How I Use Margin to Enhance Portfolio Diversification and Increase My Expected Returns

I grew up envisioning a big red warning sign anytime I saw the terms margin, leverage, or debt. I was told, just like you probably…

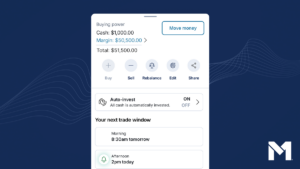

Margin investing just got simpler: Introducing M1’s margin buying power

Sophisticated wealth building, simplified Today, we’re excited to unveil our latest feature: Margin buying power. This advancement streamlines how you leverage margin in your investment…

Five years on M1: How I built a $1,000,000 dividend portfolio to become financially independent at 37

Five years ago, I took the leap of faith and started talking openly about my pursuit for a different life on my YouTube channel Dividend…

How M1 makes money

Learn how M1 makes money without management fees or commissions, including common revenue streams for most financial services companies.

83 days of market moves

The stock market has been a whirlwind throughout the first four months of the year. Entering the year, stocks were firing on all cylinders as…

An interview with M1 CEO Brian Barnes on the new High-Yield Cash Account and more

We’re one quarter into the new year, and, behind the scenes, our CEO Brian Barnes and the entire M1 team have been hard at work…

M1 introduces new High-Yield Cash Account

As of today, we’re starting the rollout of the M1 High-Yield Cash Account to existing M1 clients. We are excited to launch this feature and…

Your tax dollars are “chippy” this year

Chips aren’t just a delicious snack best paired with guacamole; they’re also the backbone of the tech revolution. Semiconductors are the chips everyone, including investors,…

The funny moments of the investing world

April showers bring May flowers, but rather than rain, let’s hope for a shower of positive stock market gains. In fact, April is one of…

Placing bets and breaking sweats for March Madness

The consistent favorite headline of March Madness is how nearly impossible it is to pick a perfect bracket, yet millions of fans decide to fill…

Airline profits are soaring in 2024, but drawbacks for travelers and investors persist

Airline companies have been through a gauntlet of business and PR challenges in the last few years. The pandemic put 64 airlines out of business,…

Nvidia is a stock market darling 30 years in the making

We’re only two months into the year, and Wall Street has identified its current crown jewel. Nvidia, a company that once focused on giving gamers…

PLANNING

M1 Budgeting Basics

What you’ll learn:

INVESTING

M1 Intro to Investing Roadmap

What you’ll learn: