How 41-year high inflation impacts everyday costs

School might be out, but the reports are rolling in. Second quarter earnings reports started trickling in on Tuesday, and the U.S. Bureau of Labor Statistics released June’s CPI report on Wednesday. Over the next few weeks, we’ll relay key company info so you can stay informed.

In this edition:

- An overview of June’s CPI report

- How potential blackouts are impacting energy

- The start of earnings season

News

CPI climbs to a 41-year high

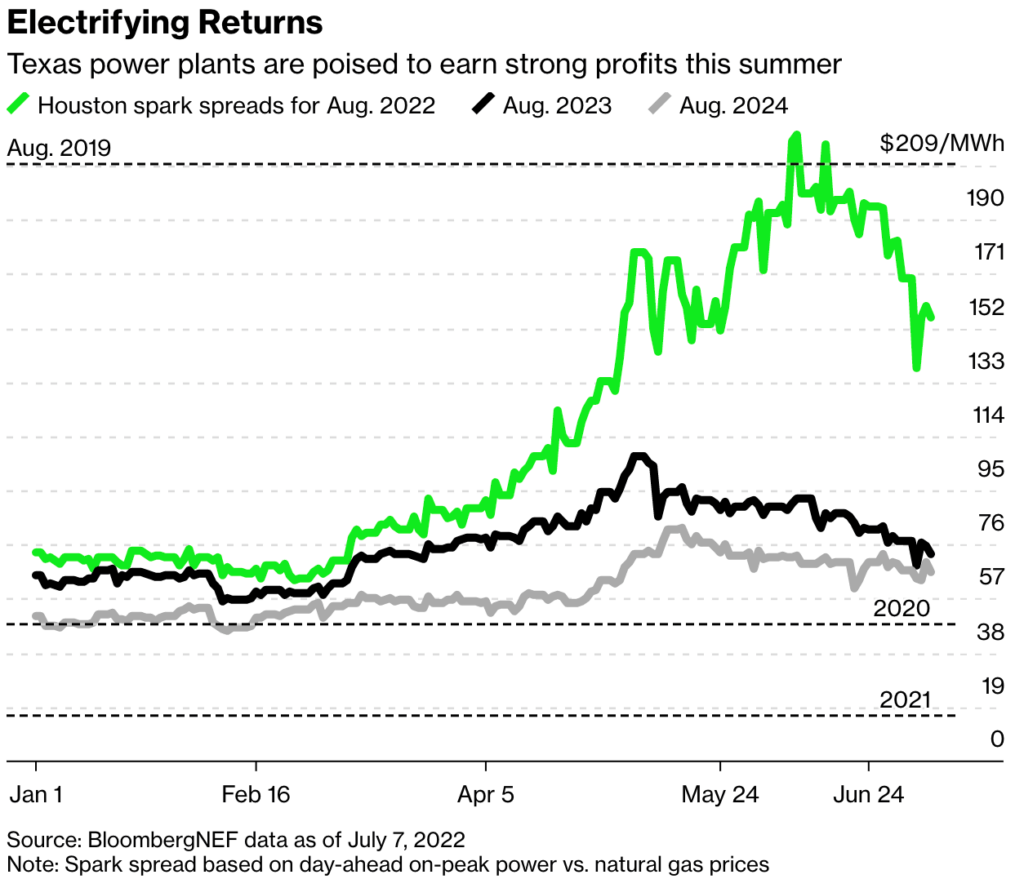

U.S. inflation is at its highest rate in 41 years, rising by 9.1% over the last 12 months. This exceeds May’s annual rate of 8.6%. The Federal Open Market Committee (FOMC) will meet on July 26-27 and is expected to raise rates by 75 basis points (0.75%). Inflation has hit the energy and food industries the hardest, with energy seeing a 40% increase in the past year.

12-month percent change, Consumer Price Index, selected categories, June 2022, not seasonally adjusted

While inflation is heating up, the housing market is cooling off. Americans canceled deals to buy homes at the highest rate since the start of the pandemic. According to a report from Redfin, “The share of sale agreements on existing homes canceled in June was just under 15% of all homes that went under contract.” This is the highest share of cancellations since home buying briefly paused in early 2020.

COVID headlines from China also hit markets negatively, with case numbers rising and Shanghai reporting its first BA.5 subvariant case. These fears led to a slight fall in oil prices, with U.S. benchmark West Texas Intermediate crude oil trading at over $104 per barrel.

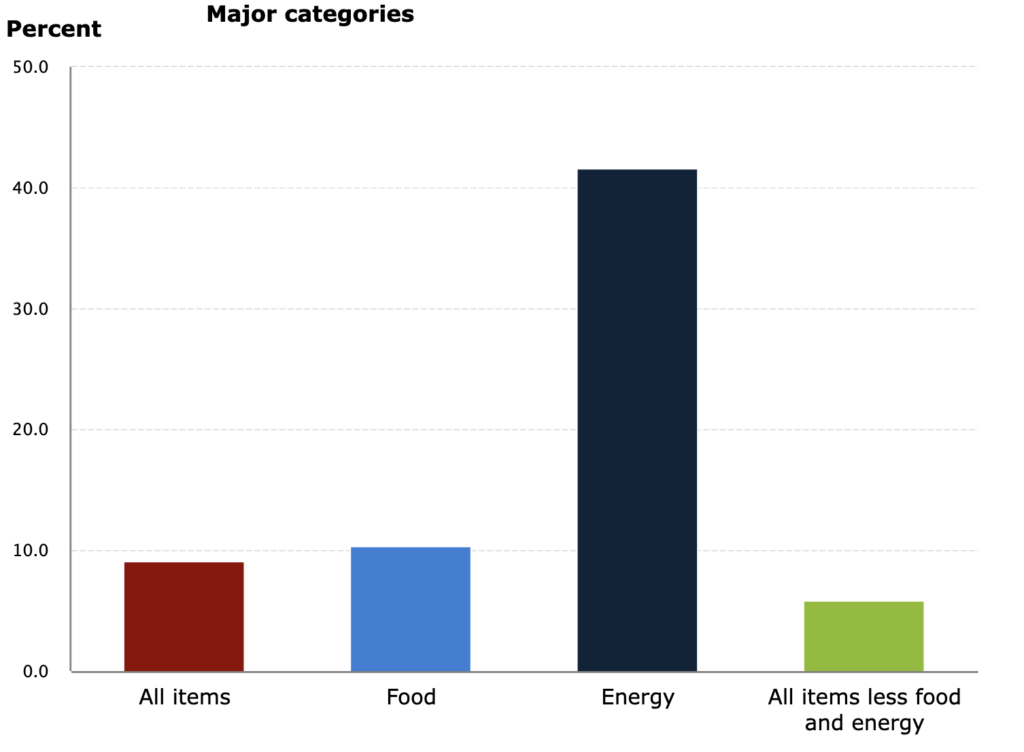

Blackout fears fuel energy profits

Soaring electricity prices are outpacing the costs of natural gas and coal, leading to the highest expected summertime profits in almost 20 years for U.S. power plants. According to Bloomberg, “On America’s largest grid, stretching from New Jersey to Illinois, a key metric for gauging the profitability of coal plants has nearly quadrupled from a year ago to $43 per megawatt-hour.” For gas plants in Texas, it’s up almost 10-fold.

These wide margins suggest trouble. Extreme heat over upcoming weeks may drive electricity demand through the roof, leading to potential blackouts. Peter Rosenthal, head of North American Power for Energy Aspects claimed, “these prices reflect the increased risk of shortfalls,” and that he’s “never seen margins this wide across so much of the country in more than 20 years analyzing power markets.”

On Monday afternoon, power prices reached peaks more than 20 times higher than normal —more than $2,000 a megawatt-hour. Unfortunately, profits will come at the expense of businesses and households that need to dial back operations to avoid steep electricity bills.

Energy Prices in Houston

Q2 earnings season kicks off

We’re halfway through the year, which means second quarter earnings reports are here. Companies started to release earnings this week, with more reports in the coming weeks. Here are two recent reports:

PepsiCo (PEP)

- Earnings per share: $1.86 adjusted vs. $1.74 expected

- Revenue: $20.23 billion vs. $19.51 billion expected

Delta (DAL)

- Earnings per share: $1.44 adjusted vs. $1.64 expected

- Revenue: $12.31 billion vs. $12.33 billion expected

Today and Monday, investors will look to the major Wall Street banks’ earnings reports, which can provide additional clues about the health of the economy. Want to track a specific company? Search report release dates by day or symbol.

Quick hits

- The important stock split coming soon

- Will this factory help solve the chip shortage?

- What’s next for Twitter and Musk

M1verse

This week in finance history

July 12, 1943

Women are allowed on the floor of the New York Stock Exchange for the first time in history. The Exchange allows women to fill jobs left vacant by men serving in the military. The women work as pages and reporters but aren’t allowed to trade.

Today, 67% of women are investing outside of retirement, compared to 44% in 2018. A study by Fidelity found that, on average, “women outperformed their male counterparts by 40 basis points or 0.4%.”

Sign up for M1 and receive the Weekly Wrap Up newsletter every Friday.

- Categories

- Spend