How M1 thinks about market volatility and market corrections

After multiple days of stock declines, even the most disciplined long-term investors get concerned. We want to take a moment to share how we think about downturns and volatility at M1.

For context, the S&P 500 has dropped more than 17% as of May 2022. The Dow Jones Industrial Average and Nasdaq are down too, by 12% and 27% respectively. Beyond the markets, interest rates have increased and recent economic reports signal a recession. The future feels uncertain.

It’s easy to let emotions take over in moments like these. Some investors may think about buying because stocks are priced lower, but others consider selling or adjusting their portfolio targets. Others do nothing at all.

As an investor, chances are you’ve heard the phrase “buy low, sell high.” While that may work in some situations, being a long-term investor is more nuanced.

Market volatility and market corrections are normal

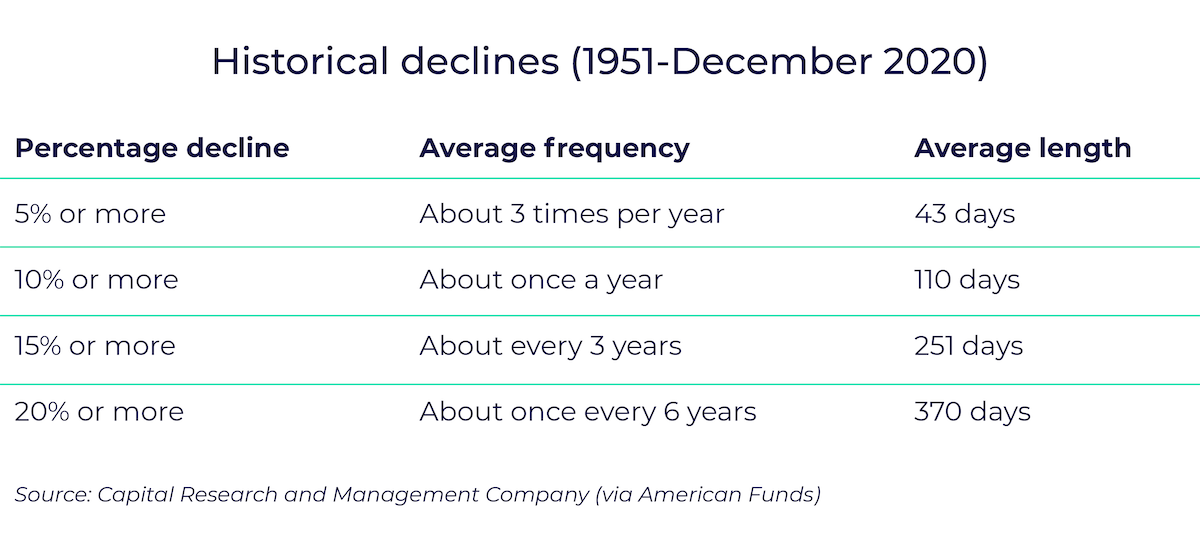

Our economy, stock market included, moves in cycles. While uncomfortable, market downturns (including volatility and corrections) have been happening for years and will continue far into the future. Just look at the frequency and magnitude of market downturns over the past few decades:

Not fun in the moment, but easier to accept at a higher level.

And although market downturns are normal (they’re even healthy and expected by economists), it can be difficult to identify a singular cause behind them.

Today, economists consider contributing factors to be rising inflation and interest rates. Added factors like geopolitical concerns and COVID-related economic impact are also likely contributing to the current market volatility.

While this can make investment decisions feel more ambiguous, history shows us that no atter the cause, the markets are constantly changing. Once we accept this, we can begin to view market downturns as opportunities to reflect on our strengths and weaknesses as investors, evaluate changing opportunities, and stay focused on our long-term goals.

Investors are motivated by psychology

As humans, we are motivated by emotion and instant gratification. Long-term investors are no exception, especially during market downturns.

Warren Buffet once said, “Success in investing doesn’t correlate with I.Q. once you’re above the level of 25. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

This means that even as long-term investors, we feel a deep urge to react to changing variables like market movements, company earnings, forecasts, corporate actions, and more. Combined with our emotions tested by fast news cycles, uncertainty, and ingrained loss aversion, it can be compelling to ignore your long-term goals for the short-term fix.

In other words, and in the context of current events, it means we’re more likely to sell during market downturns.

Think about it this way: lower priced stocks cause many of us to worry about their value. Worry is a negative emotion. To get rid of it, we sell those stocks.

Enter instant gratification—until the market bounces back and we regret it a few years down the line. When we made that decision, we didn’t consider our investment horizon. Instead, we considered psychological comfort.

Buy low, sell high approach

To combat these common psychological reactions to market downturns, many people follow the theory of “buy low, sell high.” This theory suggests that when stocks are at lower prices, they are “discounted” in some way and will increase in value over time, at which point you should buy. Though that sometimes holds true, it’s hard to simplify such an important activity (investing, building wealth) in a few words.

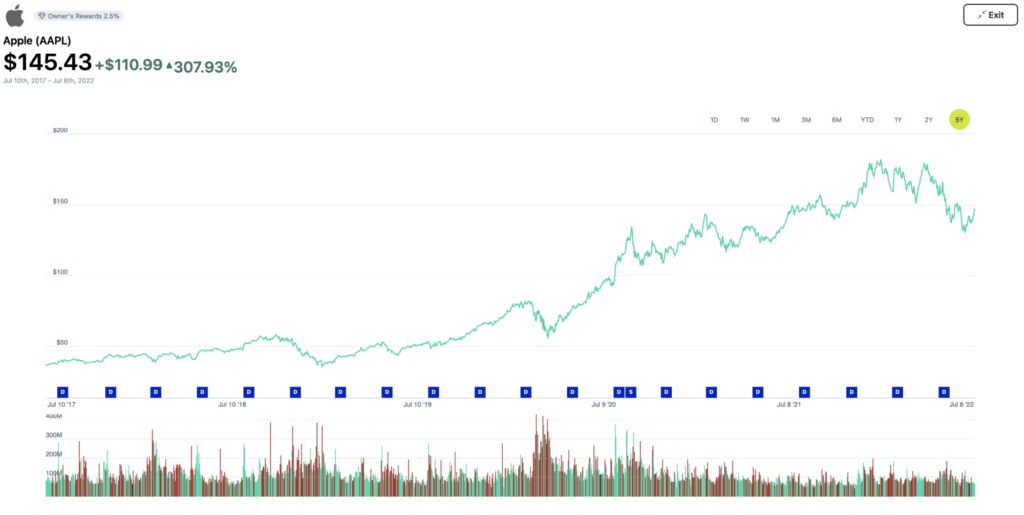

When you look at a stock or ETF that’s increased in value over the last 5, 10, or even 20 years, the overall trend line will be up and to the right. But if you zoom in, you’ll see plenty of fluctuations that indicate increases and decreases in price. Let’s look at Apple (AAPL) as an example:

Stock market data for Apple stock from July 10, 2017 to July 8, 2022

Over the last five years, Apple’s stock price and market cap have both increased. Some long-term investors may wish they would have bought Apple at a price five years ago. But hindsight is 20/20, and not all investors would have been able to think through moments like:

- A 30% loss in price during the fourth quarter of 2018

- Another 10% loss in price during the first quarter of 2019

- An 89% annual gain in stock price at the end of 2019

- A $500 billion loss in market cap in 2020 (a 22% drop from its peak)

- Stock price up 32% year to date in December 2021

- Stock price down 19% year to date in May 2022

There are hundreds of moments when even a long-term investor may have been tempted to buy or sell. But if an investor had sold at the point of the 89% annual gain news in 2019, they might make less than an investor who held the stock until it appreciated even more over the long term. Of course, that’s not guaranteed so holding on to the stock could be seen as a risk.

This example illustrates why it’s more complex than “buy low, sell high.”

Navigating volatility and market corrections

It’s human to want to realize profits and avoid losses, even more so during times of market volatility or a market correction. During the COVID-19-induced market downturn in March 2020, our Chief of Staff, Michael Savino, wrote:

What I decide to do at this point that will really make or break my investing strategy over the long term. And the way I see it, I have five choices in a market downturn:

- Adjust my portfolio targets: ”This downturn made me realize that my portfolio choices were riskier than I have the appetite for. I am going to use some more conservative investment options.”

- Do nothing: ”I know markets go up and down. I am confident this is temporary and my portfolio will stay the course.”

- Invest even more and buy the dip: ”Stock prices are down. It’s a great buying opportunity. I’m going to be more aggressive.”

- Take advantage of the dip: “I think the markets have another 10% to lose, I am going to move my positions to those that gain value when the market loses.”

- Sell my portfolio: “The big one is coming. I am going to hold everything as cash or cash alternatives until the danger subsides and re-enter when the markets have stabilized”

But which choice is the right one? This is the million-dollar question (figuratively and maybe even literally).

These options are yours to make, and we can’t tell you which one is right for you at this moment. What we can tell you is that the decision to buy, sell, or adjust your portfolio shouldn’t come from your emotional reasoning.

Note that Michael’s options are all rooted in something more objective than an emotion—they’re rooted in discipline, systems, and habits. It’s our belief (and proven by research) that if you’re worried about making a mistake, regretting something, or looking bad, you’re not in a place to make an investment decision.

It’s different when you’re researching objective factors like financial analysis, revenue models, business leadership, and industry outlook. That’s when you’re making strategic, smart decisions for your future. And it doesn’t mean you won’t make investment mistakes. Rather, it means you’ll practice the hard learned lesson of patience.

As you watch the markets cycle through ups and downs, check on your portfolio, and consider different actions based on your goals, remember to root yourself in logic and smart financial habits. So, consider if contributing to your portfolio is currently right for you and build it in a way that makes sense for your future. Approach volatility and market corrections with knowledge and understanding, both from personal context and the context of market historical performance.

The bottom line is to think through your options. Long-term conviction will help you weather downturns, market corrections, and the human side of you that just wants to react. Often (and with hindsight’s benefit), doing nothing can be the prudent move.

While you do that, we will continue building the tools and the resources you need to get you through it.

Originally published January 22, 2022, updated July 8, 2022.

- Categories

- Invest