.

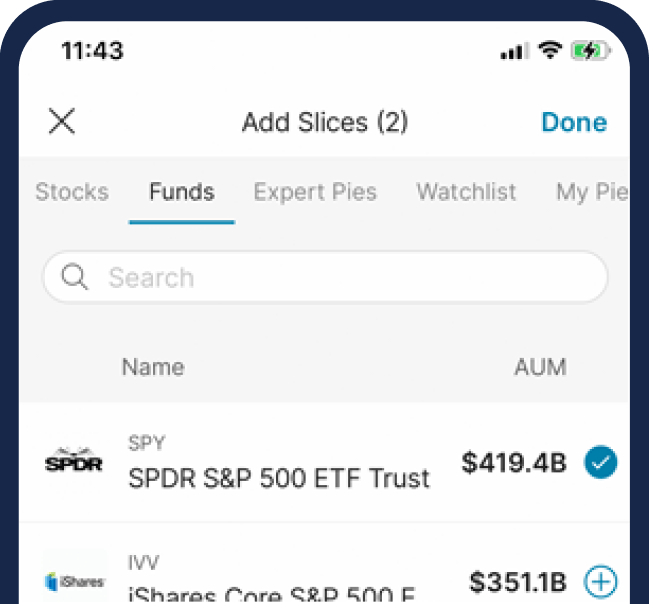

With M1’s app, you can start investing in ETFs right now by adding them to your portfolio

How often are dividends paid?

When companies pay dividends, they usually do so on a regular basis, so it’s important to be aware of the dates.

Declaration Date

The declaration date is when a company’s board of directors officially announces the upcoming dividend payment. This announcement includes details such as the dividend amount, payment date, and record date.

Ex-Dividend Date

The ex-dividend date is usually one business days before the record date. If an investor purchases shares on or after the ex-dividend date, they are not eligible to receive the upcoming dividend payment. Only those who own shares before this date will receive the dividend.

Record Date

The record date is the point at which the company reviews its records to identify shareholders that are eligible to receive the dividend. Shareholders who own shares on the record date are considered “shareholders of record” and will receive the dividend. The record date is usually set a few days after the ex-dividend date.

Payment Date

The payment date is when the company distributes the dividend to its eligible shareholders. It is the day on which the actual cash or additional shares are credited to shareholders’ accounts. The payment date usually falls a few weeks after the record date.

Types of dividends

There are four main types of dividends.

Cash dividends

Cash dividends are the most common type of dividend. When a company declares cash dividends, it distributes a portion of its profits directly to its shareholders in the form of cash payments. These payments are typically made on a regular schedule, such as quarterly or annually. Shareholders receive the cash dividend either in their brokerage accounts or as physical checks.

Stock dividends

Another form of dividends are stock dividends, where companies distribute additional shares of their own stock to shareholders instead of cash payments. The company typically creates new shares and gifts them to existing shareholders. While stock dividends don’t offer cash, they increase the number of shares owned by each investor. This can dilute the shares by increasing the total number of outstanding shares in a company, which proportionally reduces the ownership stake of existing shareholders. While an investor may lose immediate value, they will have more stock which could increase in value overtime. They also save on taxes since stock dividends are only taxed when you sell whereas cash dividends are taxed in the year your receive them. Stock dividends can be a good way to reward shareholders if the company itself is struggling because it may be able to keep shareholders from selling. Stock dividends are often considered a way for companies to reward shareholders without affecting the company’s liquidity.

DRIP (Dividend Reinvestment Plan)

DRIPs (dividend reinvestment plans) are an option for investors to reinvest their cash dividends back into the same company’s shares.

M1 has a feature similar to DRIP called Auto-Invest. If you earn dividends, they can be paid out into your cash balance. You can set a minimum cash balance and once it reaches that amount, the cash balance is automatically invested into your Pies at the percentages you specify. This is one way your entire portfolio could benefit from your dividends.

Special dividends

Special dividends are not as common as they are usually one-time payments to shareholders. Special dividends allow companies to distribute excess cash to shareholders outside of their usual dividend schedule.

Tax implications of dividends

Qualified and non-qualified dividends have different tax rules. You can use tax-advantaged accounts to benefit from some its general tax rules.

Qualified dividends

These dividends are subject to a lower tax rate, which is typically the same rate as long-term capital gains. The exact rate varies depending on your tax bracket. To qualify, the dividends must meet specific holding period requirements set by the IRS (60 days during the 121-day period that begins 60 days before the ex-dividend date).

Non-qualified dividends

Non-qualified dividends are taxed at your regular income tax rate, which might be higher than the rate for qualified dividends.

Tax-advantaged retirement accounts

If you have a tax-advantaged account, such as a ROTH IRA, then any dividends you earn could benefit from its taxation rules.

Investing in dividend stocks in a traditional IRA means any income earned is tax-deferred until withdrawal. You won’t pay taxes on the dividends until you start taking distributions.

Investing in dividend stocks in a Roth IRA means qualified withdrawals in retirement are entirely tax-free.

Other considerations with dividends

When a company has a history of consistent dividend payments, any change or reduction can be cause for concern among investors.

It could be indicating financial challenges and a company’s mere mention of a cut to its dividend can cause the stock to drop.

However, some companies choose to cut or cancel a dividend payment in order to reinvest the money into the company itself, with the hope of generating returns for the shareholders in the long term.

Another consideration of dividends is inflation. Dividend-paying stocks can possibly provide some protection against inflation since they may offer a steady stream of income. Also, some companies may increase their dividend payouts during inflationary periods to help with the stock’s total return.

The M1 line

Dividends represent the shared success and growth of a company and its shareholders. By understanding the various types of dividends, dividend dates, dividend decisions, and taxes on dividends, investors can make informed choices that align with their financial goals and risk tolerance.

20230908-3046496-9732000

DISCLOSURES

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.