5 options for your third stimulus check when you invest, spend, or save

Congress finally passed the American Rescue Plan Act of 2021, a $1.9 trillion stimulus bill that includes a third round of stimulus checks for as many as 26 million more Americans.

President Biden signed the bill on Thursday, March 11, and the $1,400 stimulus checks began hitting bank accounts a few days later. It’ll take a few weeks to get one to every eligible person, but the IRS told H&R Block they plan to send most payments by March 17.

For many people, this third payment can make a significant impact on their finances. And like the last two stimulus payments, you have options when it comes to spending, saving, or investing the money.

Here’s everything you need to know about the most recent round of stimulus checks:

- Are you eligible for the third stimulus check?

- How does the IRS send you the money?

- Will this impact your federal tax return?

- What should you do with the money?

- How should you invest your stimulus check?

Are you eligible for the third stimulus check?

It depends on your adjusted gross income.

If you’ve already filed your 2020 taxes, they’ll use your 2020 income and filing status. If you haven’t, the government will use your 2019 information. But if that’s the case, take this as a gentle nudge to get going on your taxes — many state taxes are due in April, and federal taxes are due in May this year!

The government will send extra stimulus checks through September if your financial situation was different in 2020 (for example, you made less in 2020 than you did in 2019). And don’t worry if you made more in 2020 than you did in 2019 — they won’t ask for any money back.

You’ll get the full $1,400 if you:

• Make $75,000 or less as a single tax filer

• Make $150,000 or less if you’re married (joint filers)

• Make $112,500 or less if you’re filing as head of household

Families will get an extra $1,400 for each person they claim as a dependent on their taxes. This relief bill expanded dependent status too: extra stimulus checks can include college students, adults with disabilities, parents, grandparents, or babies born in 2021. If your baby is born later in 2021, you’ll get your extra payment after you file your taxes next year.

If you make more than these limits, you could still qualify for a reduced payment. However, you won’t be eligible for any stimulus payments if you:

• Make more than $80,000 as a single filer

• Make more than $160,000 if you’re married

• Make more than $120,000 if you’re filing as head of household

You can use Kiplinger’s third stimulus check calculator to see how large your payment may be.

How does the IRS send you the money?

The IRS and US Treasury have already started sending checks. If they have your bank account information (like from when you filed your taxes), they’ll send you the money via direct deposit.

If they don’t have your bank account information, they’ll mail you a paper check. It may take longer, but it’ll get there!

You can use the IRS’s Get My Payment tool to see the status of your stimulus payment.

Will this impact your federal tax return?

Nope! A stimulus check doesn’t count as income, so you won’t be taxed on it.

And if you missed either of the first two stimulus checks, you may be able to get back paid. This would be the case if you made less in 2020 than you did in 2019. The stimulus payments were technically based on 2020 income, but the IRS used 2019 tax returns for those who hadn’t filed.

You can claim your Recovery Rebate Credit here.

What should you do with your money?

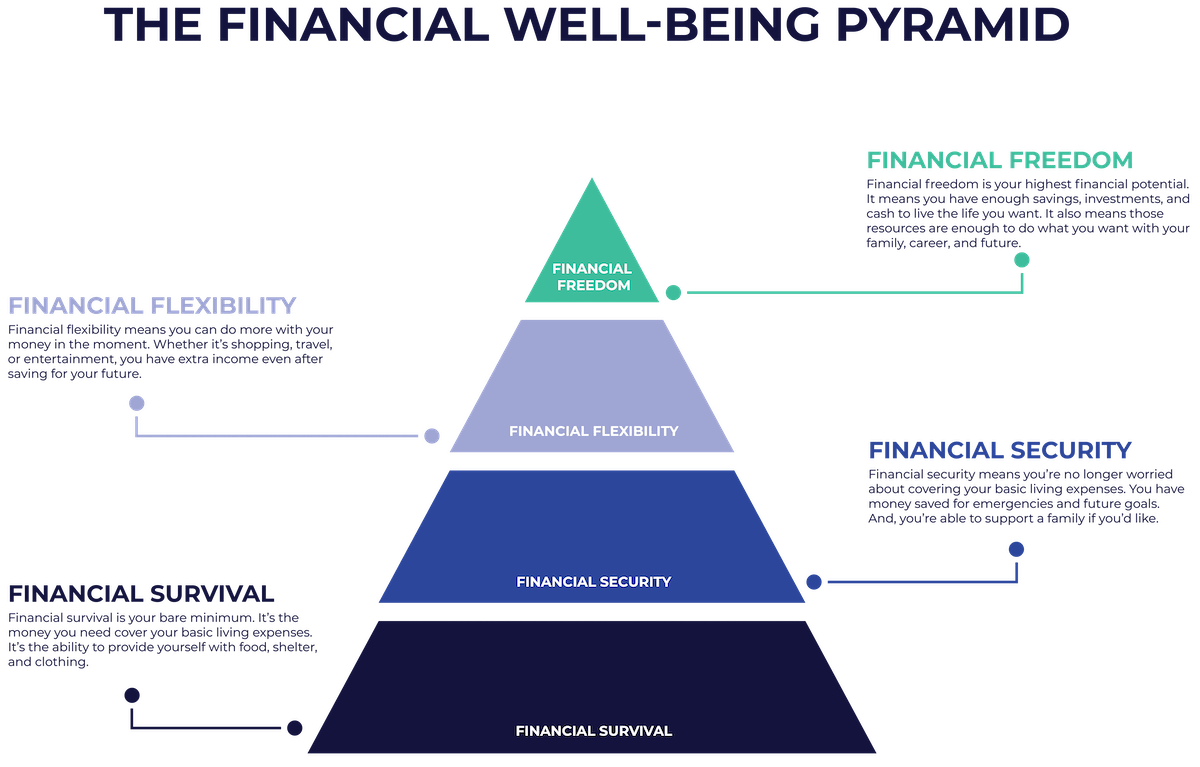

If you or your family needs to pay the bills

Use it — you must cover your basic needs first. If you’re struggling to buy groceries or pay rent, spend your entire check on necessities. It’s the baseline in our financial well-being pyramid.

You may even consider calling your provider to ask if you can get your bills reduced. Many banks, landlords, and credit card providers are extra understanding due to the pandemic. All you have to do is explain your financial situation or pull out your negotiation skills.

If you’re worried about losing your income (or you don’t have an emergency fund)

Save it – you’ll feel more comfortable and prepared.

Tuck your check away in an FDIC-insured bank account. Look for a bank account with a high annual percentage yield, or APY (that’s the percent you can make per year on money in your bank account).

*No minimum balance to open account. No minimum balance to obtain APY (annual percentage yield). APY valid from account opening. Fees may reduce earnings. Rates may vary.

If you have high-interest debt

Unlike low-interest debt (which can be helpful if used responsibly), high-interest debt can make a significant negative impact on your finances.

If you have high-interest debts like private student loans, personal loans, or credit card debt, you may consider using your stimulus payment to pay some of it off. You could also explore other options, like a portfolio line of credit.

If you’re not worried about bills or income

If you can cover your bills and feel secure with your income, you have more flexibility when it comes to your stimulus check. You can donate it, spend it, save it, or invest it.

If you’re spending part or all of your check, consider supporting a local small business impacted by the pandemic. But if you follow the data, there’s a good chance you’re investing.

A recent survey by Deutsche Bank revealed that half of 25-34-year-olds plan to invest at least 50% of their stimulus payments – and it’s not the only demographic planning to invest their check into the stock market.

The bank’s latest projections show that a total of 10% of the stimulus package could be invested in the stock market – a maximum of around $150 billion.

Investing your check can be a great option if you’re looking to build long-term wealth and feel comfortable with your financial situation.

How should you invest your stimulus check?

We can’t tell you how to invest your check, but we can give you the information and mindset you’ll need.

With a new round of stimulus checks and increased interest in the stock market, you may see people make risky financial decisions with their payments. It’s easy to get swept up in whatever stock is trending or comments on social media. But you’ll want to stick to your plan if you’re investing to build long-term wealth.

If you already built your portfolio and have an investing strategy, deposit your check into your favorite brokerage account and let it get to work.

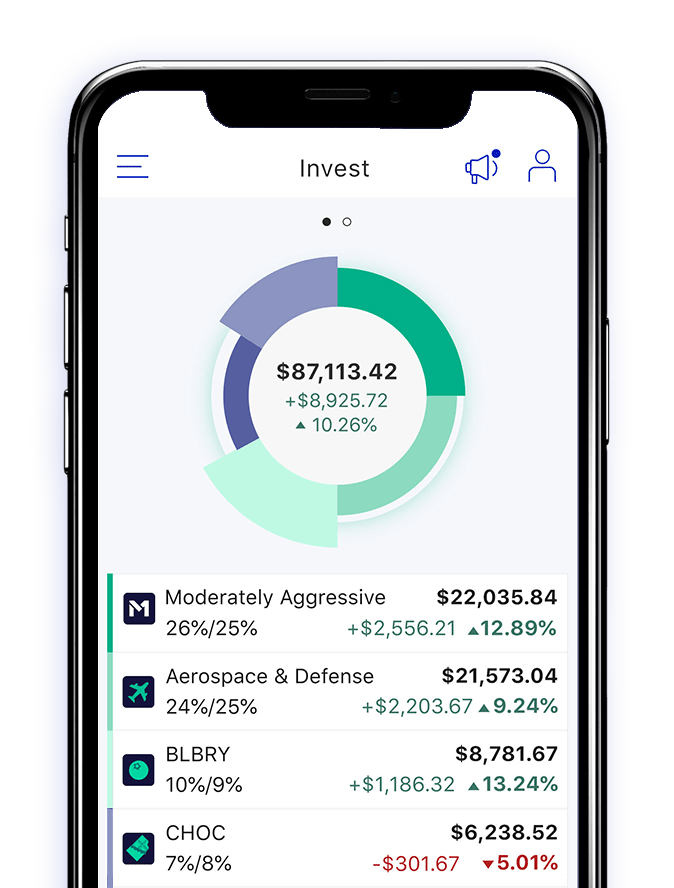

If you’re newer to investing, don’t like your current brokerage, or want to explore what’s next in personal finance, check out M1.

Ideally, you’d invest your check in a diversified, well-balanced portfolio that matches your risk tolerance, goals, and investing horizon (how long you want to stay invested).

And if you start seeing those risky decisions and tempting “all-in” strategies, remind yourself that you have a plan. Better yet – choose a brokerage that’s invested in helping you make smarter decisions.

Now that you have a plan for your stimulus check, all you have to do is to file your taxes, collect your tax refund, and keep an eye on that payment status. Then, you can put your plan to work.

P.S. If you’re investing your payment, make sure it’s money you’d be okay losing. Building long-term wealth through investing comes with risk.

- Categories

- Plan