The Fed hikes interest rates as CPI climbs

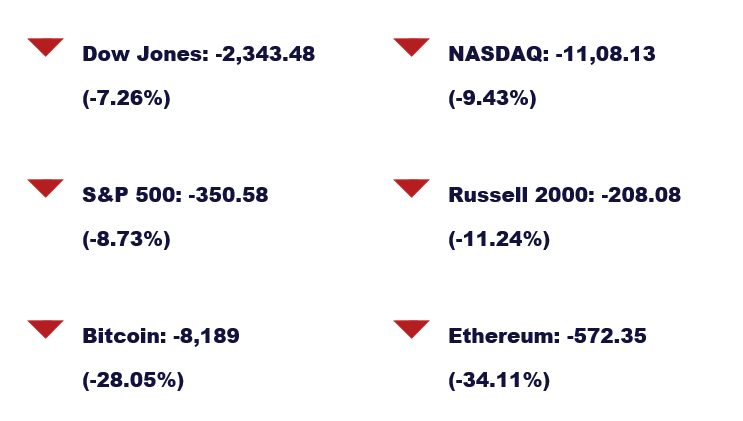

It’s been a tough week for markets, investors, and the economy. We hope you get downtime this weekend to unwind. We’re taking Monday off for Juneteenth celebrations, but we’ll be back next Friday.

To recap the week, we’re covering the Fed’s latest decision on interest rates and record-high yields. Also in this edition:

- What sparked two crypto platforms to institute a trading freeze

- Why the market has billionaires eyeing sports ownership

- How a surfer made a fortune from sweatpants

News

The Fed’s latest interest rate decision

For the first time in 28 years, the Fed is raising benchmark interest rates by 0.75%. The rates now sit at 1.5%-1.75%, the highest since just before the pandemic began in March 2020.

“Overall economic activity appears to have picked up after edging down in the first quarter,” the Fed statement said. “Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. “

This is a sharp turn of direction from Fed Chair Jerome Powell, as he told reporters in a May press conference that “a 75 basis point (0.75%) increase is not something that the committee is actively considering.”

Other major notes from the Fed’s meeting include:

- The Fed’s benchmark rate will end the year at 3.4%, which is 1.5% above March estimates.

- Officials expect a 1.7% gain in GDP, down from 2.8% in March.

Yields reach decade-high levels after CPI jump

Yields soared after the most recent CPI data was released on Friday. The report shows food costs jumped and gas prices hit record averages, leading to the largest annual increase in CPI in over four decades.

Between this jump and apprehension around interest rates, many yields felt the effects. Two-year yields reached their highest levels in 15 years, and 10-year yields reached its highest levels since 2018.

Bitcoin dips, Celsius and Binance freeze withdrawals

In a move reminiscent of the “meme stock” saga of 2020, major crypto platforms Celsius Network and Binance froze their users’ ability to withdrawal Bitcoin. The reason? Celsius cited “extreme market conditions.”

The numbers reveal why — Bitcoin is down 67% from its high in November 2021, when it traded near $69,000.

Celsius Network left clients without a timeline to unfreeze trading and transfers, only saying it would “take time.” “Celsius suspending withdrawals yesterday gave extra downside momentum,” noted Jeffrey Halley, senior market analyst, Asia Pacific, at Oanda.

Quick hits

- Stock market concern has piqued interest in owning sports teams

- How $160 sweatpants turned a surfer into one of America’s richest women

- Prologis to buy Duke Realty in $26 billion deal

M1verse

Automate your finances with smart transfers

We’ve revamped our post on Smart Transfers, and we figured we’d remind you of one of our favorite M1 tools.

To get started with Smart Transfers, take these steps:

- Learn more about optimizing your banking with M1.

- Join M1 Plus to start using Smart Transfers.

- Set Smart Transfers based on your goals to automate your financial life.

Instead of clicking around in your accounts, take control of your money so you can focus on doing what you love.

This week in finance history

June 13, 1986

Real-time market data gets an upgrade as Standard & Poor begins releasing the value of the S&P 500 every 15 seconds. What did that mean for investors other than more up-to-date data? The ability to check the value 1,559 times per day.

Market information is in a new stratosphere 36 years later, yet a simple point remains — timely data is helpful, but time in the market is crucial.

Sign up for M1 and receive the Weekly Wrap Up newsletter every Friday.

- Categories

- Spend