-

24 employees tell us why M1 is a 2021 top workplace

We’re excited to be recognized as a Chicago Tribune 2021 Top Workplace! Since there’s no awards show where our employees can get up and give…

-

The 6 principles of value investing

Everyone likes a bargain, especially value investors. Value investing is a strategy that involves picking stocks that you believe are trading lower than their value….

-

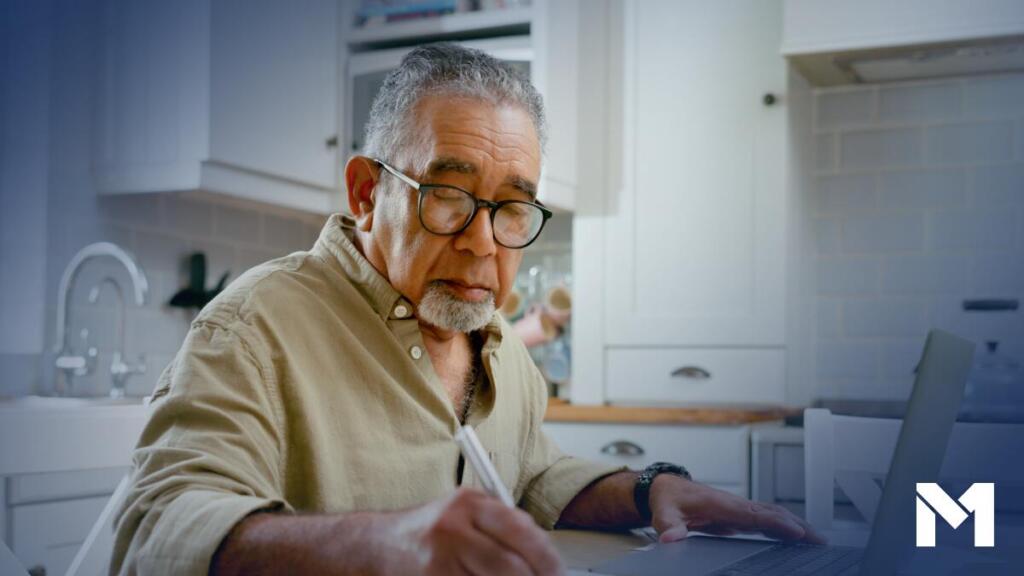

So…I bought a bank

Most of our financial institutions are decades, if not centuries old. As with any dated institution, they are bureaucratic, charge unnecessary fees, use obsolete technology,…

-

The rise of financial influencers: what you need to know about finance’s fastest growing trend

The last time I wrote a post, we were in the middle of what financial historians might call the “Meme Coin Rush of 2021.” As…

-

The truth about the “October Scare” and stock market corrections

As the calendar turns to October, people are settling into piles of leaves, warm sweaters, and everything pumpkin spice. So why do investors historically think…

-

5 ways a credit card can improve your financial well-being

A credit card should work for you. When used correctly, they can provide significant financial benefits that other services cannot. Whether you’re inserting, swiping, or…

-

How to research stocks: are you investing like the experts?

Every year millions try to beat the stock market. And let’s be honest, it’s hard, if not nearly impossible. Many investors choose to invest for…

-

5 ways M1 changed since our first billion in client assets

In February of 2020, we hit $1 billion in client assets. Today, we hit $5 billion. With the support of clients, investors, and a growing…

-

Clients come first: M1’s revamped Client Success efforts

Christine LaFrance is the Head of Client Success at M1. Christine joins M1 after advising clients in investments and capital markets, and leading client relationships,…

-

We’re officially a unicorn: announcing our Series E

Today, I’m proud to announce our $150 million Series E funding round, led by Softbank’s Vision Fund 2 with participation from existing investors. This funding…

-

12 smart personal finance books to add to your reading list

It’s easy to find finance courses in college and grad school—personal finance, not so much. So how do the rest of us non-MBAs, non-advisors, non-financial…

-

What I learned leading a major product release during COVID-19

Ryan Spradlin is the Vice President, Product at M1 Finance. Prior to M1, Ryan worked on large-scale software implementation and technical management at Acquity Group….

PLANNING

M1 Budgeting Basics

What you’ll learn:

INVESTING

M1 Intro to Investing Roadmap

What you’ll learn: