Guest Post: The Cash Cow Couple

We recently sat down with Jacob of the Cash Cow Couple. Jacob and his wife Vanessa have a passion for personal finance and try to help others achieve financial independence with their blog. The team has previously reviewed M1 Finance, and we wanted to learn more about Jacob’s unique perspective on investing.

1. How did you and Vanessa first become involved with investing?

I’m completing a Ph.D. in financial planning, so investing is something I’ve studied extensively. When you spend less money than you earn, it’s wise to do something productive with your savings. Investing in assets like stocks, bonds, and real-estate is a proven way to build long-term wealth, so those are our primary investment vehicles at this time.

2. As a couple, how do you and Vanessa complement each other with your individual investing perspectives and experience?

Vanessa isn’t as interested in learning about the intricacies of financial markets, so she leaves all of the research and implementation to me. With that said, she does offer her suggestions, and we always make decisions as a team.

Vanessa and I definitely have different perspectives on the investment process. I’m concerned about minimizing fees, maximizing returns, and building wealth. Vanessa is concerned about our investments being safe and readily available should we ever need to access those funds. The difference in perspective allows us to work well together as a team.

3. How would you describe the difference between saving and investing?

Saving is the process of spending less than you earn, creating a pool of financial resources. Investing is the process of committing those financial resources to a goal, with the expectation of obtaining a future benefit that outweighs the expected cost.

The expected future benefit could be monetary in nature, or something else entirely. For example, an investment in financial assets is expected to increase the value of your savings over time through compound growth, while building human capital through an educational program is an investment in knowledge.

4. What do you generally look for with investments? Can you describe your overall investment strategy?

Several decades of investment research has shown that fees are extremely important in determining long-term investment performance. This becomes even more important when you consider that fees are one of the only decisions that investors have complete control over in the investment process.

Additional research has shown that diversification is the only free lunch for investors. Accordingly, our investment strategy follows the science of investing. We own diversified, low-cost index ETFs that represent the global economy. To spice things up a bit, it’s also possible to invest in slightly more specialized ETFs that are created to capture value (including dividend yield), low-beta, or momentum investment strategies. It’s important to note, these specialized ETFs are still broadly diversified.

5. What do you like most about the M1 platform? What differentiates it, in your opinion, from other brokerages?

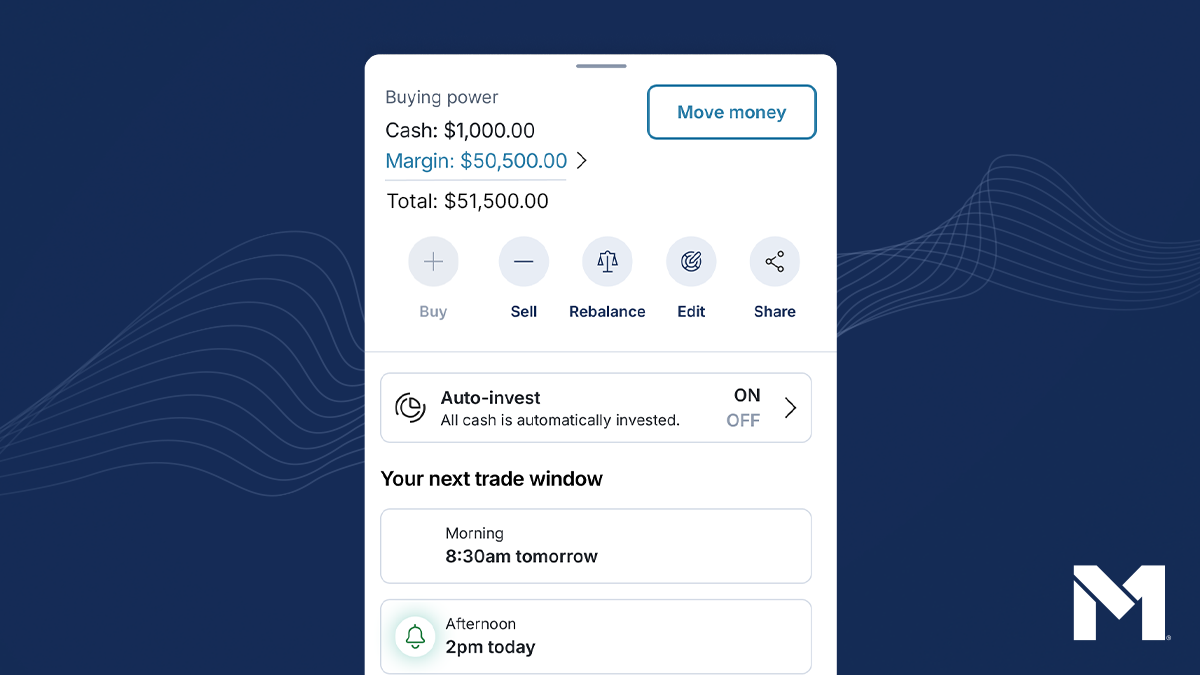

As I highlight in my M1 Finance Review, there is nothing else on the market that allows investors to trade an unlimited number of individual stocks and diversified ETFs in exchange for one all-inclusive management fee. For the first time ever, investors can create their own diversified index fund using any combination of securities without worrying about transaction fees.

The focus on customization and flexibility is what sets the M1 platform apart from competitors. By allowing investors to have complete control over the investment process while offering intelligent automated rebalancing, you’ve combined some of the best robo-advisor features with a full-service brokerage.

6. Are there specific features of M1 that you believe can encourage good financial habits?

M1 Finance allows investors to create both taxable and retirement accounts, which will encourage investors to save and invest more money over time. The recurring funding feature builds upon this by allowing individuals to automatically invest their savings each month.

I believe that the all-inclusive management fee also encourages diversification. In the standard brokerage setting, investors pay per transaction. Every purchase and every sale carries an upfront cost, which can deter individuals from creating a diversified portfolio. If an investor wants to own 50 stocks, he would have to pay 50 separate transaction fees to purchase each company. M1 Finance overcomes this barrier by allowing investors to trade an unlimited number of securities without charging any additional fees.

Thanks for sharing your thoughts with us today, Jacob! We appreciate it and look forward to reading more on CashCowCouple.com.

- Categories

- Invest