M1 Intro to Investing Roadmap

Financial wellness is a state of well-being in which you have a positive mindset about your financial life. In this frame of mind, you have a sense of financial security and the resources you need to meet your money goals. This includes factors such as an emergency fund, retirement savings, debt to income ratio, income and discretionary spending, and the ability to invest for your ideal financial future.

However, becoming financially well starts with understanding your financial health. To help you get started, we gathered financial wellness tools and frameworks about how to develop and maintain a healthy mindset around your personal finances.

In this guide, you’ll learn:

- What is financial wellness?

- Why is financial wellness important?

- How you can attain financial wellness

- How to start your financial wellness journey

What is financial wellness?

At its core, financial wellness is an ongoing commitment to improving your economic life. It’s the practice of treating your mental, physical, and financial well-being with care. When you know what you have and where you plan to go, it’s easier to feel good about your financial health.

Instead of something to be achieved, financial wellness is a lifelong journey that requires regular check-ins and adjustments to tune your goals and intentions. It’s highly individual and different for everyone.

No matter your current situation, the foundation of financial wellness begins with your mindset and your financial plan. These help you gain control of your finances so you can work toward your money goals. Before you build this foundation, it’s important to understand the benefits of being financially prepared.

Why is financial wellness important?

When one part of your life is off-balance, you likely feel off. A lack of sleep leads to brain fog, a lack of nutrition leads to low energy, and a lack of financial security leads to stress.

When you’re stressed about money, it’s difficult to focus on day-to-day tasks (let alone your goals and ambitions). But when you reach a state of financial well-being, your overall well-being can improve.

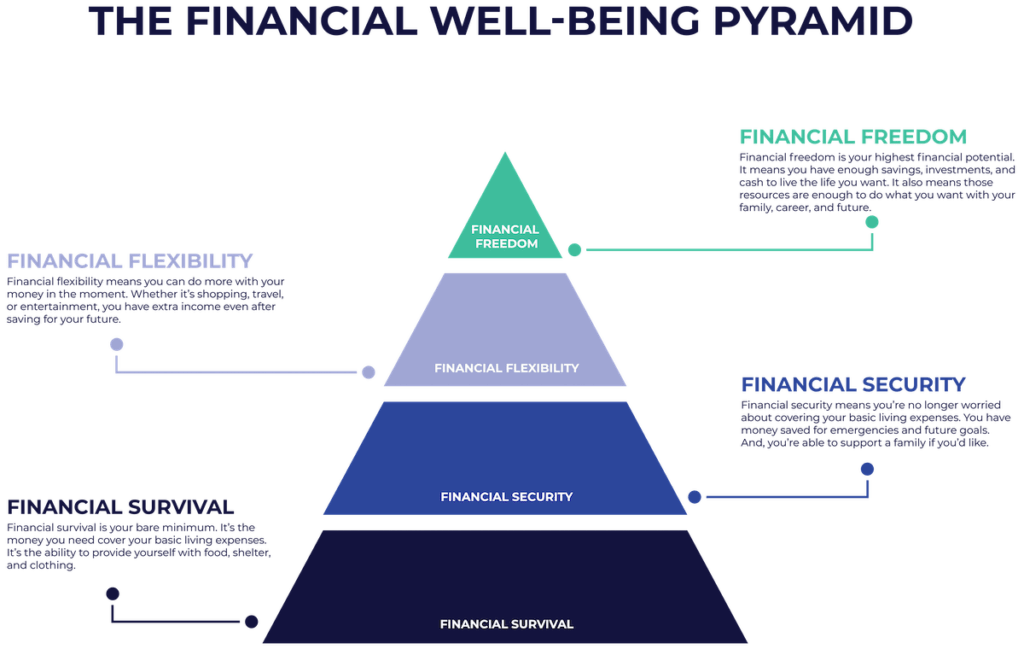

There’s a misconception in the financial world that money matters. In truth, money is a way to provide comfort and safety, which can contribute to your overall happiness. To conceptualize this connection, picture it through the lens of Maslow’s Hierarchy of Needs — a psychological theory on human motivation. The theory states that any needs at the bottom of the pyramid must be satisfied before addressing any needs at the top of the pyramid.

At the most basic level, you exchange your time, skills, experience, energy, and creativity for money (and hopefully, personal fulfillment). You then use that money to fill your needs in order of importance.

Here’s the breakdown of the five main levels, from bottom to top:

- Financial survival: Financial survival is having enough money to meet the bare minimum, such as basic living expenses, food, shelter, and clothing.

- Financial security: Financial security means no longer worrying about covering your basic living expenses. You have money saved for emergencies and are starting to make future financial goals. You’re also able to support a family, if you’d like.

- Financial flexibility: Financial flexibility allows you to do more with your money. Whether it’s shopping, travel, or entertainment, you have extra money to enjoy even after saving for your future.

- Financial freedom: Financial freedom is the highest level of financial wellness. Here, you have enough savings, investments, and cash to live the life you want. Your financial resources are enough to do what you want with your family, career, and future.

Your finances touch every aspect of your life, including your experiences, your relationships, and your future. But it’s also closely tied to building long-term wealth.

How financial wellness connects to wealth

Becoming wealthy can bring many benefits, including the freedom to do what you want, when you want. This includes making it easier to manage an emergency, pay off debts, purchase something you love, or make a significant impact on your community.

The habits you set to maintain a sense of financial well-being often overlap with the habits that allow you to build wealth.

- Invest in yourself financially.

- Spend money only on necessities.

- Create secondary sources of income.

- Manage your risk to reap rewards.

- Contribute to a monthly savings plan.

- Max out your retirement plans.

Developing your own financial wellness program can positively impact your income, increase your confidence in managing your finances, and create the habits needed to build long-term wealth.

How to work toward financial wellness

Your definition of financial wellness will likely look different than your family or friends. But every program starts with your mindset.

Develop your mindset

How you think about money has a big impact on your well-being.

Your mindset is the unique set of beliefs and attitudes about money developed through your learned experiences and environment. It probably began with how your parents (or other adults in your life) approached money. According to the National Financial Educators Council, 30.5% of people surveyed learned about finance through their mothers, 22.9% learned through their fathers, and 46.6% learned though another avenue.

The simplest way to think about your money mindset is on a spectrum. On one side are people who grew up with financial education. They may have had budgets or even brokerages accounts as a child.

On the other end of the spectrum are people who grew up in a household where talking about money was taboo or simply not discussed. Financial knowledge and skills had to be learned later in life, maybe through financial literacy programs or self-directed learning.

Depending on your mindset, you may connect with these common money beliefs.

- Money will make me happy.

- Money is evil.

- My success depends on the market.

- Only people in certain professions make money.

Our core values guide our decision-making when it comes to investing whether you know it or not. Values like:

- Autonomy: A desire to control your finances, become your own boss, or attain financial independence.

- Balance: A yearning for balance across your financial accounts.

- Growth: Learning every day.

- Passion: A healthy interest in your finances.

- Service: Giving back to others, investing in ESG companies, and donating.

- Identifying your values first allows you to save, spend, and invest with intention, plus it feels good!

When it comes down to it, money is neither good nor bad. But what you ultimately end up doing with your money is up to you and your financial wellness journey. As you practice good habits, save money, and contribute to a retirement fund, it’s helpful to keep any bias you may have in mind.

Here are several cognitive biases that can impact investors.

- Present bias: This is the tendency to discount long-term goals in favor of immediate gratification.

- Home bias: This causes people to invest in assets close to their homes, which can create an undiversified portfolio and concentrate investment risk.

- Confirmation bias: This bias makes people seek out information that confirms their beliefs, rather than searching for contradictory information.

- Reactive devaluation bias: This happens when people discount an idea because they don’t like where it came from.

- Loss aversion: This bias makes people feel like there’s more to be lost by giving something up than there is to be gained by acquiring something.

- The “Lake Wobegon” effect: This stems from a lore that everyone believes they are more astute than average.

- Optimism bias: This makes people believe positive outcomes are more likely than they actually are.

- Fear of missing out: Having FOMO in investing can cause people to make rash decisions based on what everyone else is doing at the time.

- Gambler’s fallacy: This bias occurs when people believe the past influences the future. For example, “My luck is going to change” or “I can’t keep losing.”

Once you understand your biases, it’s easier to prevent yourself from falling into bias traps and creating a negative mindset. Your mindset is dynamic and can evolve over time.

Understand your emotions

Money is emotional and comes with plenty of ups and downs. Over time, you’ll face financial successes and challenges that impact your life, often testing your mindset and decision making. It’s normal to feel negative and positive emotions towards money, even with the right mindset:

Positive:

- Feeling confident about your decision-making

- Being in control of your finances

- Having a general optimism and willingness to learn in the face of uncertainty

- Taking an action-oriented approach

- Being flexible during times of change

Negative:

- High levels of anxiety and stress

- An overall lack of control

- Persistent negativity about the future

- A sense of procrastination

- Restlessness and sleeplessness

Did you resonate more with the positive or negative mindset? If it’s positive, you’re on the right track. If it’s negative, you can work to stay in touch with how you feel about your finances and how it impacts your decision-making. When you build a healthy mindset, you set yourself to make smart choices and work toward the life you want to live.

Establish a plan

The second part of a strong financial wellness foundation is a financial plan. This is the strategy you follow to help get you and your money to where you want to go. It’s important because it allows you to make the most of your assets and contribute to your future goals.

Your plan starts with understanding where you’re at now, financially and emotionally. A simple way to check-in is through a financial audit. It’s best to conduct a financial wellness audit every quarter or year and adjust it based on your situation and needs. Here are a few questions you’ll want to ask yourself during the audit:

- What is your net worth? Your net worth is the combination of what you own (assets, like cash and investments) and what you owe (liabilities, like debt). It shows a balanced picture of your financial situation. To find your net worth, tally up your cash, savings, investments, property, and cars. Then, total all your debt, whether it’s student loans, credit cards, or personal loans. The difference is your net worth, and if you’re looking to improve your financial well-being, one of your goals may be to increase it.

- What are your assets? This includes considering your stocks, ETFs, and retirement plans like 401ks or IRAs. You’ll want to make a list of all your accounts. This will help you see the full picture when it comes to your current finances. If you have multiple accounts, you may consider consolidating them to make money management easier.

- Do your investments align with your mindset and values? Consider the companies and funds you hold. Does their corporate vision and action align with your values? Does their long-term plan align with your mindset?

- Have you had any big expenses or acquired any debt? Is there anything new to take into consideration when re-evaluating your budget? Think: student loans, medical or credit card debt, a mortgage, a car loan, or other high interest debt. Make note of the terms for each line of credit because repayment plans may impact your budget.

- Are you currently taking advantage of financial tools like automation? Double check your bank accounts, credit cards, and brokerage accounts for automation options like autopay, recurring transfers, auto-invest, or even smart transfers. Automation can save you time and energy, letting you focus on your strategy and living your life the way you want.

- Are you maximizing your compensation? We don’t just mean base salary when we talk about compensation—though doing a little salary research and negotiation if you’re below market value doesn’t hurt. A less obvious example of maximizing your compensation is any 401(k) or IRA match. Make sure you’re meeting any requirements for getting the match. It’s free money! Plus, many employers provide benefits that employees pay for in one way or another, such as dental insurance or a healthcare FSA. Check with your employer to make sure you’re taking advantage of any benefits available and helpful to you.

Set your goals

Once you know the status of your finances, it’s time to make goals. These are key to effectively managing money and working toward financial security and independence.

Consider what you want out of it and what needs to happen financially to get you there. Your financial goals are where you would like to be financially in the short-term, mid-term, and long-term.

Need some inspiration? Here are a few common goals:

- Have financial security in retirement

- Improve financial literacy

- Create and maintain a budget

- Pay off debt

- Build a good credit score

- Routinely check your credit report

- Open a savings account

- Make informed decisions for expenses

- Create an estate plan

- Start investing in the stock market

- Open a custodial account

- Max out your 401(k) or IRA

- Automate a monthly contribution

If you do not have financial goals, it’s easier to spend more than you should. But once you set goals, it’s important to revisit them at least once per year so you can adjust as needed.

Create financial habits

Good money habits are critical to your financial and overall well-being. You want to make sure you’re practicing and building the habits that contribute to your goals, values, and ideals.

- Start small: Your habit should consist of small wins that lead to the larger goal. Make it easy at first so that you gradually build this habit.

- Take time to understand what is holding you back: Become introspective and evaluate what is holding you back or why you might be failing.

- Set a schedule rather than a deadline: Get specific and intentional with your habits. Having to work at something consistently is better than a deadline far out.

A commitment to building better habits is similar to investing: start small and grow gradually. If you need help, learn more about how to make financial habits stick.

An important part of saving and investing is simple: pay yourself first. Automation and investing strategies, like dynamic rebalancing, auto-invest, recurring transfers, and smart transfers, are great ways to maintain healthy financial habits. This can save time, improve your investing focus, and build the habit for you.

Another great habit for financial wellness is budgeting. A budget is like boundaries for your future and your wealth. It should fit your lifestyle and money habits, empower you to reach your financial goals, motivate you to make the most of your money, and give you peace of mind knowing that you’ve covered all your bases.

If you don’t have a budget yet, you’re not alone. Nearly 59% of Americans don’t currently use a budget and about 66% of people would struggle to scrape together $1,000 in an emergency.

To stay on track with your monetary goals, choose a personal budgeting strategy that fits your unique needs and personality.

Find the right resources

Just as people on a path to wellness select healthier foods, choose the right gym, or find a great therapist, you need the right tools and team to help you on your way to well-being.

Try these tips to boost your financial literacy:

- Host check-ins with your spouse or partner to discuss family finances. Talk with friends or coworkers about overall financial plans, retirement accounts, and any concerns or opinions you may have.

- Create a financial book club with friends, family, or your professional network.

- Consider professionals, such as accountants, who can share experience and expertise.

- Research online, read finance books, or join in on the social media conversations surrounding financial wellness.

- Learn about financials tool, like automation, that make it simpler to be in control of your money.

Start your financial wellness journey

Financial well-being is a journey and is something that must be regularly maintained. No matter where you are in your journey, it’s important to stay engaged with your personal finances to continue to improve this part of your well-being.

M1 is built with your long-term wellness in mind. It’s why we offer flexible, customized, and automated tools to match your financial lifestyle. Whether this was an introduction or a refresher, we’re happy you’re on the path to personal financial well-being.

Learn how M1 can help you on your financial wellness journey >>

Originally published January 4, 2022, updated May 19, 2022.

- Categories

- Plan