10 signs it’s time to switch brokerage firms

Switching to a new online broker can save you a significant amount of time and money.

But it’s never easy to end a relationship.

You get so comfortable with the routine you’ve built that making a change — even if it’s for the best — can feel terrifying. If you’re here, chances are you’ve at least considered the idea. The time may have come to ask yourself the question:

Should I leave my current brokerage firm?

Even if you’re relatively satisfied with your current financial institution, it never hurts to get a better understanding of what you can expect from a financial institution. You may not even realize you’re missing out.

Choosing (or switching to) a new online broker is a tough decision, so we made it easier by highlighting the red flags.

Here are ten signs it’s time to switch brokerage firms:

- Account fees are too high

- Not enough investment options

- The interface is old and clunky

- Poor reliability

- Lack of brokerage account options

- Poor customer support

- No educational resources

- Lack of control over your investments

- Little or no automation features

- Misaligned values

1) Account fees are too high

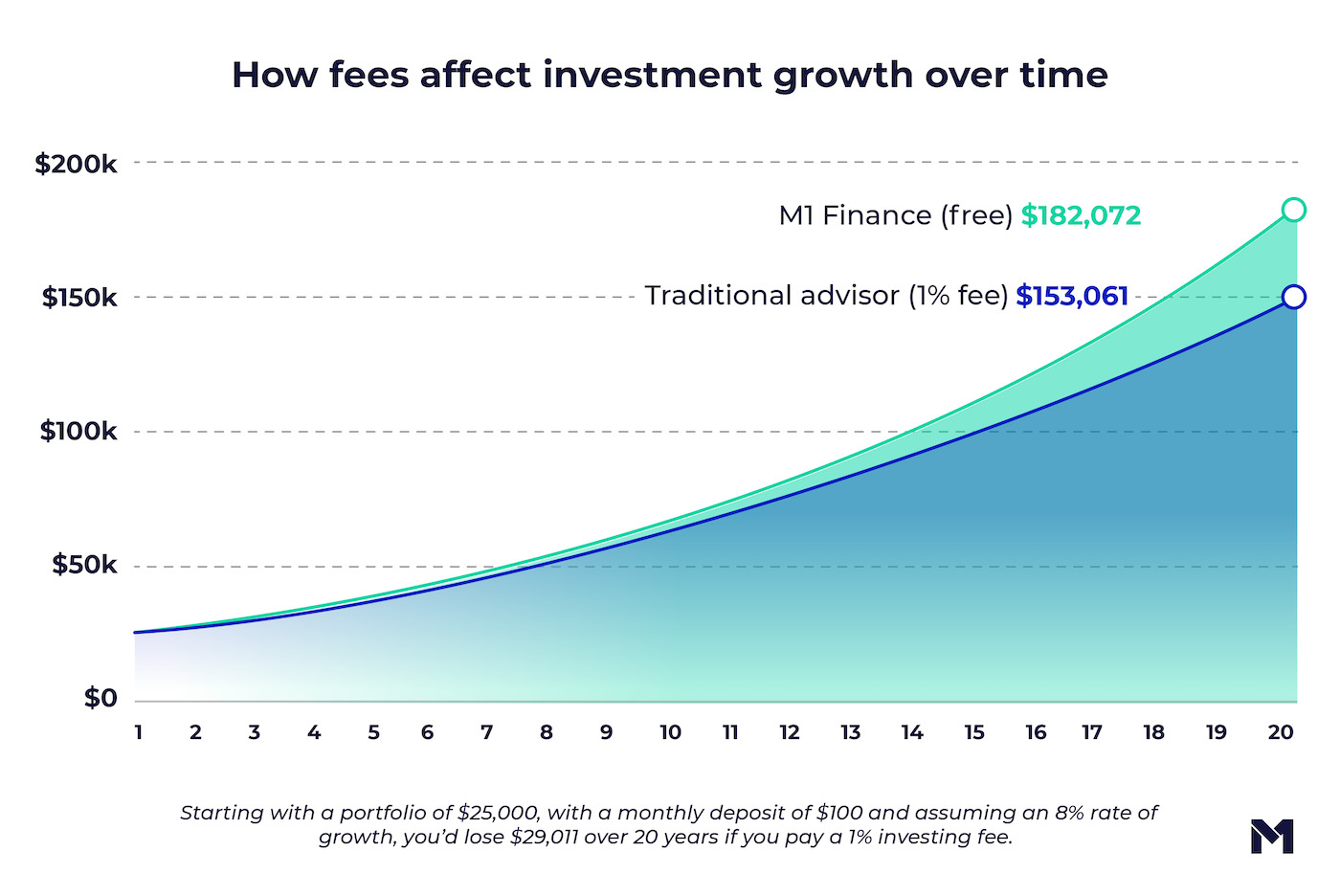

One of the most common reasons why people leave brokerage firms is that the fees are too high. These fees can include account management fees or a transaction fee on every buy and sell.

In an era where many traditional firms are now commission-free, it’s easy to find a low cost firm. For example, we charge exactly $0 in commissions per trade.

High fees can eat away a large chunk of your portfolio. Let’s say you invest $500 a month for 30 years and earn a 7% return. If you paid 1% in fees, you would lose $98,404.65 to fees over that time. Here’s another example:

2) Not enough investment options

Having a small number of funds to choose from is one of the worst attributes a firm can have. If you want to invest in a variety of securities, you’ll want an online broker that offers flexibility.

Make a list of the kind of securities you want to invest in, like ETFs and stocks. If possible, include the specific securities in which you’re interested. For example, instead of writing down “tech stocks,” write down “Alphabet and Microsoft.” Then, when you’re researching new brokerage firms, check to see if they carry those securities.

On M1, you can find this information in the Research tab.

Plus, some online brokers don’t allow fractional shares, making it more difficult for investors who want to buy individual stocks. Fractional shares let you buy part of a share if you don’t want to purchase a whole share. This can help you make the most of every dollar you invest and give you more flexibility with your target allocations.

3) The interface is old and clunky

In a time when private companies can send ships to space and self-driving cars aren’t far behind, an online broker needs to have a user friendly platform. A clunky interface can cost you time and make investing more frustrating than it needs to be.

Many online brokers offer both a web and mobile app. Some will even give you a demo of their products and services before you open an account.

4) Poor reliability

The best online brokers change with the times and don’t experience many platform crashes. If your brokerage firm has a web or mobile app with constant bugs and glitches, it might be time to look elsewhere.

Remember: the best online brokers have plenty of positive reviews on the Google Play Store and the App Store.

5) Lack of brokerage account options

Some brokerage firms may be limited in the types of accounts you can open with them. If you want to open an account that’s more specialized, like a trust account, you need to find a platform with those options available.

Before switching to a new platform, go over their list of account types and make sure it fits what you need. Consider account types like:

- Individual taxable

- Joint taxable

- Traditional IRA

- Roth IRA

- SEP IRA

- Trust Account

6) Poor customer support

Online brokers with lackluster customer support aren’t worth it. Many online brokers offer a wide range of ways to contact them, like phone or email support so you can submit a request and wait to hear back.

If you care about customer service, take the time to read reviews from legitimate news outlets and sites.

7) No educational resources

Some of the best online brokers will put together webinars, newsletters, and blog posts discussing topical issues and offering advice, like how much to contribute to an IRA or use cases for investing on margin. Some brokerage firms (like M1) will even dive into complex topics like behavioral finance.

Online brokers that don’t offer financial and investing education may not be committed to helping their investors grow.

If your brokerage doesn’t produce or share educational content, it may be time to find one that does. Having access to new information helps you develop as an investor and stay aware of the latest news. Rules and regulations that affect investing change regularly, so it helps to have a firm that cares about keeping you informed.

8) Lack of control over your investments

Brokerage firms that are also robo advisors often have control over your investing strategy. This means you may not have the ability to make changes to that strategy, or maybe you can only adjust small parts (like your risk tolerance profile).

If you’re ready to make your own investment decisions, it’s time to find a brokerage that lets you set and adjust your target allocations as needed. Having control over your investments doesn’t mean you have to do all the math – it just means you do your own research and decision making.

9) Little or no automation features

Automation can save you time and energy. We can’t think of any online brokers offering zero automation in 2021, but we can think of a few that offer only basic or little automation features.

While it’s nice to have features like scheduled transfers, innovation in personal finance automation is rapidly evolving. Why not consider a brokerage on the cutting edge?

10) Misaligned values

If your brokerage is going to hold your money, it might as well share your values.

Online brokers are like investors: they have different philosophies, values, and investing principles. For example, if you’re a long term investor, you may not be an excellent fit for a trading platform. But you may enjoy M1, a platform built for sustainable, long term wealth building.

The opposite is true too.

A brokerage firm’s values will guide all their decision making, from customer support to platform development. If your values don’t align, you may find yourself consistently frustrated with the product.

The Bottom Line

Switching to a new online broker may seem like a hassle at first, but it can end up saving you a significant amount of time and money.

Before you make the change, conduct plenty of research on what you’re missing from your current brokerage company and what you want from your new one. The better idea you have of what you’re looking for, the happier you’ll be with your choice.

Moving your investments can be complicated, especially if the old brokerage firm makes it difficult. But if you’re a self directed investor interested in transferring to M1, we’ll make it as easy as Pie.

- Categories

- Invest