How M1 makes money

M1 offers commission-free investing, so we often get the question, “How do you make money?” In this post, we’ll explain how M1 makes money so we can continue giving you an excellent client experience without charging commissions.

For a complete list of fees, please refer to our fee schedule.

On M1, we offer products that help our clients earn, invest, borrow, and spend.

- Earn: Our High-Yield Cash Account enables clients to earn 3.10% APY1 on their uninvested cash, covered by up to $4.75 million in FDIC insurance.2

- Invest: Our investment accounts are commission-free,3 automated, and highly customizable. These accounts allow you to invest in 6,000+ stocks and ETFs.

- Borrow: M1 Margin Loans are built-in to M1 brokerage accounts, empowering clients to tap into the power of their portfolio and increase their positions or pay for other expenses at a low rate. M1 also offers flexible Personal Loans, allowing you to borrow without fees.

- Spend: The Owner’s Rewards Card by M1 allows clients to earn up to 10% cash back4 on select brands, which can easily be invested.

Through these products, we make enough money to support our growing business and invest it back in the products and features our client’s request. Here’s how we make money on each of our products:

How M1 makes money on Earn

We offer the M1 High-Yield Cash Account as a way for investors to park their short-term cash for a future investment. This account comes with no additional fees and offers joint accounts for those who have a partner contributing to the same goals.

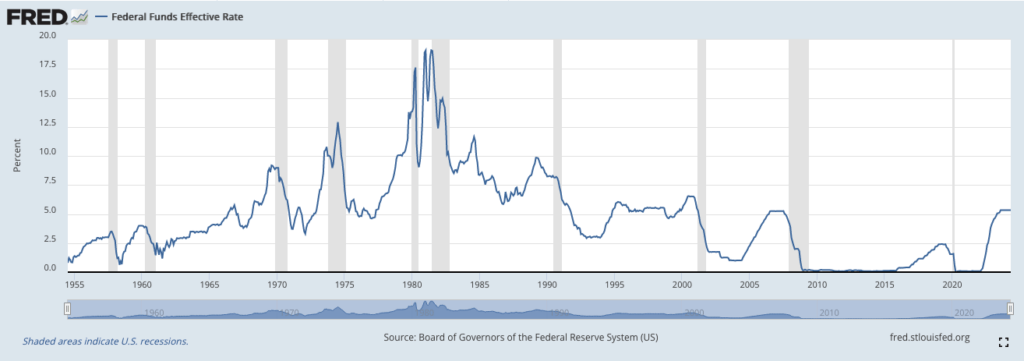

On this account, we pay substantially all the interest we receive from partner banks but retain a portion of the interest to operate the product and platform. These rates, and the APY we pay to clients, are driven by the Effective Fed Funds rate, which is set by the Federal Open Markets Committee. This APY we pay clients and the EFF (effective federal funds rate).

How M1 makes money on Invest

Unlike other investing platforms, you’ll never be charged commissions or markups on trades or fees for deposit or withdraw from your connected bank. But we do make money in different ways, including miscellaneous fees.

Interest on brokerage cash

When M1 customers hold cash on our platform, we can lend it out. Since the cash needs to be available at a moment’s notice to either withdraw or make investment purchases, we primarily lend the cash to banks on an overnight basis. The amount we receive tracks the Federal Funds rate — the interest rate controlled by the Federal Reserve.

Federal Funds Effective Rate from 2015 to 2024

Image courtesy of the Federal Reserve Bank of St. Louis

Our clients hold less cash on M1 than people typically do on competing brokerages for a few reasons.

- We use fractional shares5 so money can more efficiently go into the investments our clients want.

- The default option for M1 clients is to automatically invest cash anytime the balance goes above $25.

Whether clients are waiting to make an investment decision or are holding cash as an asset within their investment portfolios, we’re able lend out this cash as one of our revenue streams.

Interest on lending securities

In addition to lending cash, brokerages like M1 can also borrow securities. This provides capital for other activities, including tax and dividend trades. To lend a security, a brokerage must first borrow the security and sell it on the open market. When it wants to close out its position, it will buy the security on the open market and return the shares to the lender. This strategy is commonly used and has created a large marketplace to lend and borrow securities.

When lending the security, the lender still owns the security outright. They own all economic interest, both from the movement in stock price and through dividends en lieu. The lender can recall the security at any time and sell whenever they want.

When M1 lends out securities, we make interest on the cash. This interest rate is highly variable and fluctuates daily based on any given security’s available supply and demand for borrowing. The borrower pays this interest rate on the value of securities they borrow.

We only lend securities in high demand, which accounts for less than 5% of the total capital we have on the M1 platform. There are market participants willing to pay interest rates to borrow these securities, so we make use of this option and lend out a portion of securities held on M1.

Payment for order flow

When we buy or sell a security on behalf of our clients, we have a choice of where we send the orders for execution.

- Exchanges are marketplaces where participants interact and match with securities. The exchanges publish the highest price someone would be willing to pay for the security (the bid) and the lowest price someone would be willing to sell a security for (the ask).

- The bid is lower than the ask and the price difference between the two is called the spread.

- Exchanges make money in part through matching buyers and sellers at the ask and bid respectively and pocketing the spread.

There are alternative, off-exchange markets that specialize in electronic market making. These industry participants pay brokerages like M1 a tiny amount per share to execute using their services rather than other exchanges. In return, they’ll provide better prices than what’s available in the public markets, which comes with price improvements for our clients.

This revenue stream is a bit of a bogeyman in our industry but unnecessarily so. These participants add substantial liquidity to the market, making it much more likely you’ll be able to buy or sell exactly when you want. Since they came around, spreads have decreased substantially. While most people don’t see the spread as an outright fee, it’s an implicit cost anytime you buy and sell a security. Smaller spreads mean your trading costs are lower. We do take this payment, $0.002 per share, for all securities except OTC stocks.

What about crypto?

M1 doesn’t charge commission for investing in cryptocurrencies. Apex Crypto is assessing 1% (or 100 basis points) fee to all crypto transactions on purchases and sales, reflected in the execution price. M1 and Apex Crypto have entered into a fee rebate agreement.

How M1 makes money on Borrow

M1 Borrow gives you access to a flexible and low-cost line of credit using your portfolio as collateral. This lets you access liquidity in the form of cash by borrowing against your portfolio while staying invested, also known as margin lending.

Margin Loans

Since you don’t have to sell any securities and pay taxes on any capital gains, portfolio margining may be a tax advantaged way to borrow money. You may also be able to deduct the interest expenses against your investment income on your personal taxes.6 The other advantage is that there’s no additional paperwork, credit check, or approval process—the money is available on demand.

Clients can borrow up to 50% of their total assets (the sum of all their stocks, funds and cash) without any lengthy process or paperwork.7 Our borrow rate is lower than most mortgages, HELOC (home equity line of credit), auto loans, and nearly every other type of loan out there. Despite having a low rate, we still make money because our costs are lower than the capital we loan out.

Personal Loans

When you borrow money on a personal loan, you will pay back the principal plus interest. That interest is our profit margin.

How M1 makes money on Spend

Interchange fees

The Owner’s Rewards Card is a unique credit card for investors that rewards you for thinking like an owner. It’s the only card that integrates into your portfolio to potentially help you grow your wealth, long-term.

It provides one additional revenue stream to us in interchange fees. This means we mall percentage of the transaction value, called interchange, anytime you use your Owner’s Rewards Card. The fees are paid to M1’s bank to cover handling costs, fraud and bad debt costs, and the risk involved in approving each payment.

Membership fee

M1 prides itself on keeping the costs associated with using the platform as low as possible. However, we want to ensure our clients use the variety of products we offer to their fullest potential.

For clients with less than $10,000 with M1 for at least one day during each billing cycle, they will incur a $3 monthly fee. Clients with an active M1 Personal Loan will also avoid the monthly fee.

Your total M1 assets include the aggregated settled value of all M1 Investment and Earn Accounts. This includes Individual Accounts, Joint Accounts, Traditional IRAs, Roth IRAs, Trust Accounts, Custodial Accounts, Crypto Accounts, High-Yield Savings Accounts, and High-Yield Cash Accounts.

The bottom line on revenue

Nearly every financial service company makes money in all the ways outlined above, whether they charge fees or not. We simply decided these revenue streams were enough, so we don’t need to charge hefty fees.

We have no problem with a company looking to make money. People pay for things when they get more value from it than it costs, and companies generate revenue from the difference between what they charge and what it costs to produce. It’s a symbiotic relationship between companies and their customers. Things tend to ebb and flow between who gets the better end of the deal.

In financial services, the pricing pendulum has swung too far. It mainly benefits companies that have maintained high profit margins for a very long time. We think it should swing back towards you.

Progress is driven by some combination of a better product at the same price or the same product at a better price. At M1, we strive to offer a great product at a better price. So, we decided to build our entire business on revenue streams that don’t focus on fees.

We make up for this loss in potential revenue by making our business far more efficient and lowering the costs of operating the business. We do this by replacing high salaried financial personnel with the latest and greatest in technology and automation. As a result, you’ll get better service at a lower cost — and M1 will grow on its existing revenue streams.

Originally published March 19, 2019, updated on June 21, 2024.

Disclosures

¹ Stated APY (annual percentage yield) with the M1 High-Yield Cash Account is accrued on account balance. Obtaining stated APY requires a minimum initial deposit of $100. APY is solely determined by M1 Finance LLC and its partner banks, and will include administrative and account fees that may reduce earnings. Rates are subject to change without notice. M1 High-Yield Cash Account is a separate offering from, and not linked to, the M1 High Yield Savings Accounts offered by M1 Spend LLC’s banking partner. M1 is not a bank.

2 The cash balance in your Cash Account is eligible for FDIC Insurance once it is swept to our partner banks and out of your brokerage account. Until the cash balance is swept to partner banks, the funds are held in a brokerage account and protected by SIPC insurance. Once funds are swept to a partner bank, they are no longer held in your brokerage account and are not protected by SIPC insurance. FDIC insurance is not provided until the funds participating in the sweep program leave your brokerage account and into the sweep program. FDIC insurance is applied at the customer profile level. Customers are responsible for monitoring their total assets at each of the sweep program banks. A complete list of participating program banks can be found here.

3 Commission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Other fees may apply such as regulatory, M1 Plus membership, account closures and ADR fees. For complete list of fees, visit M1 Fee Schedule.

4 2.5% – 10% Owner’s Rewards cash back is earned on qualifying purchases based on M1’s rewards tiers that can be found here. All Standard Reward purchases receive 1.5% cash back. Owners Rewards and Standard Rewards are subject to a maximum of $200 cash back in aggregate per calendar month. Exclusions may apply. See Rewards Terms for additional information and exclusions.

5 If you choose to transfer your account to another broker-dealer, only the full shares are guaranteed to transfer. Fractional shares may need to be liquidated and transferred as cash.

6 Consult your financial, tax, or other adviser to learn more about how these benefits (or any limitations) would apply to your specific circumstances. The availability of tax or other benefits may be contingent on meeting other requirements.

7 To qualify, customers need a taxable account (IRAs do not qualify) and a minimum of $10,000 total account value. For more information, read our FAQs.

- Categories

- M1