Sharing Pies 101

Away from the Thanksgiving table, most of us don’t think too much about how sharing a pie could affect our lives. But if you’ve got an investment portfolio with M1 Finance, sharing a Pie could have substantial impact on your life – or the life of someone you care about.

What are we talking about, you ask? Let’s go back a few steps.

What are investment Pies?

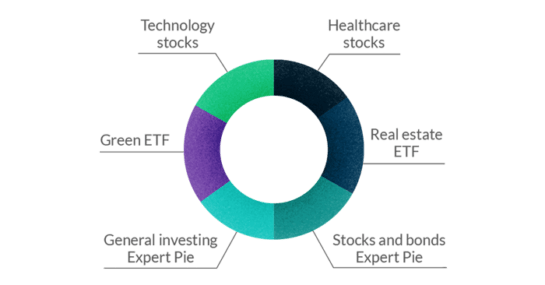

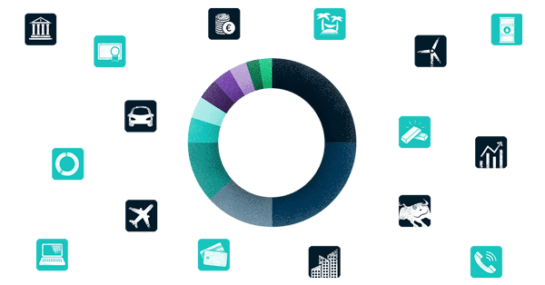

The foundation of M1 Invest portfolios is the Pie (pictured).

Each slice represents a type of investment – either an individual stock, an ETF, or another Pie. Because you can see the relative size of your investments at a glance, the Pie offers an easy and intuitive way to keep track of where your money is.

What is Pie sharing?

When you create an M1 account, you’ll have the ability to share any investment Pies you create with other people. You can even share a Pie you created but haven’t actually funded – maybe to get feedback from a friend or partner with more investing experience than you.

M1 tip: if you share a Pie with someone who’s not already using M1 and that person signs up, we’ll give you both $10 to invest.

But sharing a Pie doesn’t let you just show investment allocation. Our Pie share feature also shows…

- Backtested performance, meaning a look at how your Pie would have performed in the last week, month, quarter, three years, or five years.

- Number of holdings within the Pie.

- Dividend yield (aka, the dividend per share divided by price per share).

- Expense ratio (aka how much of the investment goes toward administrative expenses).

So by sharing a Pie, you can give someone you care about a detailed look at an investment you’re considering or already pursuing.

The benefits of sharing a Pie

How can that kind of view benefit someone you care about? Consider this: even though investing in the stock market for the long term is one of the best ways to grow wealth, fewer Americans are investing in stocks now than before the stock market crash and the Great Recession of 2007 to 2009.

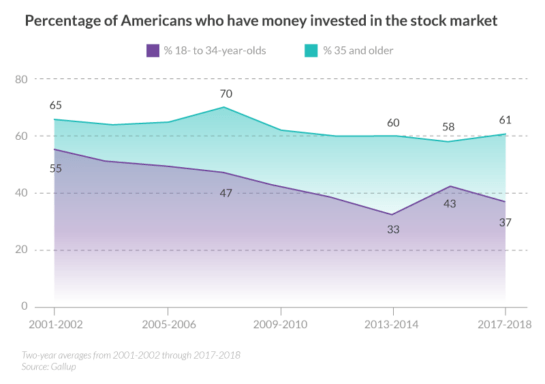

The group that’s been most reluctant to jump back into the market is the under-35 crowd, as shown in this chart.

Before the stock market crashed in 2007, 52 percent of people younger than 35 were invested in the stock market. Today, that number has fallen to just 38 percent – a 27 percent decrease.

And yes, it’s understandable that a generation whose first adult memories involve dire daily news updates about home foreclosures, rising unemployment, and a decimated stock market would be hesitant to put their money in that same stock market (once bitten, twice shy, after all).

But it’s also not a good financial decision to avoid the stock market because of fear. In fact, avoiding the stock market altogether can seriously hurt a person’s ability to grow wealth over the long term. Why? Because historically, the stock market has continued to go up.

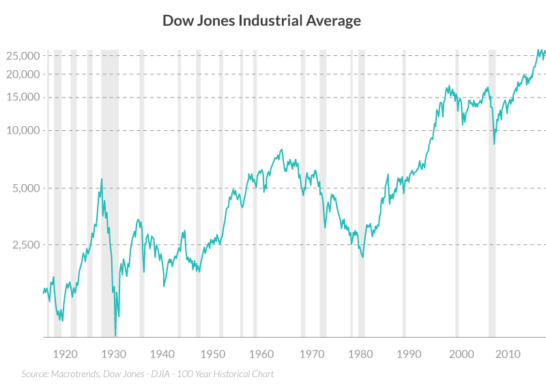

Take a look at this chart, which shows a 100-year view of the value of the Dow Jones Industrial Average:

The gray lines on that chart are recessions. While these can feel catastrophic when you’re living through them, it’s helpful to look at a chart like this to get a long view on how recessions fit into the bigger picture.

Sharing a Pie with a friend isn’t hard, but it may be the nudge they need to take the first step toward securing their financial future by putting their money somewhere it can grow and offer them financial stability for years.

Pie share use cases

1: Start the graduate in your life on the right financial foot

Not sure who to share your first Pie with? Graduation season is coming up, and new graduates are in a prime position to start investing. Thanks to the magic of compound interest, people who start investing in their 20s have a much easier time funding their golden years than those who put off investing until later.

By creating and sharing an M1 Invest Pie with the newly minted graduate in your life, you can set them up for a more secure financial future.

Maybe you can even combine a shared Pie with a check that you encourage them to put into an M1 account. Who knows? Your gift may be the one that sets them on the path to financial freedom so they can pursue their dreams much earlier than they might have otherwise been able to.

2: Try competitive Pie sharing with a partner or friend

As we’ve mentioned many times in the past, we’re big on the concept of engaged investing – that is, being neither fully active nor fully passive in your investment strategy but rather aiming to learn as much as possible about your finances and using that knowledge to guide strategic decisions that help you meet short- and long-term goals.

One way to learn more about investing is to create investment Pies and share them back and forth with a friend or loved one.

Because M1’s share Pie feature shows so much information about the Pies you create, you could have a friendly competition to see who can create a Pie with…

- The lowest expense ratio.

- The highest dividend yield.

- The best historic performance.

By doing this, you’ll start paying attention to these data points, which will help you understand where various types of investments fall on the spectrum. You’ll be motivated by the competition to beat your opponent and, as in all the best games, you’ll be learning while you play.

After a while, you’ll both have pies with some really favorable terms, at which point you can fund them confidently, knowing you’re likely to earn solid returns on your investment.

3: Share a Pie to start a conversation

Money is one of the hardest things to talk about. In fact, 44 percent of Americans think it’s harder to talk about personal finance than death, politics, religion, or personal health. Yikes!

Sharing a Pie can be just the icebreaker you need to start talking about investing with someone in your life, whether that’s an older child, a partner, a friend, or even a parent. Because M1 Invest Pies are concrete (and – we’re not afraid to say it – pretty fun), they’re a great way to broach the topic of finances in a low-stakes way.

And because the share functionality is built right into our platform, you can easily start a financial conversation without having to clear the calendar, clear the table, and make a big to-do of it.

Sharing is caring

There are plenty of good reasons to share an M1 Invest Pie with people you care about. Maybe the best one is that, by sharing a Pie, you can spread the word to your loved ones that the future of finance is free – that is, that they can invest for the future without paying for the privilege of doing so.

If you’ve been enjoying M1, Pie sharing is the perfect excuse to convince any holdouts you know who are still paying financial advisors or forking over management fees to mutual fund managers on other investment platforms.

Remember: every time you share a Pie with someone who opens and funds an account, we’ll give you both a financial reward.

If you still haven’t built your first Pie (or you have, but you’re now inspired to see if you can build one with a lower expense ratio or a higher dividend yield), get started! It really is fun and (as you know) it’s a great way to set yourself up for long-term financial success.

- Categories

- M1