I bonds, tax-loss harvesting, and stress recovery

Today we’re discussing the U.S. Treasury backed, inflation-protected savings bond yielding 9.62%. Americans bought nearly $11 billion of these bonds over the past six months, compared with roughly $1.2 billion in the same period in 2020 and 2021. They’re popular – and yet another strategy investors can consider during this period of inflation.

We’re also talking about:

- The benefits of tax-loss harvesting during bear markets

- Five business hacks used by Jeff Bezos

- Stress recovery

Reading

THE NAME’S BOND, I BOND

In the previous edition of The Investor’s Mindset, we discussed steps investors can take to try and minimize the impact of economic downturns. Steps such as:

- Sticking to your long-term plan

- Creating an investing schedule

- Bettering your financial wellness

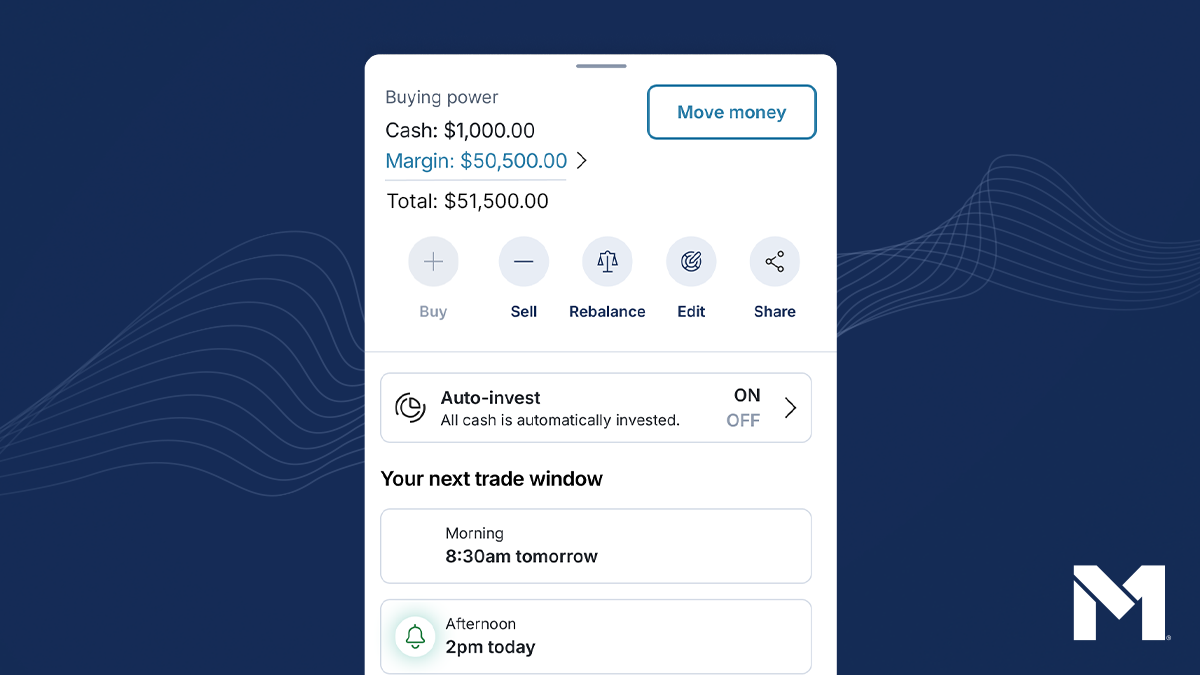

- Automating your finances

While practicing these steps is one of the ways to ride out a bear market, there are investment options as well.

As inflation rages on, the U.S. Treasury’s inflation-protected savings bond is becoming increasingly popular among some investors. In fact, eager investors crashed the website in May.

Known as an “I Bond”, the investment is backed by the federal government (low-risk) and combines two interest rates to make its yield. One interest rate is fixed by the Treasury and one is based on the consumer price index (CPI), which is updated every six months depending on inflation. Even if there is deflation, 0% is the lowest the yield can go. I Bonds are currently yielding at 9.62% through October 2022.

Here’s what investors should know:

- I Bonds are not offered on M1 or any other platform. They must be bought at TreasuryDirect.gov.

- Individuals can only purchase up to $10,000 in electronic I Bonds each year.

- Investors pay the face value of the bond, meaning you pay $100 for a $100 bond.

- I Bonds cannot be cashed for at least one year. If the I Bond is cashed before five years, you lose the previous three months of interest.

- Individuals pay federal income taxes on the bond (but if you use the interest to pay for college, you won’t owe any taxes at all).

Considering other investments while sticking to your long-term plan can be an option for some investors during times of poor market performance. Ultimately, decisions regarding your portfolio come down to your risk tolerance and personal investing preference.

Note: This is not an investment recommendation.

Learning

LEARN ALL ABOUT FRACTIONAL SHARES

Why invest in fraction shares? See why investors are partial to stock slices.

LOSSES INTO WINS WITH TAX-LOSS HARVESTING

Create tax breaks from your investment losses with this strategy.

Well-being

This week, take a moment to focus on:

Methods: Feeling burnt out? Try these five methods for stress recovery, according to Harvard Business Review.

Frameworks: Five business hacks Jeff Bezos used to turn a $250,000 loan into a $1.2 trillion company.

Health: Looking to enjoy the summer weather and get fit? These 13 workout ideas will get you outside and moving.

Sign up for M1 and receive The Investor’s Mindset newsletter every Monday.

- Categories

- Invest