Apple, Tesla, and Stock Splits on M1

What is a stock split?

A stock split is a change in the number of shares that are outstanding. It’s a decision typically made by a company’s board of directors.

Recently, companies like Apple (AAPL) and Tesla (TSLA) announced stock splits. Apple announced a 4-for-1 stock split, and Tesla announced a 5-for-1 stock split.

Before we talk about those splits specifically, let’s go through what happens in a split.

How do stock splits work?

Let’s walk through an example stock split scenario.

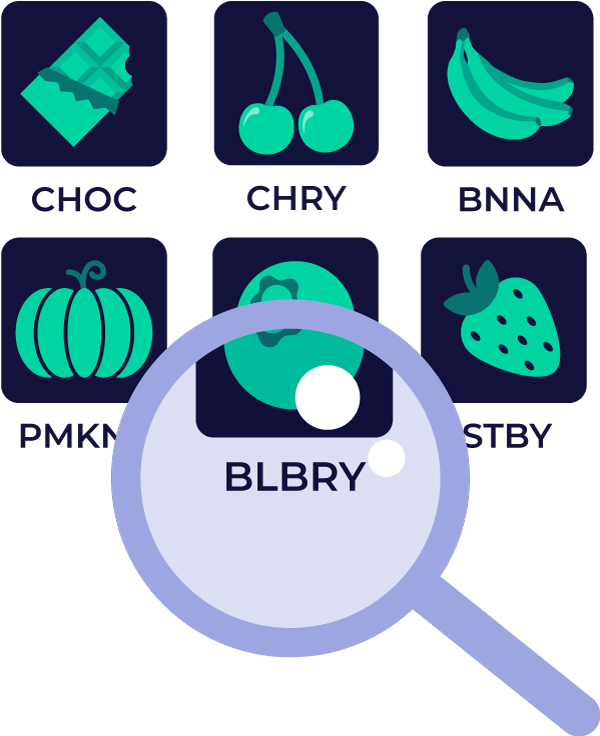

Say we have a company that recently announced a 2-for-1 stock split. We’ll call them BLBRY.

In a 2-for-1 stock split, one additional share is given for each share held by a shareholder. If BLBRY had 5 million shares outstanding before the split, it would have 10 million shares outstanding after it.

Additionally, the price would be adjusted according to the split. In this case, the share price would be halved. But since the number of shares increased, the value wouldn’t change.

In this example, let’s say BLBRY’s pre-split share price was $2 per share. Post-split, the price would change to $1 per share.

That means that before the split, BLBRY was worth $10 million (5 million shares x $2 per share). After the split, BLBRY’s market capitalization (value) remains unchanged: 10 million shares x $1 per share = $10 million.

If you’re an M1 client, the split-adjusted information will typically show up one business day after the stock split.

What should I know about AAPL and TSLA’s stock splits?

Like we said before, Apple is undergoing a 4-for-1 stock split and Tesla is undergoing a 5-for-1 stock split.

On M1, both splits will be applied after market close Friday, 8/28/2020. They will be in effect for trading on Monday, 8/31/2020, though some historical data may be out of sync until after market close.

Shareholders can expect the share price to split and the number of shares they own to multiply according to each company’s announcement. The relative value of the shares will not change.

If you own fractional shares of Apple or Tesla, they will be treated like whole shares. For example, if you own 0.1 shares of TSLA, you would own 0.5 shares of TSLA after the split.

Unless you want to buy or sell any shares, you don’t need to do anything at this time. We’ll take care of the split on our end.

You can learn more about Tesla’s announcement here, and about Apple’s announcement here.

Should I expect market volatility when these go into effect?

There is always a chance for market volatility, but the relative value of your shares will not change. If it helps, here’s how we think about market volatility.

Is this what happens with a merger or acquisition?

Stock splits are not the same as mergers or acquisitions. Those involve changing ticker symbols and may require taking a quick step on M1. Learn more about acquisitions on M1 here.

P.S. M1 does not provide recommendations or advice. Any mention of a specific stock or company is for information purposes only.

- Categories

- M1