Put your best foot forward: 10 habits for better investing

Huge, transformational goals often fail. In fact, 92% of New Year’s resolutions fail, according to research from the University of Scranton.

Yet year after year, we set huge, transformational goals for our health, relationships, career, and finances. We dream of better investing, better fitness – but life gets in the way.

Setting some high bar of accomplishment, like the perennial “I’m going to lose 10 pounds,” for example, is one thing. But resolutions feed a cycle of “all or nothing” thinking.

It explains why packed gyms in January often return to normal by February. What if, instead of making resolutions, we committed to building habits?

Successful people build habits that ladder up to long term goals. When it comes to better investing and sound financial practices, this is especially true.

There’s no one size fits all to better investing, and this year’s financial decisions won’t only impact you now. Many choices will affect your financial well-being far into the future.

As we covered in this piece and this one on tiny habits, a commitment to habits leaves room to start small and grow gradually. This is often more sustainable than trying to make a big change immediately and all at once.

Positive habits even build on each other. The ones that make us strong in one area give us confidence and a foundation to flourish in others. Not only are consistent habits more exciting than a shopping list of unrelated (and unrealized) resolutions, but they’re also based on science.

Whether you want to change your mindset, adopt new technology, or embrace exciting new goals, habits provide the glue that holds everything together.

To get you started, we’ve assembled this list of 10 habits to help you with your journey to better investing:

- Educate yourself

- Regulate your media intake

- Shift your spending

- Sharpen your skills

- Study another long term investor

- Clarify your finances

- Review your portfolio

- Make priority lists

- Master your emotions

- Adopt a growth mindset

1. Educate yourself

Smart investors never stop learning and educating yourself can fit into the time you already have in your day. You don’t need to hit the books like an MBA student.

But you can still feed your curiosity and fill in knowledge gaps with resources like Jason Zweig’s column in The Wall Street Journal, Investopedia’s financial terms dictionary, or our newsletter: The Investor’s Mindset.

This better investing habit can even be as small as reading a personal finance article each morning after you have your first cup of coffee.

2. Regulate your media intake

The 24-7 financial news cycle provides a never-ending torrent of sensational headlines, knee-jerk advice, and doomsday pronouncements. It also provokes unwitting investors into making rash decisions based on the big story of the day.

Yes, stay informed. But choose your news sources wisely, with an eye towards how much time you spend consuming media on your devices.

This year, time-box your media intake and stay distraction-free. Perhaps that means 30 minutes of news at the end of the day.

3. Shift your spending away from high-interest credit cards

High-interest debt multiplies —and, as of Dec. 2020, the average credit card minimum APR ranged between 14.82% and 21.18%.

For example, a $2,000 balance with an 18% APR turns into more than $2,400 if you pay off $50 a month. That’s money you could have been contributing to your taxable account or retirement savings portfolio.

If you want this to be the year you rely less on high-interest debt, make it a habit to explore alternatives each time you have a considerable expense or want to add leverage to your portfolio.

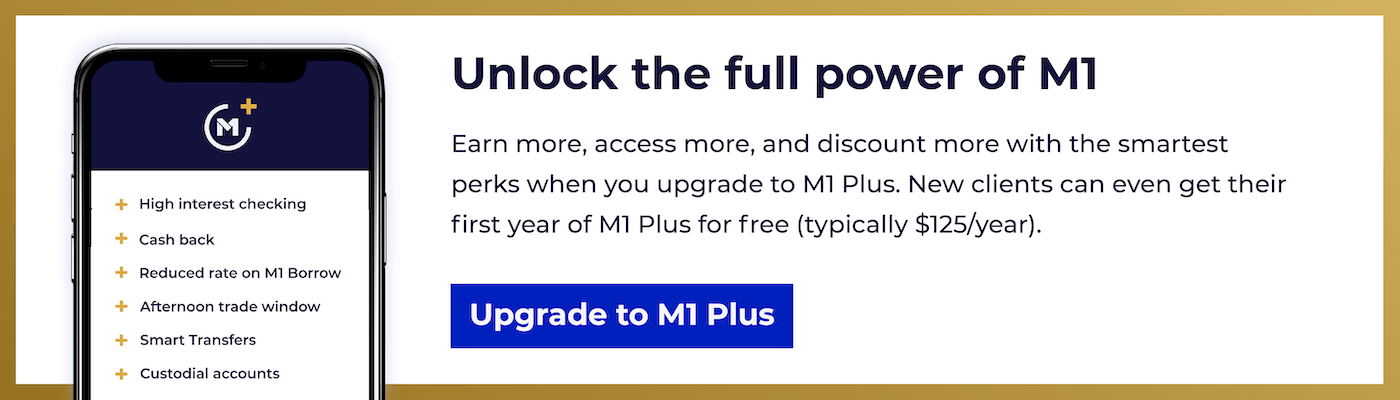

Among your options may be M1 Borrow, our portfolio line of credit with one of the lowest rates on the market. We’ve seen clients use it for different use cases, like restructuring higher-interest debt.

4. Sharpen your skills with automated investing

No matter your skill level, automated investing tools can help you on your journey to better investing. They save time, improve your investing focus, and build the habit for you.

Depending on your platform of choice, you can take advantage of features like recurring transfers or automatic investments.

On M1, we take automation seriously with dynamic rebalancing, auto-invest, recurring transfers, and Smart Transfers.

That last one is even built like a habit: you set the triggers (like maintaining a certain amount in your M1 Spend account). Smart Transfers automatically executes your desired action (like sweeping the extra money to your M1 Invest account).

5. Study another long term investor

Yes, billionaire Warren Buffett had an investment hero. He studied with Benjamin Graham, author of The Intelligent Investor and a professor at Columbia Business School. You don’t have to know the Oracle of Omaha personally to learn from his many discussions and interviews on value investing.

Just remember that every investor has a unique strategy (and only financial advisors can give advice).

6. Clarify your finances

You probably know how much you make. But how much do you spend weekly? Or want to save for retirement? Or need to deduct from your paycheck to land your employer’s retirement match?

Whenever you think about a vague personal finance metric, make it a habit to state its real value. Actual numbers will help you understand what actions you need to take. The vague ones may paint an untrue picture when it comes to your finances.

7. Review your portfolio at regular intervals

Somewhere between the investor who checks her stocks three times a day and one who has no idea what or how much they own, you’ll find a healthy habit of setting regular dates to examine your portfolio up close.

Your review can be monthly, quarterly, or annually (you decide), guided by questions such as, “Is my profile too risk-averse?” or “Do I want to move more money into this company that champions clean energy?”

Set the trigger (like your quarterly OKR review at work) and define the action (research any fundamental business changes impacting your holdings). If you’re doing a full review, you might need a series of habits, triggers, and actions.

8. Turn your checklists into priority lists

The problem with conventional checklists is that all checkmarks look alike. Financially speaking, “clean out 2016 tax file folders” shouldn’t share equal billing with “fill out paperwork to increase my IRA contribution.”

The habit of putting first things first is a game-changer. The 15 minutes you might spend surfing social media could be used to set up an automatic withdrawal from your bank to your investment account.

Guess which one builds long term wealth?

Every time you create a checklist, make it a habit to prioritize each item according to a system that’s personal to you. We like to keep it simple: low, medium, and high priority – depending on your long-term goals.

9. Master your emotions

Ben Carlson, the blogger and CFA Charterholder behind A Wealth of Common Sense, says it best:

One of the more difficult aspects of being an investor comes from the fact that we often have competing emotions depending on where we are in the market cycle. There’s fear and greed. Overconfidence and loss aversion. Panic and euphoria.

From the “fear of missing out,” or FOMO, to the adrenaline-junkie jolt that comes from betting on stocks in search of a jackpot, to the urge to sell when a stock drops more than 5%, irrationality too often clouds our thinking.

Avoiding these pitfalls and so many more has everything to do with trusting your long-term plan and knowing how to stay calm during market turbulence. Mastering your emotions comes in large part from remembering, among other things, that the average annualized total return for the S&P 500 is roughly 10% – over the past 90 years.

So this year, when the market experiences some volatility, build a habit that helps you stick to your plan. For some, that might look like telling yourself the volatility is temporary when the market moves a certain percent. For others, this habit will look completely different.

10. Adopt a growth mindset

A wealthy investor’s mindset is a growth mindset. It doesn’t come by accident, and it doesn’t come from money alone.

Ever wonder why Elvis Presley made all those movies in the 1960s? He was a multi-millionaire who didn’t need more money, but his growth mindset kept him wanting to grow his career.

It’s hard to grow your wealth if you don’t grow your mind. But don’t just take it from us – here’s what Stanford psychologist Carol Dweck has to say:

For twenty years, my research has shown that the view you adopt for yourself profoundly affects the way you lead your life. It can determine whether you become the person you want to be and whether you accomplish the things you value.

To adopt a growth mindset, build habits that focus on the process, challenges, and learning opportunities. This way, it’s not about failing or making a poor investing decision. It’s about improving your long term strategy each time you adjust.

The right headspace makes a huge difference as you tackle your goals to improve your financial well-being. And building the right habits can get you on track towards better investing.

- Categories

- Invest