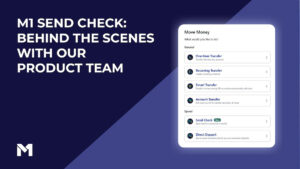

M1 Send Check: Behind the scenes of a physical product built in a digital world

Allie Curry is a senior product manager at M1 Finance. We’ve been building M1 for a few years now, growing our team, client assets, and…

Dogecoin on M1?

Dogecoin, the cryptocurrency that’s all the rage these days, was started as a joke. This “joke” cryptocurrency is now worth around $50 billion, worth more…

The long-term power of dollar-cost averaging

If you’re a fan of movies, music, or TV, you probably subscribe to a streaming service. Every month, you pay a set amount of money…

Socially responsible investing: How to build a portfolio that matches your values

Do you buy organic food? Do you shop fair trade? SRI investing can be adapted to many value systems; read on to see how you can adjust your investments to align with your values.

5 options for your third stimulus check when you invest, spend, or save

Congress finally passed the American Rescue Plan Act of 2021, a $1.9 trillion stimulus bill that includes a third round of stimulus checks for as…

M1 to the moon: announcing our Series D

Today, I’m proud to announce our $75 million Series D funding round, led by Coatue, one of the world’s largest tech-focused investment firms. This follows…

Mission-minded money management: the case for the long-term investing mindset

For hundreds of years, only an exclusive group of people could invest in the stock market. Over the past several decades, access increased but investing…

URGENT: trading announcement (1/28/21)

UPDATE: trading as of 1/28 at 3 pm ET Our clearing firm, Apex Clearing, has opened up trading on securities impacted earlier today (1/28). All…

10 signs it’s time to switch brokerage firms

Switching to a new online broker can save you a significant amount of time and money. But it’s never easy to end a relationship. You…

Put your best foot forward: 10 habits for better investing

Huge, transformational goals often fail. In fact, 92% of New Year’s resolutions fail, according to research from the University of Scranton. Yet year after year,…

M1 hits $3 billion in client assets

We’re excited to share that we hit $3 billion in client assets, just four months after doubling to $2 billion: “The financial services industry has…

7 steps to include in your year-end financial planning

2020 is almost over, we promise. But between year-end deadlines and contribution limits, there’s still time left to make sure you’re not leaving money on…

PLANNING

M1 Budgeting Basics

What you’ll learn:

INVESTING

M1 Intro to Investing Roadmap

What you’ll learn: