How lifestyle creep can impact your finances

Most people can agree that getting a raise or a bonus feels incredible. You put in the work, land the extra income, and feel psyched about the boost to your budget.

It’s tempting to take your hard-earned money and spend it on a relaxing vacation or the latest tech trend. It’s also easy to start making smaller purchases, like revamping your wardrobe or ordering take out.

These slow and subtle changes to your spending habits are known as lifestyle creep, which can have drastic consequences for your financial goals, retirement savings, and long-term wealth.

Luckily, there are ways to identify lifestyle creep and strategies to prevent it. Whether your income has recently increased, or your budget has slipped to the wayside, you can avoid lifestyle creep by understanding it and taking action to protect your spending.

Create a budget, or adjust your current one, with our guide to budgeting >>

What is lifestyle creep?

Lifestyle creep occurs when your discretionary spending increases as your disposable income increases. This often happens when you get a raise and begin spending more money to elevate your lifestyle. On a personal finance level, it truly takes hold when you start to see spending as a right, rather than a choice.

When you spend mindlessly, rather than intentionally, lifestyle creep becomes the norm. You wind up purchasing the vacation, car, or shoes you want without a second thought. Impulse spending can quickly become a difficult habit to reverse as you get used to making bigger purchases with your extra income.

As you progress through your career, you deserve to be rewarded in any way you see fit. But when your rent, mortgage, or car payment increases with each paycheck, it’s easy to lose control over your finances. This leaves little room for saving for retirement or investing for long-term wealth.

The effects of lifestyle creep for investors

Lifestyle creep is considered an unhealthy financial habit because it can be easy to fall into and has long-term effects on your financial well-being. It can also happen to anyone, regardless of income.

The impact of lifestyle creep depends on how much money you make and your financial habits. Maybe earning more money means you can finally afford things that may have been out of reach. So, you spend. This lifestyle inflation inevitably leads to saving and investing less.

Casually spending money on unnecessary expenses could mean you’re missing out on opportunities to put your money to work, such as investing in retirement funds or dollar-cost averaging.

What young investors should know about lifestyle creep

Typically, your twenties are the first decade where you begin making real money. After landing a well-paying first job, lifestyle creep can set in as your life begins to change. This behavior can quickly erode your savings account or emergency fund, increase your debts, and prevent you from saving for your first home or retirement.

Your twenties are a great time to develop healthy financial habits that improve your overall financial health. Understanding the power of long-term investing is the first step, so take this decade to educate yourself, work on your career, and set up ways to invest in yourself.

Lifestyle creep in retirement planning

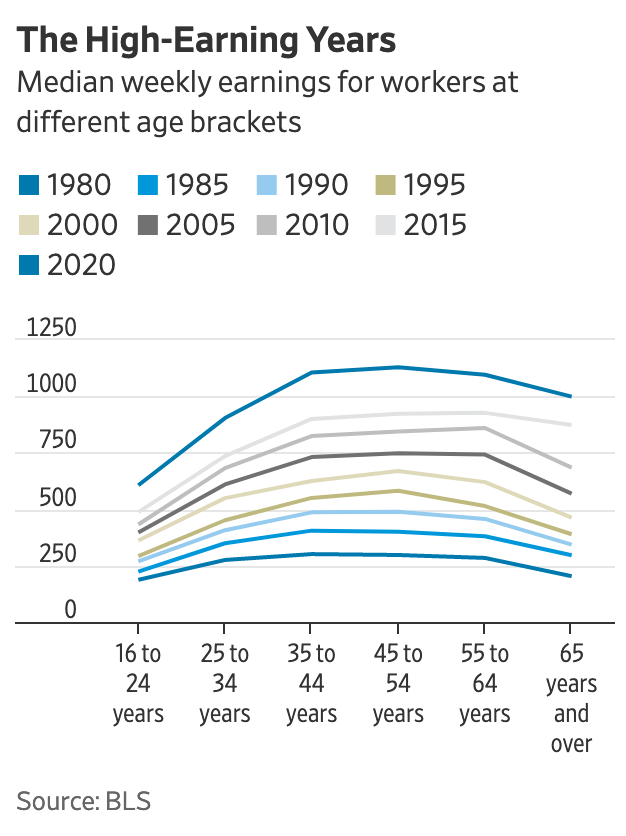

Lifestyle creep can be particularly dangerous for near-retirees as well. Ten to fifteen years before retirement are usually peak earning years, as the average weekly earnings for workers across age groups increase during that time.

Median weekly earnings for workers at different age brackets

What’s more, you’ve typically paid off your largest expenses, such as credit card debt, a mortgage, or college tuition. This feeling of newfound wealth can lead to unstructured financial decision making. You may buy a new car, a second home, or take pricier vacations.

The goal of retirement is often to reach a point of financial independence or maintain your current lifestyle. If that lifestyle becomes too expensive due to lifestyle creep, you may end up running out of cash earlier than planned.

Manage lifestyle creep by taking control of your finances >>

How to prevent lifestyle creep

Preventing lifestyle inflation requires a change in thinking or behavior around spending. For investors, developing a long-term mindset and setting financial goals are the most important strategies you can practice.

If you find yourself spending more with each pay bump, take these three steps to avoid lifestyle inflation.

1. Know your goals.

Typically, a raise doesn’t come as a surprise. When you make a plan for your extra money once you get it, managing it becomes a lot easier. Set aside time to make short term and long-term financial goals. Then, prioritize them.

When considering your financial goals, remember the 3 P’s of investing, purpose, plan, and patience. Identify a clear purpose, create a recurring plan, and practice patience. Once you’ve created and prioritized your goals, it’s time to budget.

2. Revamp your budget.

After each raise, you should review your finances and create a plan. This can help you see 1) a list of your largest expenses and 2) how you spend, save, and invest.

Start by identifying areas where you may be spending too much. Then, look to areas where you may be spending too little. You may be able to contribute more to your 401(k), Roth IRA, or individual brokerage account each month.

Budgeting is about finding a balance. Having extra income doesn’t mean you have to spend more. If your current budget works well for you, consider saving or investing your raise until you’re ready to increase your life expenses in a calculated and appropriate manner.

Once you’ve created a budget, you can free yourself from impulse spending by automating your savings. Many companies, like M1, make it easy to automate payments to and from your checking and investing accounts. Once you set up payments each month, your money works for you.

3. Celebrate accordingly.

When you do get a raise, celebrate! Enjoy the extra money and congratulate yourself. Just remember to rework your budget and check that you’re still living within your means. Rewarding your future self with extra savings or investing has all the positives of a raise, while avoiding the negatives of lifestyle creep.

Managing lifestyle creep for the long-term

After you outline your financial goals, revamp your budget, and celebrate the extra income, simply continue your path towards financial well-being. Look into the positive impacts of dollar-cost averaging for brokerage or retirement accounts, or find time for a financial audit to calculate your new net worth.

Start automating your investments to limit lifestyle creep >>

- Categories

- Plan