Why supply chains may soon outpace demand

Many Q2 earnings reports are falling short of estimates, but inflation sure isn’t on that list. See how soaring prices are affecting spending and other top news this week, including an airline’s big bet on 737s.

In this edition:

- What falls as inflation rises

- Big banks’ earnings reports

- The next strain for the supply chain

News

Inflation cuts spending

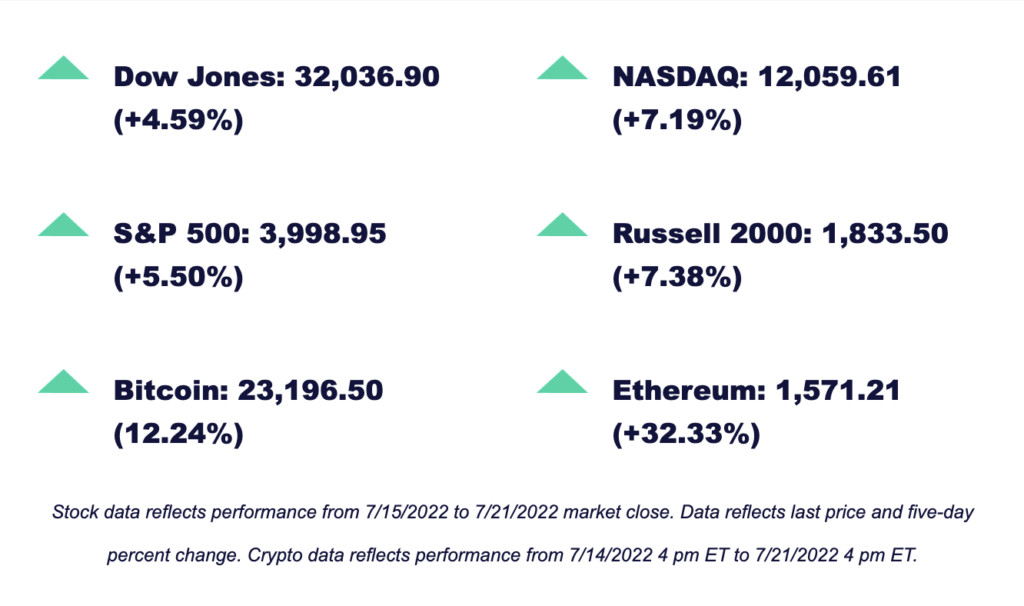

Pay raises have been historically high over the past year but continue to lag behind inflation rates. Year-over-year wage growth has held steady at 4% each month, while inflation boosted the cost of goods by over 9% in the past 12 months.

As a result, workers haven’t experienced a month with year-over-year earnings growth since March 2021.

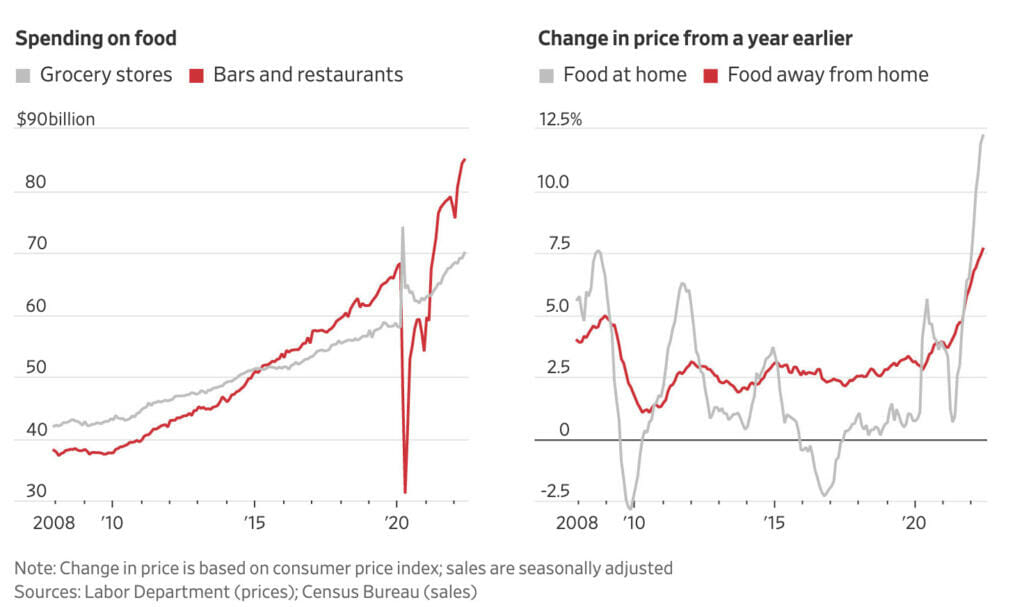

Spending has increased thanks to rising prices. For example, spending on “food at home” is higher now than during the pandemic. But when you factor in inflation, people are consuming less. The exception? Dining out. Prices in the “food away from home” category rose less than 8% in June, but sales were up almost 14%.

Despite the gap between pay and inflation, a meal out seems to be one of the few indulgences people continue to work into their budgets.

Big bank bombshells

Goldman Sachs and Bank of America shared second-quarter results on Monday that surprised investors, with Goldman Sachs smashing expectations. These were the final two banks to report profits. Here’s a quick look at each report:

Goldman Sachs (GS)

- Earnings per share: $7.73 adjusted vs. $6.58 expected

- Revenue: $11.86 billion vs. $10.86 billion expected

Bank of America (BAC)

- Earnings per share: $0.73 adjusted vs. $0.75 expected

- Revenue: $22.79 billion vs. $22.67 expected

David Solomon, Goldman Sachs CEO, repeated comments from other bank leaders by highlighting “increased volatility and uncertainty” in markets, rocked by inflation, interest rates hikes, and Russia’s invasion of Ukraine.

Supply change

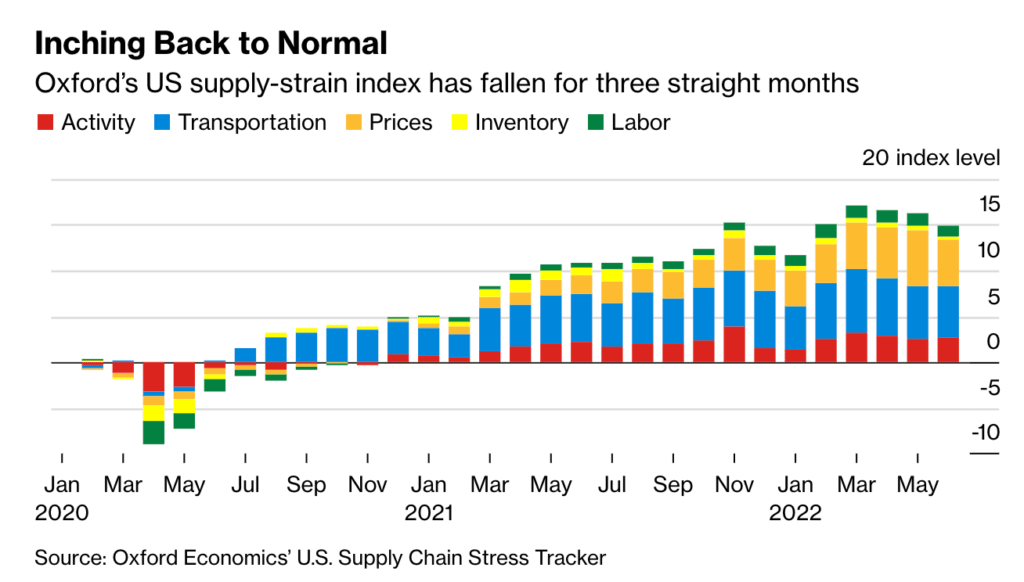

Though shipping strains may finally be on the mend, weak demand is the next pressing problem for suppliers. Supply chain problems in the U.S. have eased back from their pandemic peaks — but so has consumer spending. This drop could throw economic growth into reverse and lead to inventory pileup.

In research released this month, Citi economists wrote “pressures in the global good sectors, which have been a central driver of inflation, may finally be easing.” The issue, “is that this looks to be occurring on the back of a slowing in the global consumer’s demand for goods, especially discretionary goods, and thus may also signal rising recession risks.”

Below is the latest reading of U.S. supply strains from Oxford Economics.

Quick hits

M1verse

Checking APY* is changing

To give Plus members even more powerful digital banking perks, we’re raising the APY on M1 Checking Accounts to 1.70%*, effective July 28.

Learn about the high-yield M1 Checking account >>

*No minimum balance to open account or to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary.

This week in finance history

July 19, 1990

Six companies set the record for the most IPOs issued in a single day. The businesses — Command Security, In-Store Advertising, MECA Software, Modtech Holdings, O’Charley’s, and Wisconsin Pharmacal — raised a collective $100.4 million. During a time of recession, this was a favorable sign that both the stock market and economy were recovering.

Sign up for M1 and receive the Weekly Wrap Up newsletter every Friday.

- Categories

- Plan