What is a high-yield savings account?

A high-yield savings account is an account where consumers can earn a competitive interest rate, compared to the national average savings account interest rate (0.37% at the time of publishing). These accounts have been attractive to consumers recently as the Federal Reserve has been hiking up interest rates, and financial institutions are able to raise their offerings in response.

The account is simple: you deposit money in a high-yield savings account and your balance accrues interest over time. You can withdraw the funds at any time, and the account may be FDIC-insured up to $250,000 per person, per account, per FDIC member bank. These accounts are a great way to earn interest on your saved cash without having to lock away your money in something like a certificate of deposit (CD).

The M1 high-yield savings account is launching soon with a valuable 4.50% APY*, giving consumers an opportunity to earn cash on their cash. (This account is furnished by B2 Bank.)

Here’s everything you need to know about the high-yield savings account, what you can use it for, and how much you can potentially earn from having your funds in one.

How does a high-yield savings account work?

A high-yield savings account operates by consumers ideally holding their funds consistently in the account. The more money you keep in the account, the more interest you can earn. The interest is typically represented by annual percentage yield (APY). And along the way, you will earn interest on top of the interest you’ve already earned — also known as compound interest.

As you keep money in the account, the bank will award you interest based on the balance you have in the account. However, that interest rate can go up or down, based on both the bank’s decisions and the current federal funds rate.

Additionally, at the end of the calendar year, you will receive a tax form from your financial institution for your interest earnings if you earned more than $10 in interest during that tax year.

Learn more about the difference between high-yield savings accounts and regular savings accounts.

What can you use a high-yield savings account for?

The Federal Reserve’s Regulation D governs both traditional and high-yield savings accounts and limits the number of transactions per month to six. But since the onset of the Covid-19 pandemic, that regulation was suspended. Now, many banks and other financial institutions allow consumers to put money in and take funds out as often as they would like — making a high-yield savings account a great opportunity for consumers to potentially earn passive income.

With inflation at levels not seen since the 1980s, the argument to use a high-yield savings account has become stronger. In fact, some investors are opting to hold their cash rather than investing because of the safety and interest to be potentially earned.

Here are a few ideas to use a high-yield savings account to reach your financial goals:

- Emergency fund for unexpected life events

- Save for a down payment on a home

- Put money away for a future car purchase

And as mentioned above, depending on your bank or financial institution, you may not be restricted on how often you deposit or withdraw funds on high-yield savings accounts — giving you the flexibility like a checking account.

How much can you earn?

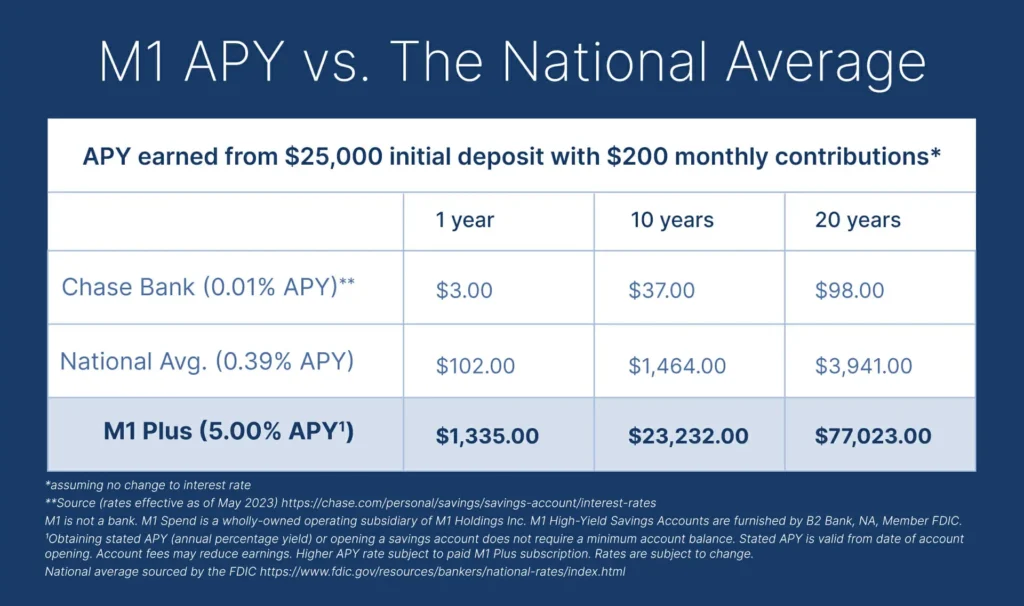

Let’s look at a few scenarios of how much interest you could potentially earn within a high-yield savings account with M1 against other institutions with savings accounts:

You can use a savings calculator to get an idea of how much you can earn with a high-yield savings account, or simply multiply your estimated savings balance by the interest rate. If you use the M1 high-yield savings account, you can multiply your balance by 1.045 to get a close estimation for one year’s earnings.

Disclosures:

*Obtaining stated APY (annual percentage yield) or opening an account does not require a minimum account balance. Stated APY is valid from date of account opening. Account fees may reduce earnings. Rates are subject to change. Stated APY (annual percentage yield) for M1 Savings accounts is subject to change prior to product launch due to changing federal funds rate.

All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. M1 does not provide any financial advice

M1 is not a bank. M1 Spend is a wholly-owned operating subsidiary of M1 Holdings Inc. M1 Savings Accounts are furnished by B2 Bank, NA, Member FDIC.

1Obtaining stated APY (annual percentage yield) or opening an account does not require a minimum account balance. Stated APY is valid from date of account opening. Account fees may reduce earnings. Rates are subject to change. Stated APY (annual percentage yield) for M1 Savings accounts is subject to change prior to product launch due to changing federal funds rate.

20230411-2828148-8996141