-

The future of finance is free… and so much more

About 8 months ago, M1 announced we removed all fees to offer a free investing experience for our users. We made this choice for a…

-

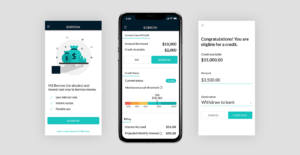

Announcing M1’s newest feature: M1 Borrow

I love talking with our users and hearing how M1 helps with their personal finances. Whether it’s demystifying investing, making ownership of particular companies possible…

-

M1 Finance: The Best ShareBuilder Alternative

Capital One Investing (previously ShareBuilder) has been bought by E-Trade, and as a result, all Capital One accounts will be transferred to E-Trade. This type…

-

How to make financial New Year’s resolutions that stick

Americans don’t particularly excel at setting and keeping New Year’s resolutions. Only around 40 percentparticipate in the tradition at all[1], and 80 percent of those who do abandon…

-

Everything you need to know about automatic rebalancing

Choosing your investments is more than selecting stocks of companies with high growth potential, large dividend yields, or low price-to-earnings ratios. When you select your…

-

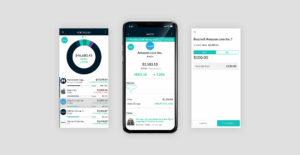

Introducing M1’s two newest features

I started M1 with one simple mission: make it easy for everyone to invest exactly how they want. You see, years ago I ran into…

-

6 finance flicks to watch this weekend

From serious stock market films to funny finance flicks, we’re sharing our staff’s all-time favorite movies about money. So kick back, order a pizza, and…

-

The one simple step to a better financial future

Here’s the thing: growing your nest egg doesn’t have to be complicated. Sure, you could surf the internet for hours, scouring countless articles for the…

-

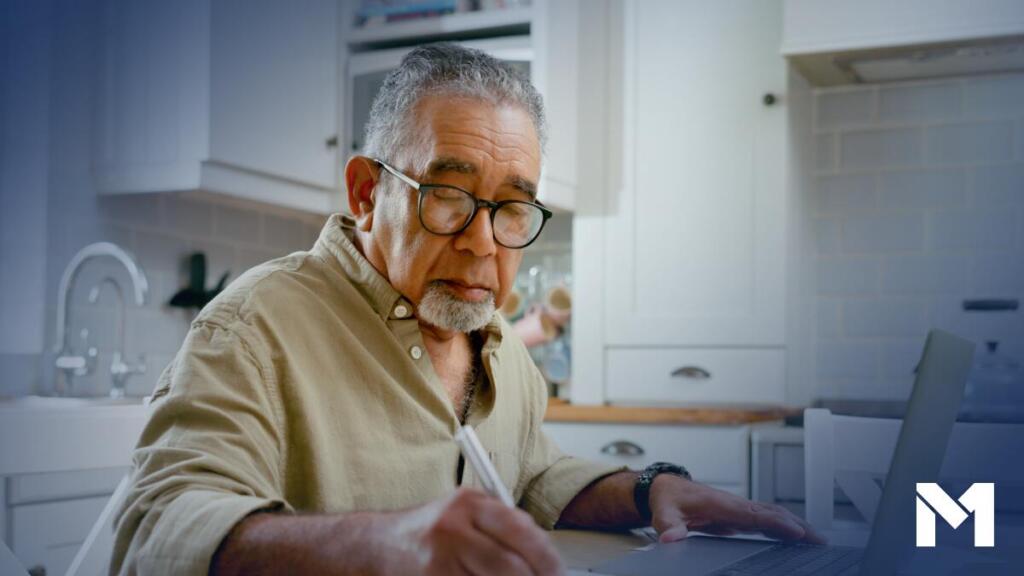

How to talk about money as a couple

Nearly half of all Americans identify personal finances as the toughest subject to talk about, making it an even more unpopular topic of conversation than…

-

How to choose stocks in 3 simple steps

By now, you’re probably already familiar with M1’s pies, which make it easy to customize your portfolio to your unique investing needs. You can choose from…

-

Avoid these 5 common investing mistakes at all costs

Earlier this week, I shared 3 tips for how to choose stocks. Knowing what not to do, however, can be equally important. Steer clear of these five common…

-

Trading vs. investing: 6 things you need to know

Should you pursue short-term gains or buy and hold? Consider these 6 key differences between trading and investing to find out.

PLANNING

M1 Budgeting Basics

What you’ll learn:

INVESTING

M1 Intro to Investing Roadmap

What you’ll learn: