7 things to consider when your brokerage gets acquired (or shuts down)

It’s been a busy few months full of brokerage acquisitions.

Earlier this year, Motif announced that they were being acquired by Folio, only for Folio to announce that they will be acquired by Goldman Sachs a few weeks later. And most recently, Folio announced they will stop servicing self-directed investors in early January 2021.

Is your head spinning yet? Ours are too.

Between these new announcements, the other acquisitions announced earlier this year (like Charles Schwab buying TD Ameritrade), and countless more developments in fintech, money is moving between brokerages at a rapid pace.

For many smart long-term investors, this is a pivotal moment: do you let your money move to a brokerage you didn’t choose, or do you reassess your money management platform?

No matter how stressful a brokerage acquisition may seem, it’s actually an opportunity to do a financial checkup and make sure you’re using the platform that makes sense for you.

Here are 7 things you can consider if your brokerage was recently acquired (or shut down):

- Understand the deadlines.

- Make a list of your accounts.

- Know your investing priorities.

- Determine your desired level of control.

- Make a list of options.

- Compare fees.

- Make a decision, and act on it.

1. Understand the deadlines.

During most acquisitions, brokerages give investors a specific deadline by which they can transfer out of their account to avoid being sent to the acquiring brokerage. This means that if you decide to not move with your old brokerage, you’ll need to initiate an account transfer to your new brokerage of choice before that deadline.

If you participate in automated investing with your current brokerage, you’ll also need to understand any ACH transfer deadlines. This can affect automatic deposits or withdrawals to your expiring account.

2. Make a list of your accounts.

This includes considering your stocks, ETFs, and retirement plans like 401ks or IRAs. You’ll want to make a list of all of your accounts, even ones outside of the brokerage being acquired. This will help you see the full picture when it comes to your current investments.

3. Know your investing priorities.

Think about how you want to grow your wealth.

Are fractional shares important to you? What about automation? Are you focused on a specific strategy, like dollar-cost averaging? How much time do you have to dedicate to researching your investments, executing trades, and maintaining your portfolio over time? Do you want built-in tax efficiency, or do you love taxes enough to do manual calculations? Do you want to pay management fees or are you more of a self-directed investor?

There’s a lot to think about. The answers to these questions will likely depend on your experience, your tolerance for risk, and your financial goals.

Your priorities could even include access to a portfolio line of credit or an available checking account on one platform. You’ll want to think about your priorities when it comes to fees, flexibility, and availability of perks in both of those areas, as they may vary between brokerages and banks.

4. Determine your desired level of control.

How you want to control your investments will be heavily impacted by your personal investing strategy, priorities, and bandwidth.

Depending on their personal schedule, some people prefer day trading or robo-investing. At M1, we believe in long-term investing with automation and personal control.

Ultimately, you decide the strategy you want to pursue and how it fits into your life.

5. Make a list of options.

Now that you know your investing priorities, you can begin to consider different brokerage options. One of these options can include the brokerage acquiring your current go-to.

You can list out the different features of each brokerage and align them with your investing priorities. These features can include things like automation and client support.

InvestmentNews recommends compiling this information into a matrix, so you can easily compare notes between brokerages to find the one that’s best for you.

6. Compare fees.

This one’s important. While the industry has pivoted towards commission-free trading, every brokerage is different. If you’re a more frequent trader, even smaller commission fees add up. And if you have a larger portfolio, management fees could eat up a large portion of your returns.

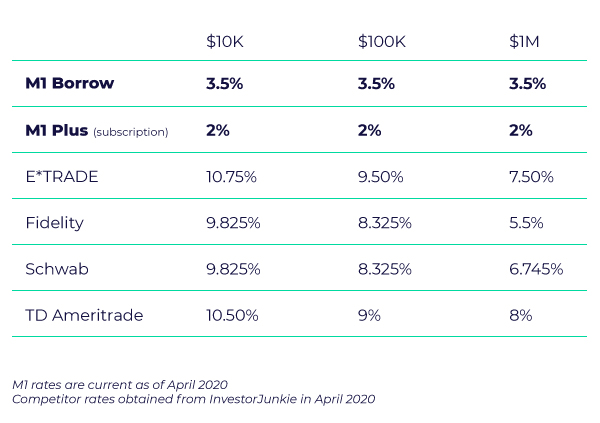

Charges also come into play when thinking about portfolio lines of credit offered through your brokerage. Each brokerage has different account minimums and base rates that can depend on several factors.

For example, see how M1 Borrow and our M1 Plus membership compare to other margin options:

If your recently acquired brokerage – or its bank affiliate – also offered a checking account and debit card, make sure to consider any available APY you can earn on cash balances and cash back rates for purchases.

At the end of the day, you’ll want to find the rates that make sense for you.

7. Make a decision, and act on it.

Have you noticed a theme? The brokerage you use for your investments is entirely up to you (as long as it’s still operational, of course).

If you decide to move with your newly acquired brokerage, you’ll want to pay attention to any instructions they send regarding the transition.

But if you decide to make a change, you’ll want to begin the process of transferring your securities as soon as possible. Remember when we mentioned deadlines in #1? You’ll need a plan.

You’ll likely be able to transfer your brokerage account, including cash and securities, between brokerages. The new brokerage you choose will have instructions on how their account transfer process works, and what that timeline could look like for you.

If you’re curious about M1’s account transfer process, you can learn about it here.

To wrap things up:

Either way, you’ll probably have to follow a few steps and get some paperwork in order. It might feel like a lot. You may even be nervous about myths you’ve heard in the transfer process (don’t worry, we debunked those).

But in the end, you would have reevaluated how you manage your money and realigned your brokerage and investing goals.

For more information on navigating brokerage acquisitions, check out “What to do if your brokerage account is acquired by another firm.”

- Categories

- Invest