Where to possibly park your money in a down market

Sometimes having too many options is harder than having a defined few. It’s called choice paralysis and can be particularly hard in a down market with so many financial products. Today, we’re discussing options you can consider if you’re deciding where to “park” your cash.

We’re also talking about:

- Some of the highest APYs on the market

- Amazon’s billion dollar bet with the NFL

- What’s new with the Owner’s Rewards Card

READING

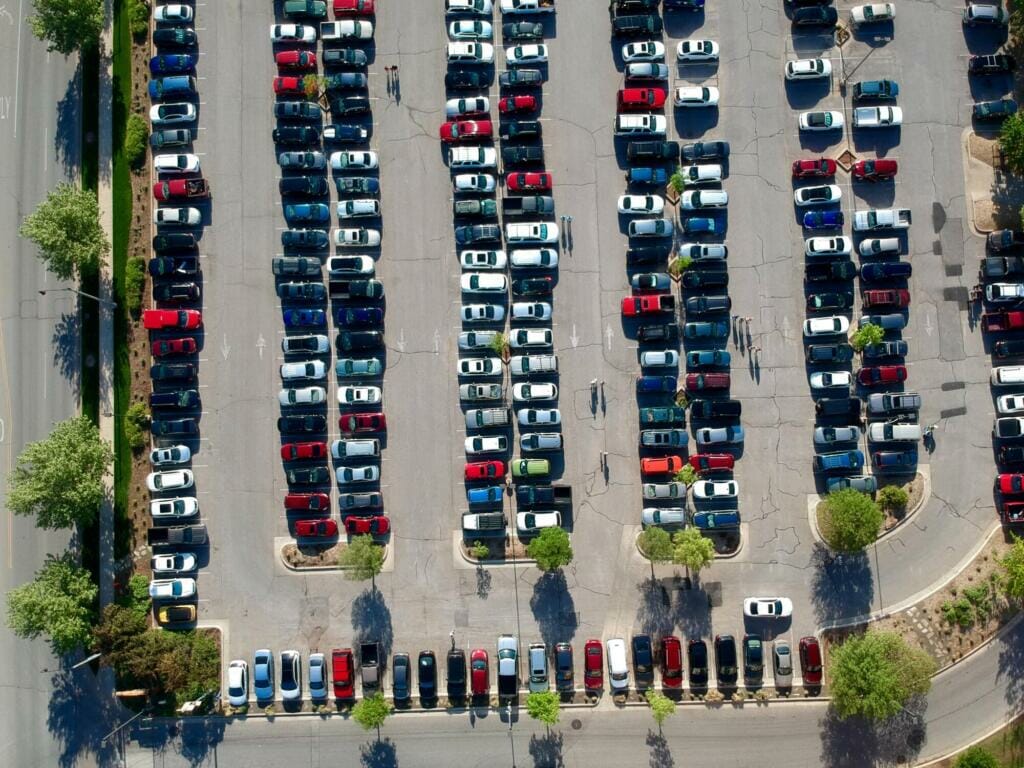

Helping you find a space

In a world of changing interest rates and market cycles, building wealth has some of us feeling like we’re circling a big parking lot. Where should you park? When it comes to your car, that depends on which store you’re going to and if you mind the walk.

When it comes to your cash and investments, it depends on your specific circumstances. Here are some options we’ve seen clients taking in the current economic environment.

Valet

Some investors may view this down market as a buying opportunity for equities and cryptocurrencies. These investors tend to “park” their cash in brokerage accounts, automating their contributions. On M1, this looks like using auto-invest or Smart Transfers on a schedule that works for them. We see a range of recurring transfers weekly, biweekly, monthly, and beyond.

These investors follow a range of strategies, from dollar-cost averaging where they follow a schedule regardless of market conditions, to value investing where they may consider certain equities “on sale” in a down market. They can consider parking their cash in brokerage accounts and automating their contributions.

Learn more about the “buy” approach >>

Park close

Risk tolerance varies, so not everyone will feel comfortable investing in a down market.

In these cases, some people vie for a potentially lower-risk action like choosing to park their cash in a checking or savings account with high APY.

On M1, we’re seeing more and more clients take advantage of our Plus membership, which unlocks 2.5% APY* on their M1 Checking Account.

If you’re somewhere in between, it might be worth checking your risk tolerance with a quick quiz.

Take our risk tolerance quiz >>

Switch spaces

Down markets are times to re-evaluate where your cash and investments are currently parked. If there is a better space available for you, consider moving.

We’ve seen clients transfer additional accounts over in search of better rates.

Stay parked

For some investors, they may want to stick to their long-term plan. We’ve seen this look like a combination of the above or something completely individual to the investor. In other words, they stay where they are parked and keep building on it.

Learning

Your feedback changed the Owner’s Rewards Card

Updates include no annual fee or shareholder requirements.

Access cash without liquidating your portfolio

Achieve your short-term financial goals with the help of margin loans.

well-being

Investment: Why Amazon is betting a billion dollars every Thursday for you to watch football.

Estate: What investors can learn from those who pass down their family business.

Goals: Knowing what you don’t want can be just as important as knowing what you want. Here’s how to set anti-goals.

Sign up for M1 and receive The Investor’s Mindset newsletter in your inbox every Monday.

*No minimum balance to open account or to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary.

- Categories

- Invest