An afternoon trade window for M1 Plus customers

Summary:

- M1 customers who are M1 Plus members now have access to two trade windows: 9:30 AM and 3:00 PM ET, every day the NYSE market is open.

- M1 Plus members whose account value is $25,000 or more can trade during both windows; if your account value is less than $25,000, you can trade during one or the other window, per day.

- The new flexibility gives investors greater control over their money and lets them take action when they perceive a benefit.

Eligible M1 users with M1 Plus membership now have access to two trade windows during every day markets are open: a morning trade window at 9:30 AM ET and an afternoon trade window at 3:00 PM ET.

Who can trade during these windows?

- M1 Plus members with an account value of $25,000 or more in their accounts may trade during both windows.

- M1 Plus members with an account value of less than $25,000 in their accounts may trade during either trade window.

- Those with standard M1 Finance accounts continue to trade during our morning trade window at 9:30 AM ET.

Why these rules? We put them in place to make sure we’ve followed FINRA’s regulations for day trading. FINRA offers strict guidance around what’s called “day trading,” which it defines as “the purchase and sale, or the sale and purchase, of the same security on the same day in a margin account.”

Further, FINRA notes that anyone who carries out four or more day trades within five business days is a “pattern day trader.” And FINRA requires that pattern day traders maintain paid securities valued at no less than $25,000 in their trading accounts.

The M1 Team is mindful of this rule for the benefit of all M1 customers—so our customers can focus on their investing. So in order to comply with FINRA’s rules, M1 must also require a $25,000 minimum account balance.

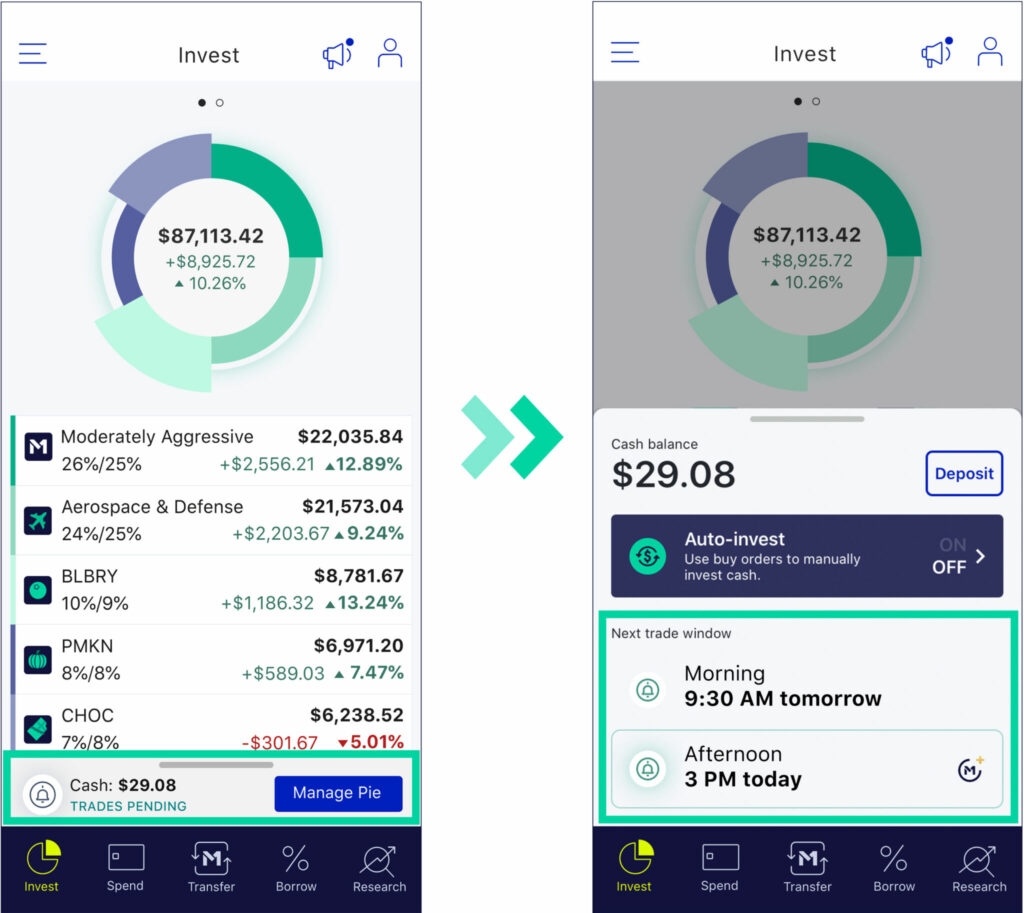

Where to find trade windows in the M1 app

Ready to plan your next trade? Open the M1 app on your mobile device and go to the “Invest” tab. Swipe up on the drawer at the bottom of your portfolio screen, then scroll until you see “Next trade window” (see Figure 1).

From here, you can…

- Make a deposit.

- Turn auto-invest on or off.

- View the next trade window.

- See whether you’re eligible for the next trade window.

- View your upcoming trades.

- Sort your portfolio by various features (gain, symbol, value, etc.).

- Edit your Pie(s).

- … and more!

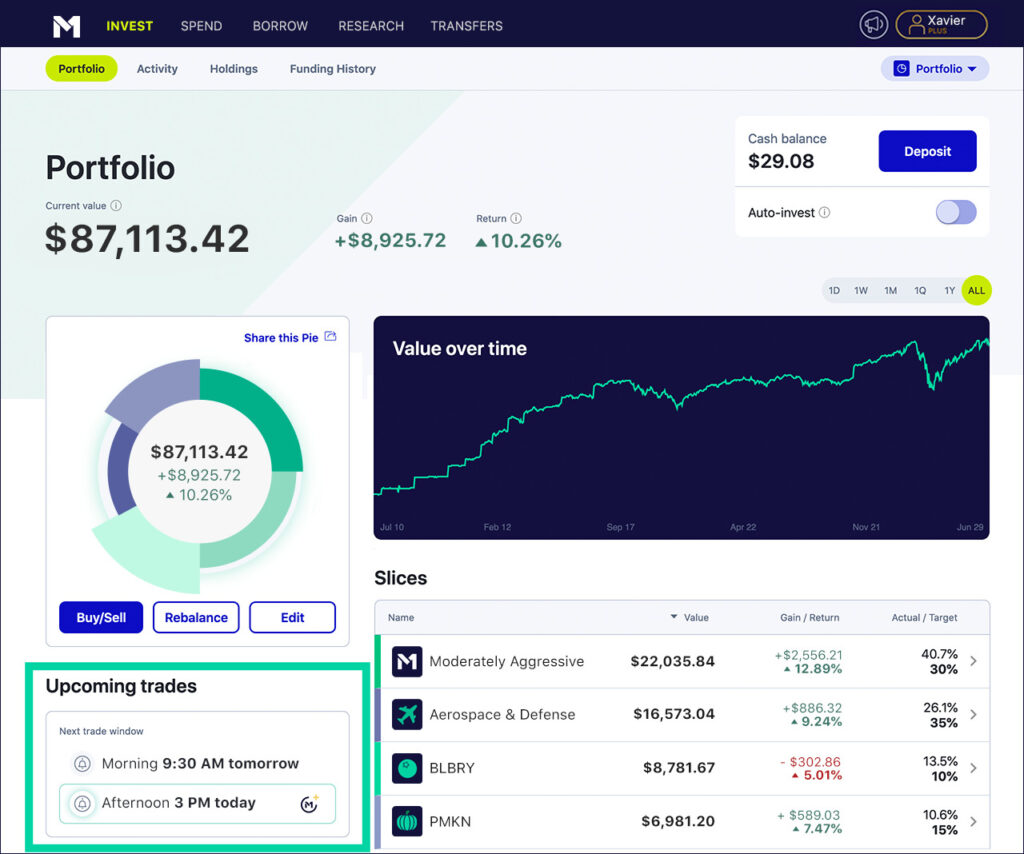

From the M1 Finance desktop dashboard, you can view trade windows by clicking into the Portfolio tab. Look for the “Upcoming Trades” label, which will appear on the left below your Pie(s) (see Figure 2).

How to trade with M1’s new trade window

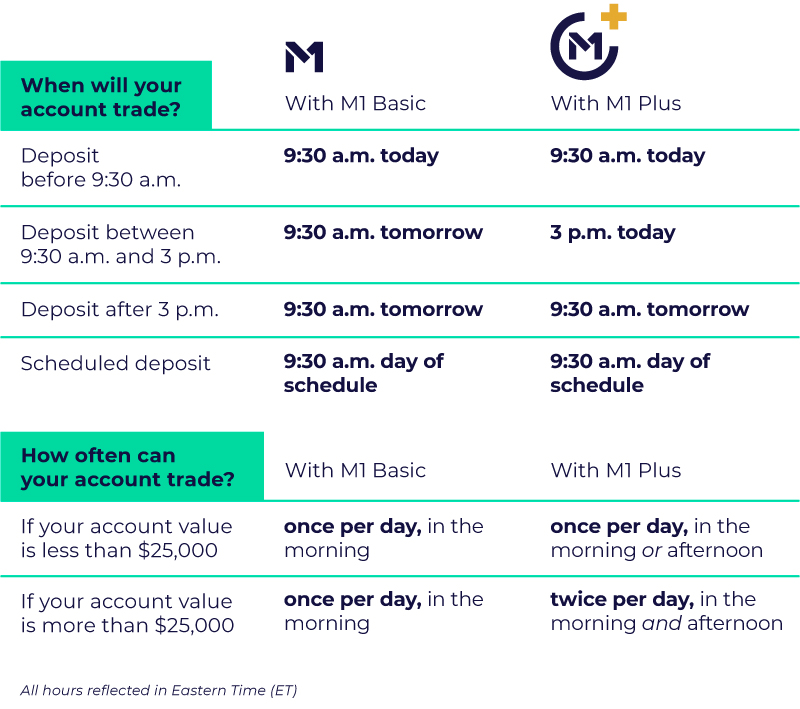

Your buy and sell transactions will execute depending on the type of M1 account you have (M1 Standard or M1 Plus) and the time you make changes to your portfolio.

If you have a standard M1 account, your trades will always go through during the standard morning trade window. If you make changes to your portfolio (including deposits, withdrawals, buy/sell transactions, or changes to your target allocations) before 9:30 AM ET, your trades will go through that same day. Otherwise, your trades will go through during the next available morning trade window.

If you’re an M1 Plus member, you have more options available. Your trades will go through during the next available trade window, whether it’s in the morning or in the afternoon. If you have more than $25,000 in your Invest account, you can participate in both trade windows every day (based on FINRA’s requirements mentioned above).

Don’t forget that you can also schedule regular deposits into your different M1 Invest accounts automatically on a weekly, bi-weekly, or monthly basis. Scheduled deposits will go through during the morning trade window.

Check out the table below to see how deposits work with the new trade window:

Still have questions about how trades work at M1? Refer to “How M1 Finance Trades” for additional details on our trading algorithm, and check out “Trade Window” to learn more about the morning and afternoon trade windows.

Why did we add an afternoon trade window?

We’re always listening to our customers to understand how we can make the M1 platform better. One request we’ve heard often is to add another trading opportunity every market day. We prioritize new features and updates based on customer feedback, and our afternoon trade window is the latest example.

But it wasn’t just popular demand that pushed us to expand trading opportunities for M1 Finance customers. Adding an afternoon trade window also fits into our larger philosophy of empowering investors to be engaged with their finances. A second trade window can help investors have more control over their money.

It also gives investors more opportunities to take action based on market movements and their investing philosophy. For example:

- If you forget to make updates before 9:30 AM ET, you don’t have to wait until the next trading day for your trades to take effect.

- You can react to news that’s important to you (including IPO announcements) more quickly.

- You can take action that aligns with your investing strategy when the market moves and you want to adjust your investments before the markets close that day

Another key benefit is for our members in Western and Mountain time zones: 9:30 AM ET is early in those regions (7:00 and 8:00 AM, respectively). If you live in the Western US and aren’t a morning person, the 3:00 PM ET window lets you trade at a more comfortable time each day.

The afternoon trade window is a popular reason why M1 customers choose to pay the annual membership fee for M1 Plus. By unlocking this feature, M1 Plus members gain more control over when their investments trade. So while M1 Finance has a free platform that will remain free, M1 Plus is available as a premium to customers who want to engage further with their finances with additional M1 Plus tools and features, including:

- An M1 Invest afternoon trade window.

- A high-interest M1 Spend checking account.

- An M1 Spend debit card that offers one percent cash back.

- Coverage of ATM fees four times per month.

- A 1.5% reduction on the already-low base rate on funds borrowed through M1 Borrow.

Read more about the benefits of becoming an M1 Plus member.

Why is the afternoon trade window so popular?

Let’s take a closer look at some potential scenarios where an M1 customer might want to use the afternoon trade window, which include the following:

- Reacting to market movement: An investor who wants to adjust their portfolio based on market activity that happens after 9:30 AM ET could use the afternoon trade window to do so.

- Implementing trades faster: An investor who misses the first trade window but wants to add, change, or delete slices in their investment Pies can now do so that day by using the second trade window.

- Trading more flexibly: Investors living in the western part of the country can now make same-day trading decisions without setting an early alarm clock. The 3:00 PM ET trade window happens at 12:00 PM Pacific and 1:00 PM Mountain.

- Capitalizing on buying and selling opportunities: M1 Plus customers who have at least $25,000 in their account can more quickly make trades when they perceive opportunities as being beneficial to their investment strategy.

- Making account changes more quickly: The afternoon trade window will also make it possible for other account changes to take effect faster. Eligible investors will be able to use the afternoon trade window to transfer funds, remove a slice in their Pie, rebalance their Pies, submit buy or sell orders, and change their auto-invest settings.

How will you use the afternoon trade window?

We’re always trying to make M1 Finance better for our customers, which means we’re always curious to hear what you think about it. If you have questions about the afternoon trade window or would like to share your plans for using it, please reach out to us at hello@m1finance.com.

We look forward to hearing from you!

- Categories

- M1