How to make your financial habits stick

When it comes to investing, our habits decide our destination.

Sure, we may have huge goals for our lives and finances. But having those goals means nothing if we don’t actively work towards them every day. New research shows that we only make real progress when we become consistent in the small behaviors that move us toward those goals.

And this isn’t theoretical finance guru speak. It’s based on the ground-breaking work of Dr. B.J. Fogg, PhD., the founder of Stanford’s Behavior Design Lab and author of the book Tiny Habits: The Small Changes that Change Everything.

If you’ve been part of the M1 community for any length of time, this concept of owning your journey isn’t new. What might be novel, though, is Dr. Fogg’s barrier-shattering system of establishing those habits.

We can pressure test Our financial behaviors with the Tiny Habits model

First, some good news. We’ve always heard that repetition is the key to building reliable patterns. But Dr. Fogg calls that… well, nonsense. “Some of today’s popular habit bloggers still talk about repetition or frequency as the key,” he writes. “Just know this: They are recycling old ideas. They have not done the groundbreaking research.”

In fact, Dr. Fogg’s empirical evidence has determined that habits can and often do form immediately.

How? Feel-good emotions.

“When I teach people about human behavior, I boil it down to three words to make the point crystal clear,” says Dr. Fogg. “Emotions create habits. Not repetition. Not frequency. Not fairy dust. Emotions.”

We call this good news because it means that:

- We do not need to “suffer through” a certain number of painful reps to establish a new habit. We can become the kind of person that makes smart financial moves immediately.

- Failed past attempts are not a reflection on us but on our systems. (Failure — especially regretful splurges, missed opportunities, and lost time — is a design flaw, not a personality flaw).

- The old “go big or go home” philosophy can be relocated to the compost bin. For example, the goal of reading one chapter of investment wisdom a day is just as worthwhile as the goal of taking on three jobs to earn and invest like crazy. For the first time, the small, quiet, consistent behaviors are being praised for moving the needle.

- Accountability buddies and rewards are no longer needed. Dr. Fogg teaches us to celebrate every time we successfully complete our Tiny Habit.

- We’re able to change a handful of behaviors at once. No need to “focus hard” on just one to achieve our goals. It’s true: Dr. Fogg’s work shows that we can successfully potentially earn more, learn more, and save more all at once with tiny consistent habits.

- There’s also no need to wait until another life event to start. Committing to begin saving money once we earn a pay raise, for example, is as ill-fated as promising ourselves we’ll start eating healthy… but only after the holidays. Tiny habits are just that – they’re so tiny they can (and should) be done today.

- Replacing unwanted patterns with new desirable ones is not the only way. That means if you want to untangle your unwanted habit of reading panic-inducing sensationalist news, for example, there’s no need to replace it with a subscription to the Sunshine Times.

Feeling better? We are. Here’s how it all works:

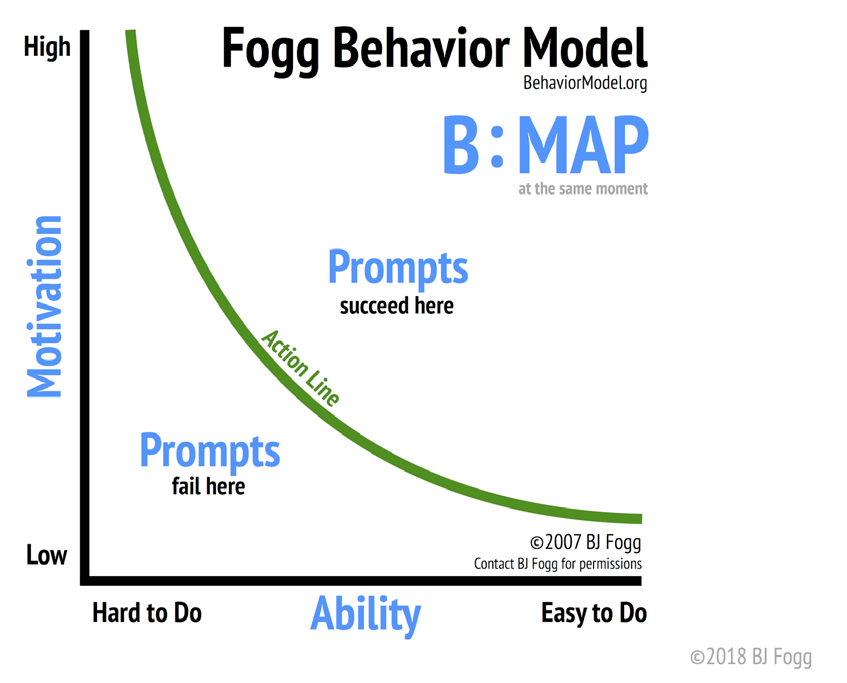

Behavior = motivation + ability + prompt

All behavior – that includes the good and bad – happens when three elements coincide. Motivation and ability are your first two factors, and those are on a scale of least to most.

Source: Dr. BJ Fogg

When you’re most motivated and most able to do something is when a prompt will always work to influence your behavior.

For example, when you’re inspired by seeing your friend’s parents head off to explore another exotic destination (high motivation) and just earned a raise anyway (high ability), you opt to increase auto-contributions to your retirement funds in the hopes of one day following your adventurous predecessors to top exotic spots.

On the other hand, when you’re least motivated and least able to act, no prompt will instigate a move on your part.

For example, you’re not interested in a new vehicle right now (low motivation) and even if you were, you’d have to open a new line of credit and may not even be approved (low ability), so the blaring car commercial prompts you only to do one thing: mute the TV’s volume. The prompt to buy fizzles, unsuccessful.

Now, if something were to make buying a vehicle easy or enjoyable right now, then this behavior would likely happen. For example, if the motivation is middling (“new cars are fun, but I’m not exactly hungry to buy one right now”) but you learned that M1 Plus members are using M1 Borrow to pay off new cars, then the likelihood of that behavior goes from zero to sixty in around five seconds.

Now that we’ve seen how motivation, ability, and prompts work together to help or hinder our habitual success, let’s look at three ways to build the kind of financial habits that work for your future.

3 ways to create smart (& enjoyable!) habits in life

Dr. Fogg lists several concrete things people can do to successfully design their earning, spending, saving, and investing behavior for optimum results.

Skill up

Motivation, one of the three factors of our equation, is known to come and go. To compensate, Dr. Fogg recommends using the height of a motivating moment to increase the other axis of the behavior model: ability.

“By gaining skills, you’re turning up the volume on ability,” he writes. “The act of ‘skilling up’ feels natural when you are riding a Motivation Wave because you are using this energy crest to your advantage. They are one-time actions that make behaviors easier to do, so why not do them when you’re bursting with energy at the outset?”

For investors, this can mean subscribing to a monthly investing newsletter or reading a book by a trusted voice in the industry.

Improve your environment

If a behavior annoys us, then it’ll never become a habit.

Improving our surroundings is the second behavior design strategy we can use to reduce friction when it comes to creating more beneficial patterns. It looks like this:

You’re motivated to put your new pay raise percentage straight toward your portfolio, but your brokerage still requires you manually transfer your deposits into your investment account. Remembering to do it regularly proves harder than anticipated.

As you try to log in again, you get distracted by the many notifications on your phone, including a flash sale on a big-ticket item you wanted. Eventually, the savings boost isn’t worth fighting all the factors for, so you cave and splurge.

“None of us lives in a habit vacuum,” writes Dr. Fogg. “Our environment, which includes people, influences our habitual behaviors more than we recognize or care to admit.” This may mean unsubscribing from your favorite retailer’s newsletter, canceling a travel magazine, or getting to know friends who enjoy outdoor activities in lieu of restaurants and shopping.

Since our environments are full of prompts, don’t be surprised when the balance between ability and motivation is tested multiple times a day. Instead, design for those moments.

We’ll interrupt this for a little M1 plug: that’s exactly what we’re doing when we focus on automation. When you set a habit on autopilot, like increasing the contributions to your portfolio, you’ll decrease (or even eliminate) the distractions that prevent you from keeping up with that habit.

Scale back the behavior

Does investing $20 a month sound absurd? Probably not. According to Dr. Fogg’s research, truly tiny habits with accompanying celebrations are the only way to build lasting behavioral patterns.

“The scaled-back version is your tiny habit – it’s your baseline behavior, the only thing you have to do [regularly] to cultivate the [desirable] habit that will eventually grow to full size,” he says. “We’re not aiming for perfection here, only consistency. Keeping the habit alive means keeping it rooted in your routine no matter how tiny it is.”

Returning to our example of adding our pay raise to our investment account, consider scaling back the behavior to make it a super small amount. Then, whenever you’re tempted to skip a transfer, instead of skipping, you can revert to your Tiny Habit amount, instead.

And reap the rewards of knowing you didn’t miss a beat.

Dr. Fogg says this is best done directly after another habit like eating a meal or receiving a paycheck. He says the best way to start a tiny habit is to declare, “After I _____, I will _______.” And then stick to it.

Let’s wrap this up

Any regular tiny move forward is infinitely better than the occasional colossal backslide.

Think of your momentum like compounding interest in a high-yield checking account: at one point, the interest begins earning interest! In the same way, our momentum from doing tiny things consistently eventually begins to earn its own momentum, propelling us forward and on to other, even better aspirations.

For more information on how to build the perfect portfolio of beneficial behavioral habits, check out the Investor’s Mindset, a new email newsletter exclusively for M1 Finance clients.

M1 Finance is not affiliated with Dr. BJ Fogg, his books, or other work. We’re just fans.

M1 Plus is an annual membership that confers benefits for products and services offered by M1 Finance LLC and M1 Spend LLC, each a separate, affiliated, and wholly-owned operating subsidiary of M1 Holdings Inc.

- Categories

- Plan