How much can I contribute to my IRAs?

An IRA, or individual retirement account, can potentially be a great vehicle to bury more money away for your post-working years outside of an employee-sponsored plan. However, there are IRA contribution limits to be aware of.

Additionally, IRAs have income restrictions, so not everyone is eligible to contribute to these accounts. Also, if you’re over the age of 50, you can contribute slightly more — potentially ramping up your retirement nest egg amount.

So if you’re eligible to contribute, here’s everything you need to know about IRA contribution limits, and how to get started putting money away.

IRA contribution limits: Here’s how much you can invest in 2024

Each year, IRA contribution limits can be changed as mandated by the Internal Revenue Service (IRS). These limits are typically changed during times of inflation so those putting funds away can avoid losing momentum.

For the 2024 tax year, here are the IRA contribution limits for traditional and Roth IRAs:

- If you’re less than 50 years old: $7,000

- If you’re 50 and over: $8,000

There are a few rules to keep in mind:

- If your taxable income is under the limits for 2024, you can only contribute up to that amount. For example, if you’re 18 years old working part-time and you make $5,000 for the entire tax year — you’re limited to contributing up to that earned amount.

- You can only contribute up to the maximum between a traditional and Roth IRA. For example, if you contribute $5,000 to your Roth IRA in 2024, you can only put $2,000 towards your traditional IRA (if you’re under 50 years old).

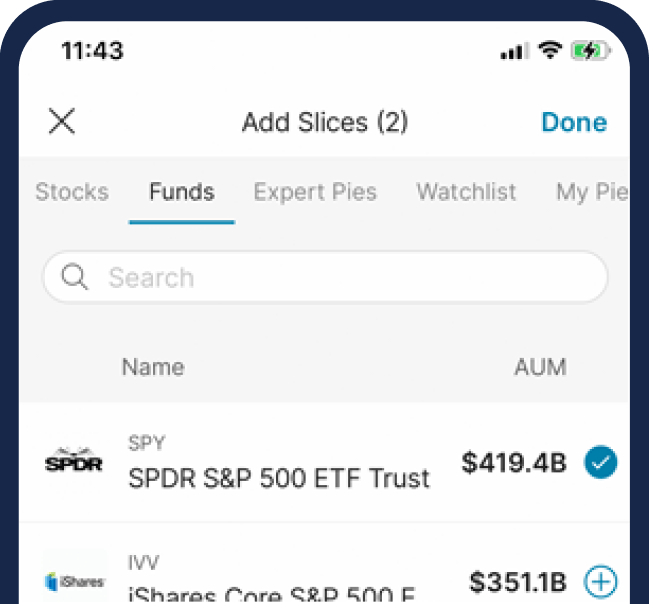

On M1, you can contribute to either your traditional, Roth, or SEP IRA and build towards a potential nest egg to use in retirement.

For the full rules and exceptions, visit the IRS website here.

How IRAs are different from employer-sponsored retirement plans

IRAs and retirement plans from an employer both at their core have the same purpose: to give consumers the opportunity to put money away for their post working years. But each of these accounts have stark differences.

If you’re investing in an employer-sponsored plan, you will have a select number of investments to choose from. You’re subject to their plan, which could be with a lackluster provider and have potentially higher fees. And as long as you work for the employer, your funds are likely restricted to stay with their selected provider until your working relationship ends. But employer plans have much higher contribution limits and the opportunity to take out loans against your balance.

An IRA is self-opened and self-funded, giving you much more control over how you use it. It’s up to you to open your own account and begin investing money on your own. This is different from an employer-sponsored plan where you may be automatically opted in to putting money away. Also, you could have a much larger selection of investments to choose from, as well as the ability to choose the brokerage you want. However, IRAs may be subject to account and trading fees.

How an IRA can potentially benefit your investing journey

If you’re working full time, it’s likely that you have access to an employer-sponsored retirement plan. Many private sector workers, along with a vast number of government-employed workers, had access to an opt-in retirement plan in 2022, according to the Bureau of Labor Statistics. If you fall into this category, this is a great start to saving for retirement.

And by saving for retirement in one of these accounts, you can potentially defer or eliminate tax liability. However, each IRA account has different tax advantages, so be sure to select the one that meets your financial goals and needs:

- Traditional IRA (pre-tax advantage)

A traditional IRA works by putting post-tax dollars into the account, but when it comes to tax filing time, you may be able to deduct this amount off your taxable income. However, when you decide to withdraw the funds in retirement, you’ll need to pay ordinary income tax at that time.

- Roth IRA (post-tax advantage)

A Roth IRA is a post-tax account, where you put money in after it has been taxed by your employer. The funds can appreciate over time, and once you reach retirement age (59.5 years old), you may be able to withdraw the funds tax-free. Keep in mind the funds need to be held in the account for five years in order to withdraw the earnings tax free.

But what is the true difference of investing in just an employer-sponsored plan, versus doing both an employer-sponsored plan and an IRA?

Here’s what you should consider:

If you invest $20,000 into your 401(k) for 30 years and assume a 7% rate of return, you could have just over $2 million.

If you keep the same investing habits with your 401(k) and invest $6,000 into your traditional IRA at the same pace, you could have over $2.6 million — a total difference of ~$600,000. Also keep in mind that there are catch up contributions for both 401(k) and IRA plans as well once you turn 50 years old.

So as you’re thinking about investing for the future, investing in multiple accounts rather than just your employer-sponsored retirement could be massively beneficial.

M1 bottom line

Investing within an IRA can be massively beneficial for your path towards retirement. While they have contribution limits, they can be great vehicles for potentially using compound interest to your advantage.

But as these accounts are self-directed, it can be easy to forget to manually contribute on a regular schedule. With M1, you can automate your deposits so you can take the manual work out of your investing journey. Even if you don’t have the ability to max out your IRA contribution, small deposits like $50 a month can potentially be a significant help to your post-working nest egg.

All examples above are hypothetical, do not reflect any specific investments, are for

informational purposes only, and should not be considered an offer to buy or sell any

products. M1 does not provide any financial advice.

All investments involve risk including the loss of principal and past performance does not

guarantee future results.

All investing involves risk, including the risk of losing the money you invest. Brokerage

products and services are offered by M1 Finance LLC, Member FINRA / SIPC, and a wholly

owned subsidiary of M1 Holdings, Inc.

20230718-3006873-9546377