How to do your own mid-year financial wellness review

Over the past six months, markets have dropped, interest rates have risen, and travel is back in full swing. The plans or budget you made at the beginning of the year may not make sense anymore, which means it’s the perfect time for a mid-year financial wellness review.

A routine financial wellness review lets you check on the progress you’ve made toward your financial goals and ensure you have a plan for the rest of the year. If you have clear goals and regularly check-in on your portfolio, you’ll likely only need a few hours in the morning or afternoon to complete it.

Work through each of the following steps to figure out where your finances stand and set a plan for the next six months.

Track your performance to date.

Tracking your home team’s wins and losses is just as important as keeping tabs on your financial performance.

To evaluate, it’s important to consider the economy’s current and future condition. As of June 2022, the S&P 500 is down 22% year to date. If your portfolio looks a bit red, you’re not alone. Markets are struggling this year, and the dips are impacting investors. A mid-year financial review is a good reminder to keep your financial well-being and long-term mindset in check.

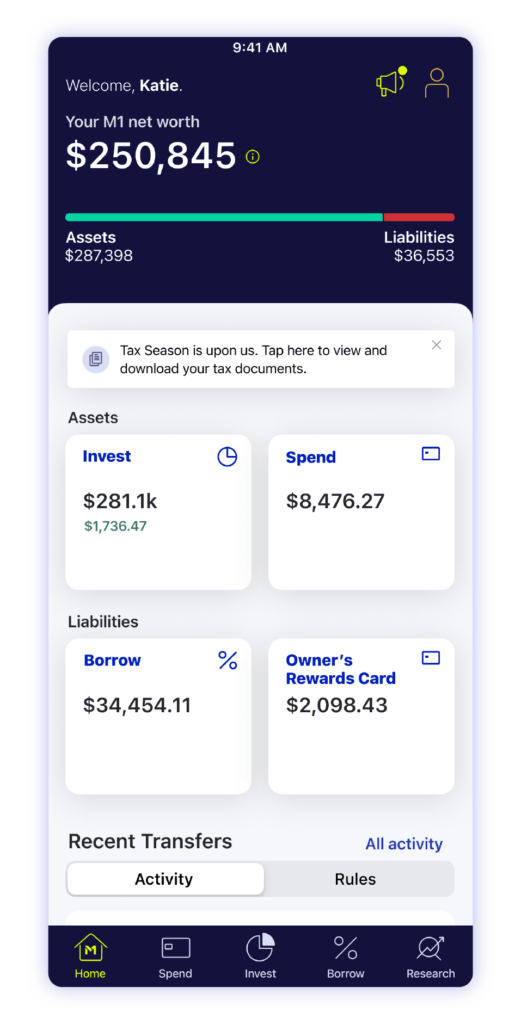

To start tracking your finances, log in to your M1 account and take inventory of your assets (including cash, savings, stocks, ETFs, and retirement plans) and liabilities (credit card bills or loans). Our new home screen lets you intelligently keep tabs on your financial health and holdings across all M1 accounts.

If you want a deeper understanding of your finances, you can run a financial well-being audit. This financial wellness review tool walks you through a valuable checklist of information to keep top of mind when evaluating your performance. While reviewing your portfolio, you may realize you want more control and automation. Make it simpler to meet your financial goal with M1 Plus.

Consider any personal life changes.

During your financial wellness review, consider how has your life changed since the year began. These personal life changes can have an impact on your financial life too. Maybe you’ve experienced one or more of the following events:

- Getting married

- Grieving over a death in the family

- Celebrating the birth of a child or grandchild

- Accepting a new job

- Buying a new car

- Moving to a new city

- Purchasing a home

- A financial emergency

Personal life changes can create tax and financial implications that need to be addressed by year end. Purchasing a home means adding a mortgage payment to your budget or borrowing money for furniture or renovations. Getting married may mean combining investment accounts or debt. If you’re celebrating a new child, you may want to open a custodial account to invest in the child’s future and build generational wealth.

Life comes with surprises — you can’t anticipate every event ahead of time. A mid-year financial review serves as a great time to evaluate your life changes, adjust your savings or investments as needed, and factor any major purchases into your overall plan.

Factor in economic trends.

While everyone is subject to the economy’s rise and fall, the swings affect people in vastly different ways. In 2022, Americans are facing record gas prices, inflation, rising interest rates, and the impact of global conflicts. The market is performing poorly as a result, and a recession may be on the horizon.

Market volatility and corrections happen, but a downturn can still shake seasoned investors.

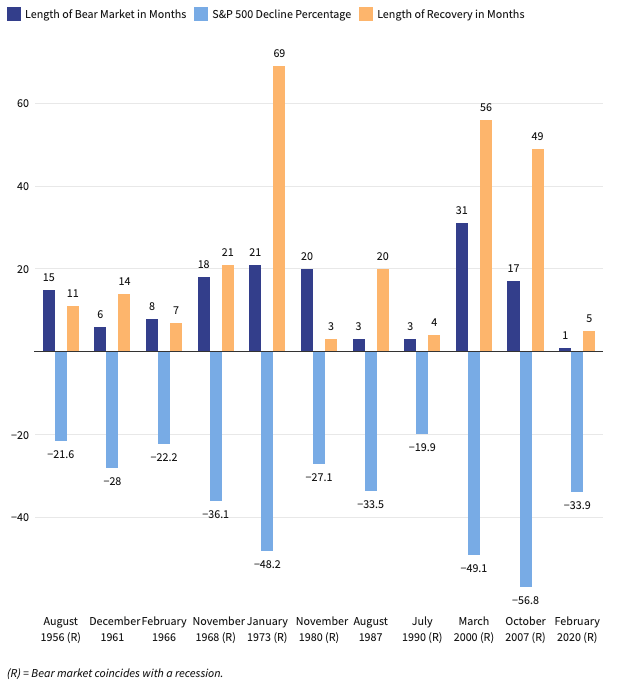

As a long-term investor, it’s important to stay focused on your financial goals when emotions get the best of you. No one knows how long this bear market will last but, historically speaking, they don’t last forever. Bear markets typically come twice a decade and last for, on average, less than two years.

S&P 500 Bear Markets and Recoveries

Check your debt and credit.

In this era of online and mobile banking, Americans are taking on increasingly high amounts of debt. If you’re among this group, it may be time to assess your debt or create a debt repayment plan. You can factor this plan into your budget using various methods:

- The snowball method: Follow this to pay off smaller debts in their entirety first. Once that debt is paid, you roll the money you were putting towards the small debt into the next-smallest debt owed. This process continues until all debts are paid off.

- The avalanche method: Follow this method to pay off accounts with the highest interest rates first. Once you pay off a debt, you put money towards the account with the next highest interest rate. This continues until all your debt is paid off.

It’s important to evaluate your debt, come up with a plan, and work towards repayment (especially when times are tough). The long-term impact of compounding debt actively works against any compounding investments or savings.

Review your budget.

Considering life changes and economic trends, you want to make sure your budget is helping you meet your short and long-term financial goals. Your budget can be as basic as a few categories or as detailed as a color-coded spreadsheet but should include the following information:

- Income (fixed and variable)

- Expenses (fixed and variable)

- Non-monthly expenses (like annual subscriptions or quarterly insurance payments)

- Savings goals

- Retirement planning

- Investing contributions

Tracking your budgeting and spending habits can keep you on track for the rest of the year as you work toward specific financial goals. It will also provide valuable insight into your spending habits and financial habits as a whole.

Create a plan for your money with M1’s Guide to Budgeting >>

Assess your tax withholdings.

Review how much you’re withholding from your paycheck to make sure you’re paying the taxes you owe — and nothing more. If you withhold too much money, you’ll get a refund when you file your return next year. But you’ll miss out on an opportunity to invest that money and let it compound and grow. By over-paying taxes, you’re essentially giving the government an interest-free loan.

As you evaluate your withholdings, it can be a good time to consider tax-loss harvesting for some of your positions. This could help you realize losses in order to offset taxable gains, without negatively impacting your overall long-term commitment to the market.

Check your retirement contributions.

Consider your retirement goals to see if you’re saving the right amount to meet them. It may even be time to boost your retirement savings, as a bear market can be seen as “stocks on a discount” for long-term investors. Check in on your target date and net worth and adjust accordingly.

You may want to consider raising your retirement contributions if you’ve recently received a raise or celebrated a birthday. Certain age-specific benefits, such as catchup contributions, let workers ages 50 and older contribute $6,500 more to 401(k) plans than younger workers.

If you are retiring soon, it could be a difficult time for your investments as they may be dropping in value. In this case, you may want to review and reduce your spending, bolster your liquid reserves, and stay flexible. If you’re not planning on retiring soon, it could be best to maintain a long-term mentality and stick with your current investment strategy.

Consider your estate plan.

It’s helpful to review your estate plan and factor in your life changes at least once a year. Check and update the following, if necessary.

- Will

- Guardianship

- Powers of attorney

- Health care directives

Planning your estate correctly ensures your money goes where you want it to. If you need help, it can be helpful to meet with your attorney or accountant to draw up a plan for your specific financial situation.

Automate your finances to stay on track.

Once you finish your review, make sure you have the tools and resources you need to meet your goals. Automating your investment and retirement contributions is a simple way to help build wealth, without manually transferring money each month.

No matter where you’re at halfway through this year, a mid-year financial review can keep you on track to meet your goals and improve your financial wellness.

See a snapshot of your M1 accounts to start your review >>

- Categories

- Plan