How a financial plan can provide a roadmap to your future success

Personal finance 101: What is a financial plan?

A personal financial plan is a written examination of your finances, including your income, an asset evaluation, your liabilities, and your investments to determine both your current financial state and your future financial state. Financial plans are crucial for you to help assess whether you will be able to reach your financial goals, and to decide the steps going forward.

Despite the importance of personal financial plans, many people fail to engage in financial planning for their futures or to even understand what actual financial planning is. A 2016 Fortune survey revealed that nearly two-thirds of Americans are not able to pass a fundamental test of financial literacy.

Financial planning should start early. When you begin saving while you are young, your money will have more time to grow. The purpose of a financial plan is to help you determine the feasibility of your goals and to understand the steps that you will need to take to reach them. Gaining a good understanding of what financial planning is can help you get started on a more successful financial future.

Knowing how to write a financial plan can help make the difference in your financial success. If you complete a plan, you will be less likely to make poor financial decisions. Financial planning can also help you enter a higher income bracket and improve your quality of life.

So what should you include in a financial plan? Here are a few elements to get started:

- Financial goals

- Net worth

- Current cash flow

- Strategy for retiring

- Risk management plan

- Tax planning

- Investment plan

- Estate plan

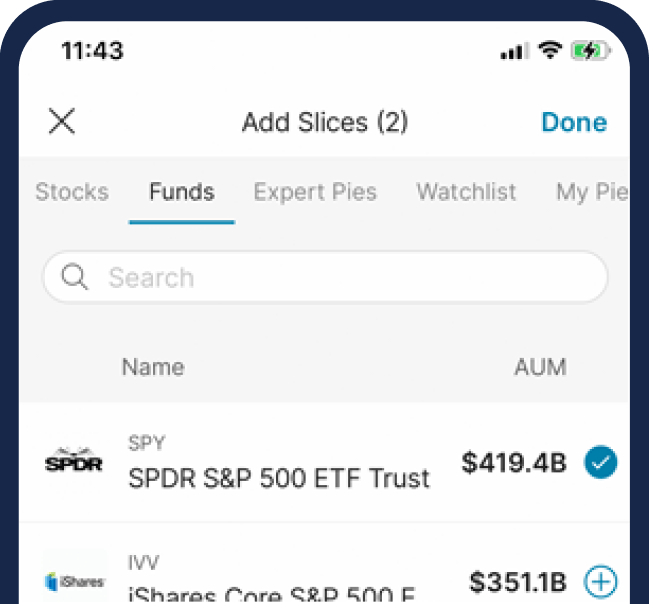

Part of a personal finance plan is investing for the future. With M1, you can start an IRA or brokerage account and save for retirement.

Creating a financial plan will take a bit of work, but the end results can be life-changing. Doing your own plan can put you on the path to greater financial health and a better future. It is important for you to understand that your personal financial plan and its components should not be static. After you have learned the purpose of financial plans and have completed your income, liabilities, and asset evaluation, you should review the document regularly to check your progress towards reaching your goals.

Financial plans necessitate regular reviews and modifications throughout your life. You should modify your plan when you experience major life changes that could affect your goals such as the following:

- Birth of a new baby

- Getting married

- Getting divorced

- Death in the family

- Second or subsequent marriages

- New blended family

- A new job

Personal finance 101: Why do a financial plan?

Once you have a general idea of what the plan is, you will need to see how to set up a financial plan. You will have to keep track of your assets, your income, how you spend your money, the debts that you have, and your taxes. The first step is to track where you are spending your money to have a clear idea of your current finances.

Track your expenses

You should begin by tracking all of your spending for 1-2 months. Specifically, focus on putting your spending into fixed categories so you can find areas where you may be able to cut back.

There are several ways to track your spending, including:

- Use an app to track spending while you are on the go

- Track as you go with an expense spreadsheet

- Use separate accounts for spending and bills

- Download your transactions from your bank and credit cards into a spreadsheet

Organize your financial records

The next step is to organize your financial documents. Some of the documents to consider organizing can be:

- Bills

- Bank statements

- Pay stubs

- Contracts

- Credit cards

- Investments

- Retirement account statements

- Auto records

- Mortgage statements

- Tax returns

- Insurance records

- Medical bills

After you have gathered the documents, create a filing system that works for you so you’re able to reference back to them.

Determine your net worth

The next step is to determine your net worth. To do this, you will need to determine the market value of each of your assets. This is the price you’d be able to sell the asset for today.

Begin by taking an inventory of all of your assets and write them down. You can then look up the fair market value of all of your fixed assets. After that, take an inventory of your income sources and your liabilities.

Write down all of your income sources to see a monthly total. If your monthly amounts vary, use an average value of your earnings for the last six months. Finally, list all of your debts and total them. You can then determine your net worth by subtracting your liabilities from the value of your assets.

Set your financial goals for the future

Setting your financial goals is the next step in writing a financial plan. This plan is where you’re able to decide how much you want to have available in retirement, as well as setting aside funds for your children’s college savings, purchasing a home, retiring early, and other financial milestones you’d like to reach.

Examples of possible financial goals to build long term wealth might include the following:

- Pay off high interest debt, including any credit card debt

- Create a budget that you can live with

- Increase your income

- Invest more in your retirement fund

- Save three to six months’ worth of living expenses in an emergency fund

- Save for your retirement

- Save money for a down payment to purchase a home

- Save for college

- Pay off your student loans

Once you have an idea of your goals and how much money you will need to set aside to accomplish them, your next step of financial planning will be to identify the steps that you will need to meet each goal and to write your financial plan.

Create your financial plan in order to meet your goals

When you create a financial plan, you will need to write separate plans that will be included in the comprehensive financial plan. A good financial plan should address your savings, investments, tax strategies, risk strategies, and how your assets will be handled if you become incapacitated or pass away. Here is a review of each of these components in a financial plan.

1. Savings plan

All good financial plans should include a savings plan. This is a plan for how much you need to set aside from your income each paycheck or each month to reach your goals.

First, try to pay yourself first. For example, if you have a 401(k) with matching at your job, try to save at a minimum the percentage that your employer will match. By doing this, you’re automatically investing in your future self for retirement.

Additionally, try to save three to six months of your income in an emergency fund. By doing this, you’ll be financially prepared for unexpected expenses.

2. Investment plan

It’s not enough to simply save for the future. Saving is important, but investing for the future can potentially give you the nest egg you desire once your working years are over.

But first, you must determine your investment strategy. If you have a long time to save, you might choose to be more aggressive with your choice of investments. For short-term financial goals, it might make more sense to be conservative in your choices as you build a portfolio.

After you have decided the strategy that you will take, write a personal investment policy statement that can help guide you when you choose your investments. After this, you can then pick your investments while making certain to diversify as you build a portfolio.

3. Income tax plan

Creating an income tax plan is important for your overall financial plan. By taking steps throughout the year, you may be able to minimize the amount that you may owe to the IRS. For example, your tax planning could include contributing to a Health Savings Account (HSA) to potentially reduce your tax liability.

However, it’s recommended to consult with a certified tax professional to create the best strategy for your situation.

4. Insurance plan

Another important component of a personal financial plan is insurance. The insurance planning portion of your financial plan should include auto insurance, health insurance, homeowner’s insurance, and life insurance at a minimum.

The insurance needs of each person will vary, so it’s important to research how much coverage you will need. And that coverage, and subsequent premiums for the policy, will largely depend on factors such as:

- Age

- Profession

- Economic status

- Health

- Family status

- Assets

5. Estate plan

Estate planning is something that many people put off because they either do not want to think about death or because they think that they have plenty of time to do it later. Unfortunately, if you don’t have a plan in place and are incapacitated, your loved ones may have trouble accessing your accounts to pay your bills for you or finding out important health care information.

Regardless of your age, you should at least have durable financial and health care powers of attorney in place. Comprehensive estate planning may include several different documents, including the following:

- Wills

- Trusts

- Durable powers of attorney

- Advance directives

- Living wills

Estate planning should include plans for how your assets will be distributed after your death along with plans for who will have the authority to make important financial and medical decisions for you.

Implement and improve your financial plan

Your personal financial plan should not be treated as a static document. Instead, your financial plan is a living, breathing record that you should review and revise in response to changes in your life. Financial planning is an ongoing process that should continue throughout your life.

As a rule of thumb, you should review your plan regularly and make changes where they are needed. For example, tax laws change frequently, making it important for you to update your tax planning strategies in your plan in response to changes.

You should also review your financial plan after any major change in your life such as getting married, getting divorced, having a new baby, experiencing a death in the family, and other changes. Each of these situations could mean adjusting your plans, changing your designated beneficiaries, and making other modifications so that your plan continues to work for you.

M1 and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction

20230829-3080852-9796726