-

The Banking Crisis: What’s going on and what you need to know

The banking crisis over the last few days has captured headlines. Here’s what you need to know.

-

It’s been two years since the meme stock was born. Here’s what we’ve learned.

Meme stocks were a trending headline in 2021. Two years later, here’s what we’ve learned.

-

Why you should use a high-yield savings account over a regular savings account: A comprehensive comparison

Learn about the advantages, disadvantages, and personal finance decisions that go into choosing the right account for you.

-

How to use a high yield savings account to potentially build long-term wealth

The M1 high yield savings account can be a great part of your financial strategy for both short-term and long-term planning.

-

The M1 High Yield Savings Account: How you can use it to continue building wealth

The M1 HYSA can be a great addition to your financial toolbelt. Whether its for an upcoming home purchase or a simple emergency fund, the high yield savings account may be worth considering.

-

How to build wealth slowly in a few simple steps

Building wealth is a long-term commitment, not something that happens overnight. Here’s a few steps to help you build that plan.

-

Cars are becoming affordable again. Is now the time to pick up a Tesla?

The car industry is beginning to soften after three years of skyrocketing prices. Now with EV tax credit, is it a good time to buy a Tesla?

-

5 Investing Choices for a Volatile Market

Try to avoid impulsive decisions governed by emotions and instead focus on investing strengths and weaknesses, changing opportunities and long-term goals.

-

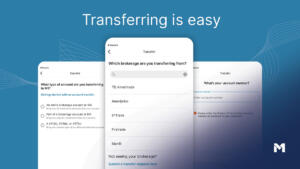

TD Ameritrade clients: Don’t settle for Schwab. Come to M1 and get rewarded!

Get rewarded with up to $10,000 bonus when you switch to M1 from TD Ameritrade. Personalized portfolios, intelligent automation, and the best rates await you. Switching is easy.

-

A look back, a look ahead: Your year-end financial review guide

As the year comes to a close, it’s important to review your finances and make necessary adjustments for the new year. Our guide covers everything you need to do.

-

10 things wealthy clients are doing with their money (and how they do it on M1)

Personal finance is just that – personal – but the goals remain the same: To protect and grow your wealth. It’s also a journey of…

-

3 ways to potentially lower your taxes before year-end

As 2022 comes to a close, we suggest some last minute ways to make the most out of your tax bill and set yourself up for next year.

PLANNING

M1 Budgeting Basics

What you’ll learn:

INVESTING

M1 Intro to Investing Roadmap

What you’ll learn: